FX Weekly Strategy: September 23rd-27th

Focus on PMIs to confirm more risk positive market tone

Some downside risks in Europe, particularly the UK

JPY weakness over the last week should fade

SEK vulnerable as Riksbank set to cut again

Strategy for the week ahead

Focus on PMIs to confirm more risk positive market tone

Some downside risks in Europe, particularly the UK

JPY weakness over the last week should fade

SEK vulnerable as Riksbank set to cut again

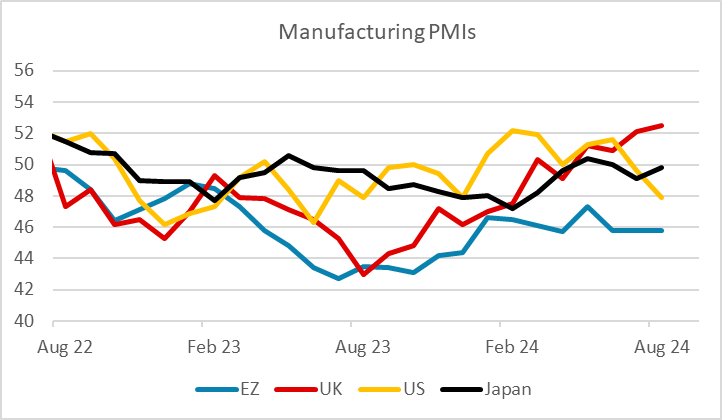

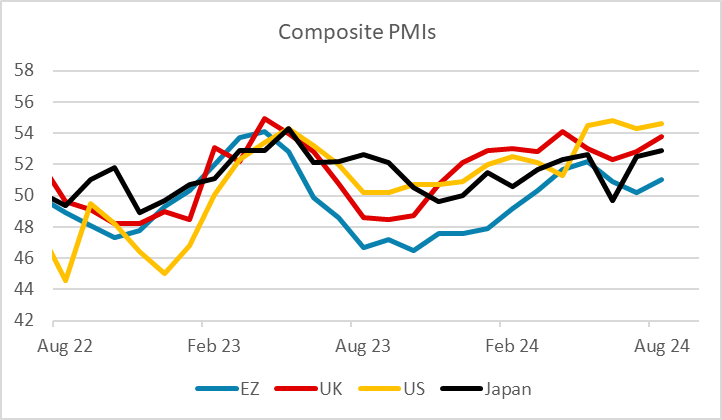

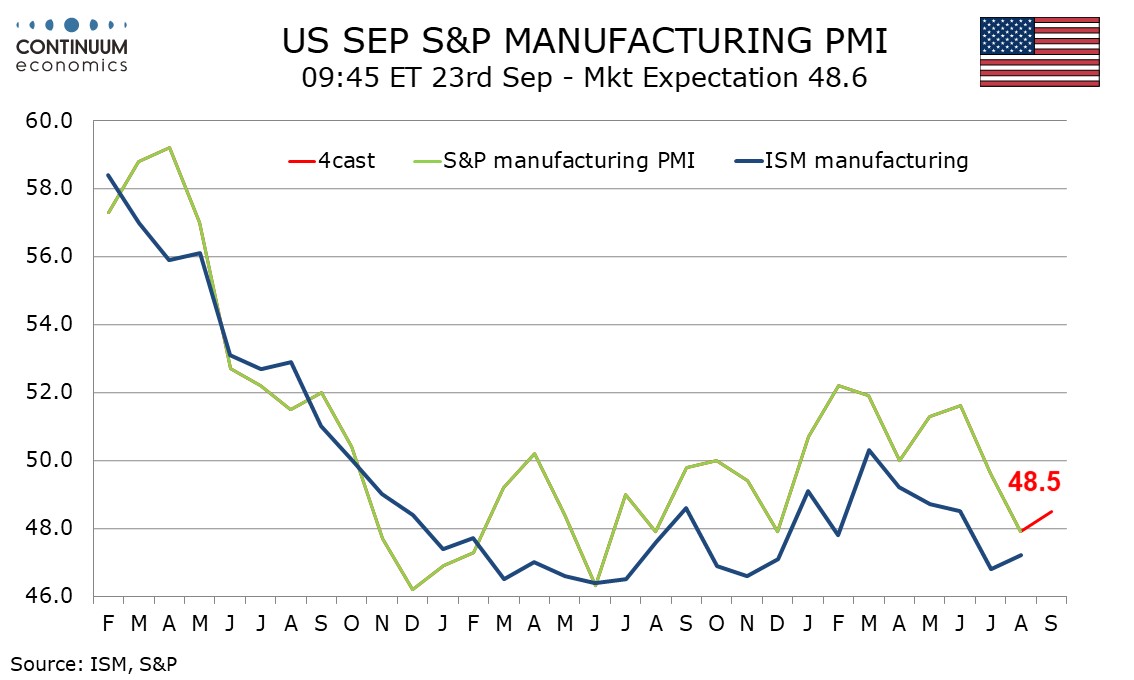

The week starts with the preliminary PMI data for September, and these could set the tone. Despite a dip on Friday, the equity market showed a generally risk positive tone through the last week, with the S&P500 making another all time high. This was helped by a confident tone to the FOMC statement which foresaw only a modest slowdown with unemployment peaking at 4.4% and inflation under control. PMI data that maintains the recent strength seen in the US would support this risk positive take. While the manufacturing index in the US dipped in August the services index remained strong, and we anticipate modest gains in both, which is slightly better than the market consensus which anticipates a dip in the services index. Even so, the consensus remains strong enough to support the current risk positive tone, and it feels as if we need to see some clearly weaker data to disrupt this latest bull market, undermine the riskier currencies and restore a bid to the JPY.

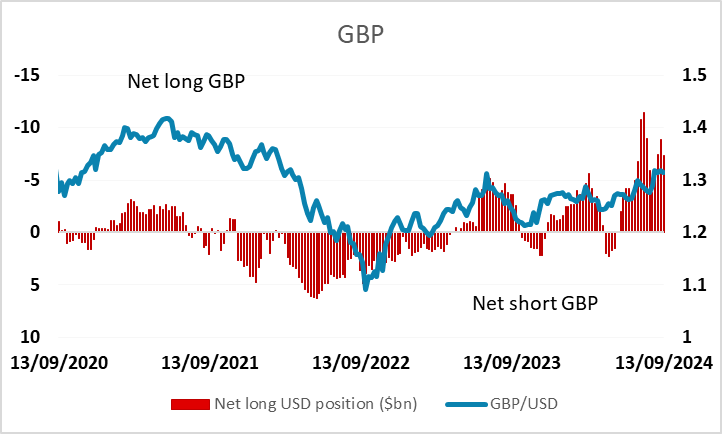

Risks of weakness are probably greater in Europe, with the German manufacturing index being particularly weak of late, and the Eurozone generally underperforming. A recovery here would be supportive for the EUR, given yield spreads do suggest some EUR upside if there is some confidence in the Eurozone economy. The most notable trend in the PMIs of late has been the strength of the UK manufacturing index, which has risen steadily over the past year. The reasons for this are hard to pin down, and we have some doubts about the accuracy of the data given that UK manufacturing output has not matched the rise in the PMIs, with the y/y growth rate in manufacturing actually falling steadily over the last year. The focus will, however be more on the composite indices, with the UK also likely to dip slightly. This being the case, the European currencies may underperform, with the recent strength in GBP making the pound look particularly vulnerable to any weak data. GBP has outperformed yield spreads this year, and is trading close to its post-Brexit referendum highs in real terms, and speculative positioning is significantly long according to the CFTC data.

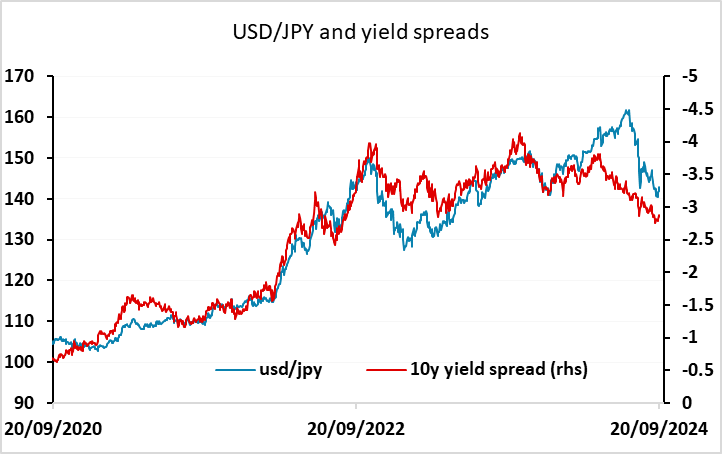

JPY weakness was the main feature of the last week, with USD/JPY reversing more than half the losses seen in September on the back of the FOMC decision, the risk positive tone and the less urgently hawkish tone from the BoJ. However, yield spreads still suggest there is downside risk for USD/JPY, and we doubt the JPY correction will extend beyond 145 without some news that pushes US yields significantly higher. If anything, lower US yields look more likely on the back of downward revisions to Q2 GDP data, particularly if these include significant downward historical revisions as seems to be the risk. The September Tokyo CPI data is due on Friday, and might impact Japanese yields which have remained very steady in recent weeks but have potential to move higher given the hawkish intent of the BoJ. This may therefore be a week for JPY bulls to re-establish positions.

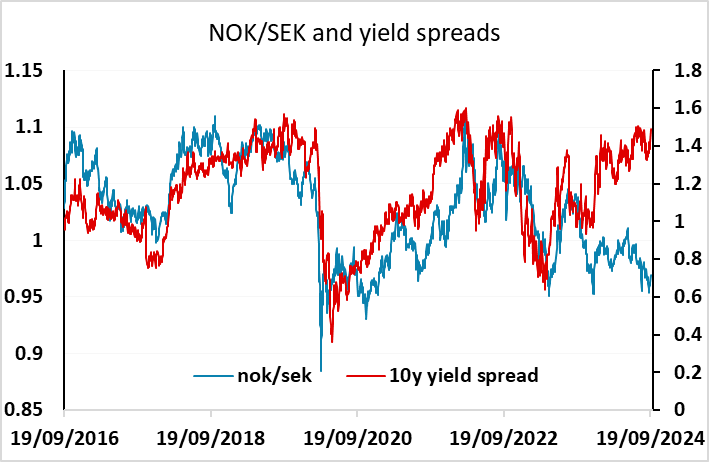

The Riksbank meeting should see a further 25bp rate cut, which is 90% priced in. The SEK has continued to outperform yield spreads against both the EUR and particularly the NOK this year, but another rate cut in the face of unchanged rates from Norges Bank last week could be the straw that breaks the camel’s back for NOK/SEK, and we see risks heavily weighted on the SEK downside.

Data and events for the week ahead

USA

It is a busy week for US data though with little that is top tier, focus may be more on Fed speakers. On Monday we expect September’s S and P PMIs to see modest gains, manufacturing to 48.5 from 47.9 and services to 56.0 from 55.7. Fed’s Bostic, Goolsbee and Kashkari will speak. Tuesday sees July house price data from FHFA and S and P Case-Shiller, and September consumer confidence, which will be following a firmer Michigan CSI. On Wednesday we expect August new home sales to fall to 650k from July’s surprisingly strong 739k.

Thursday sees weekly jobless claims and August durable goods orders, where we expect a 2.0% decline, with ex transport orders down by 0.2%. We expect only a marginal downward revision to Q2 GDP to 2.9% from 3.0%, but the release should be watched for annual historical revisions, where risks lean to the downside. August pending home sales follow. Fed’s Powell is due to deliver pre-recorded remarks, while Williams, Barr and Kashkari are due to speak.

The week’s most significant release is likely to be Friday’s core PCE price index for August, where we expect a rise of 0.2%, underperforming August’s 0.3% core CPI. We also expect a 0.4% rise in personal income to outperform a 0.2% rise in spending, and August’s advance goods trade deficit to correct lower to $100.6bn from $102.8bn. Final September Michigan CSI data follows, while Fed’s Collins and Kugler will speak.

Canada

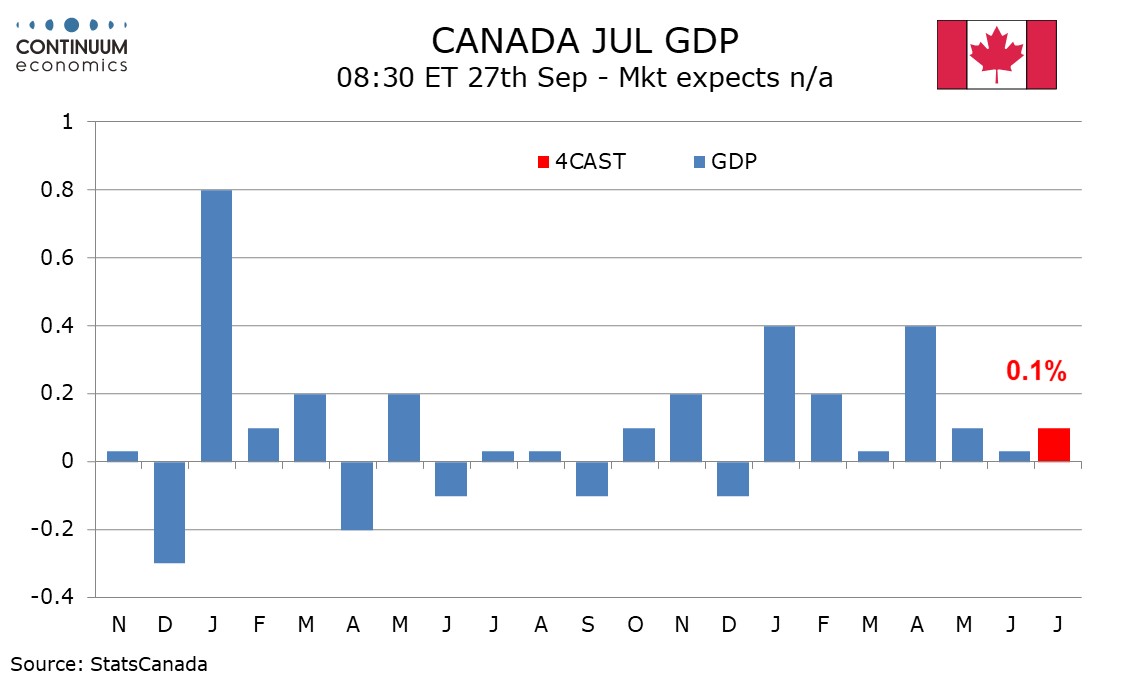

Canada’s most significant release comes on Friday when we expect a 0.1% increase in July GDP, a little stronger than an unchanged estimate made with June’s release.

UK

Flash PMI data (Mon) for September are seen correcting back slightly. At 53.8 in August, the composite was up from 52.8 in July, allegedly the fastest pace of growth since April. August data suggested a sustained upturn in private sector employment, supported by additional hiring in both manufacturing and services, something not at all backed up by payroll data computed by the HMRC. Otherwise, Monday also sees CBI survey numbers. BoE wise, MPC member Megan Greene gives a speech on consumption (Wed).

Eurozone

Datawise, the main interest will be the September PMI flashes on Monday, where we see no change in the composite index. While it increased for the first time since May to a three-month high of 51.0 in August, from 50.2 in July where what growth there was fuelled entirely by services activity but where costs pressures eased generally. Other business surveys are due, including the German IFO figure (Tue where another decline may be in the offing. There is also the ECB consumer expectations survey (Fri) and money/credit data as well as the ECB Bulletin (all Thu) but few Council speakers due.

Rest of Western Europe

In Sweden on Wednesday, a third successive 25 bp rate looms at this month’s Riksbank meeting verdict to 3.25%. More notably, updated forecasts are likely to more formally validate the rationale for the two added cuts by end-year that the Board hinted at after the August easing and which now seem all but certain. Indeed, the new projections in the fresh Monetary Policy Report may highlight that while lower inflation has provided the scope to ease policy in this speedier manner, the rationale is increasingly that from a weak economy something that the economic tendency survey may underscore (Thu).

In Switzerland, along with market thinking, we see the SNB on Thursday repeating the 25 bp policy rate cut that it has now down twice since March. This would take the policy rate to 1.0% and where the very clear below-target inflation picture in both recent actual numbers and the outlook flagged by the SNB in June warrant further easing ahead.

Japan

Tokyo CPI on Friday will carry the most weight after BoJ signalling current inflation picture plays along their forecast. The September figure for Tokyo is expected to be above BoJ’s target but should begin to exert slight moderation. It would be surprising to see a low figure despite preliminary data does show the demand side of inflationary pressure being outpaced by cost inflation.

Australia

The RBA rate decision will be on Tuesday and we are not seeing a change of monetary policy given the higher than target CPI. It will likely be another copy and paste statement. Even any change to forward guidance will be a surprise. PMIs on Monday will be overshadowed by Wednesday’s monthly CPI where it stays above 3%.

NZ

Trade Balance on Monday and Consumer Confidence on Friday.