FX Daily Strategy: Asia, September 20th

BoJ likely to leave rates unchanged…

…but hawkish tone should help cap USD/JPY gains

Risk positive tone may be overdone, but there is value in NOK

GBP strength may be overdone but can hold near term on solid retail sales

BoJ likely to leave rates unchanged…

…but hawkish tone should help cap USD/JPY gains

Risk positive tone may be overdone, but there is value in NOK

GBP strength may be overdone but can hold near term on solid retail sales

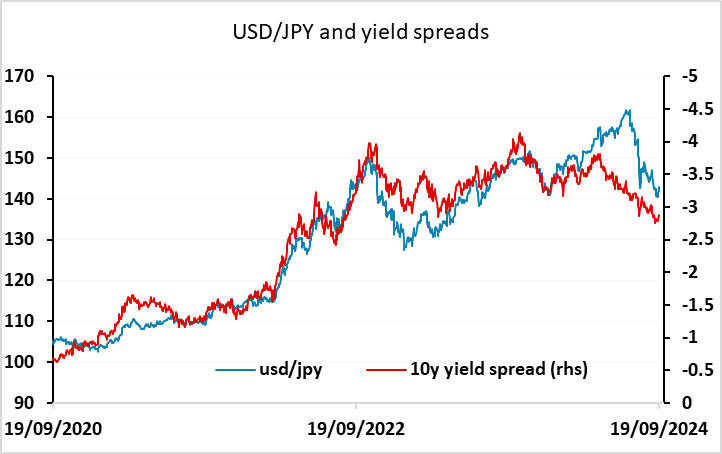

Friday sees the last central bank meeting of a week of central bank meetings. The BoJ are likely to leave rates unhanged, and there is nothing price into the market to suggests there is any risk of a move. Indeed, there are only 7bps of tightening priced in for the rest of the year, and rates are only seen at 0.5% by the end of 2025 – 25bps of tightening from here. This is despite fairly persistent hawkish comments from the BoJ suggesting that rates would go to 1% or more. But old habits die hard, and markets have been here before, awaiting a BoJ tightening cycle that never came. In an environment where rates elsewhere in the G10 are coming down, and China is struggling against an overhang of housing debt causing deflation, it is understandable that the market doesn’t really believe in the BoJ tightening cycle.

Given that there is no expectation of any BoJ action, the focus will be on the statement and subsequent commentary from Ueda. If he maintains his more hawkish recent tone, it may lead to some recovery in the JPY after the sell off seen after the FOMC. Yield spreads still support a longer term JPY recovery, but the risk positive market tone after the FOMC has led to a general unwinding of long JPY positioning both against the USD and on the crosses. For now, we would anticipate some stabilisation of USD/JPY in the low 140s, with lower US yields, weaker equities or higher Japanese yields needed to restore the JPY uptrend.

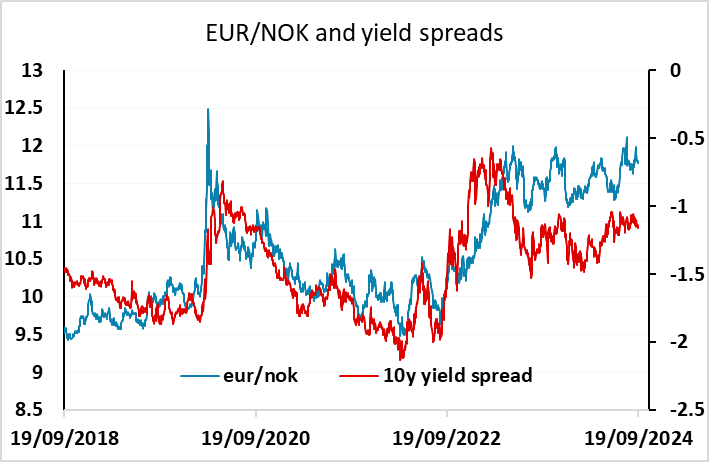

Certainly, Thursday saw a generally risk positive market tone, with GBP, NOK and AUD doing well helped by more hawkish central banks and a solid employment report respectively, as well as the strong equity market performance seen post-FOMC. The S&P 500 made another new all time high, and after the wobble seen in the summer the market seems prepared to accept the view that we are getting a soft landing, with any concerns about the profitability of AI no longer weighing on the market. But valuations are certainly stretched, and we would be wary of buying in wholeheartedly to an extension of equity gains. Nevertheless, many of the riskier currencies do represent good value based on yield spreads and longer-term valuation. The NOK in particular continues to look to have scope to extend the recovery seen on Thursday. However, the AUD may still need better news from China to convincingly break to new highs for the year.

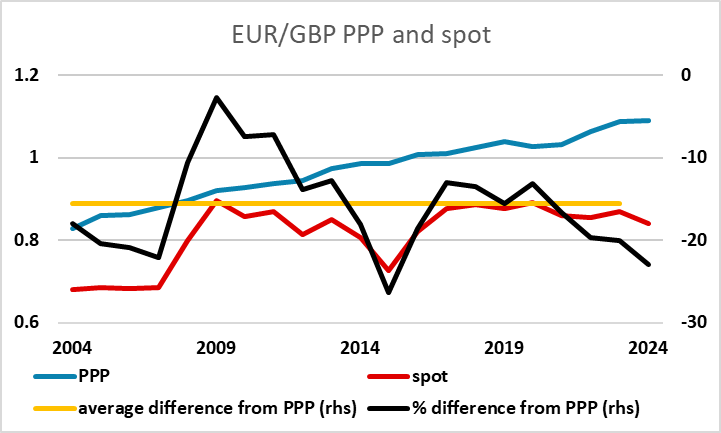

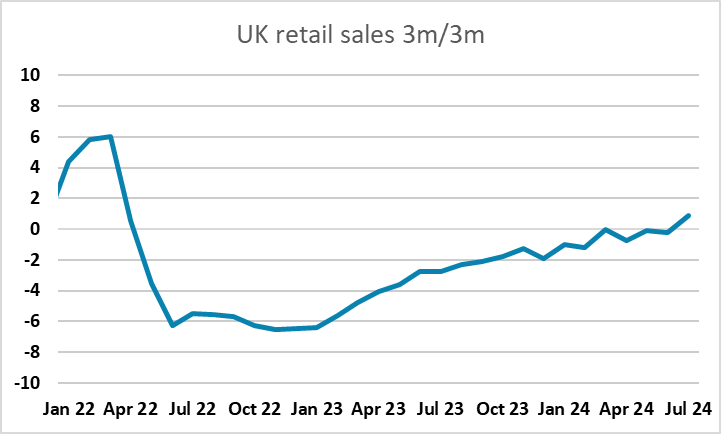

GBP strength seems a little vulnerable to any evidence that UK growth is stalling after the strong H1. We have UK August retail sales on Friday, and there has been a steady improvement in the trend over the year. The market consensus of a 0.3% increase would sustain that improvement, and may be enough to keep EUR/GBP near 0.84 near term. But the pound does look expensive here, both relative to long term valuation and current yield spreads, so we would be wary of chasing EUR/GBP lower.