Published: 2024-09-13T16:41:03.000Z

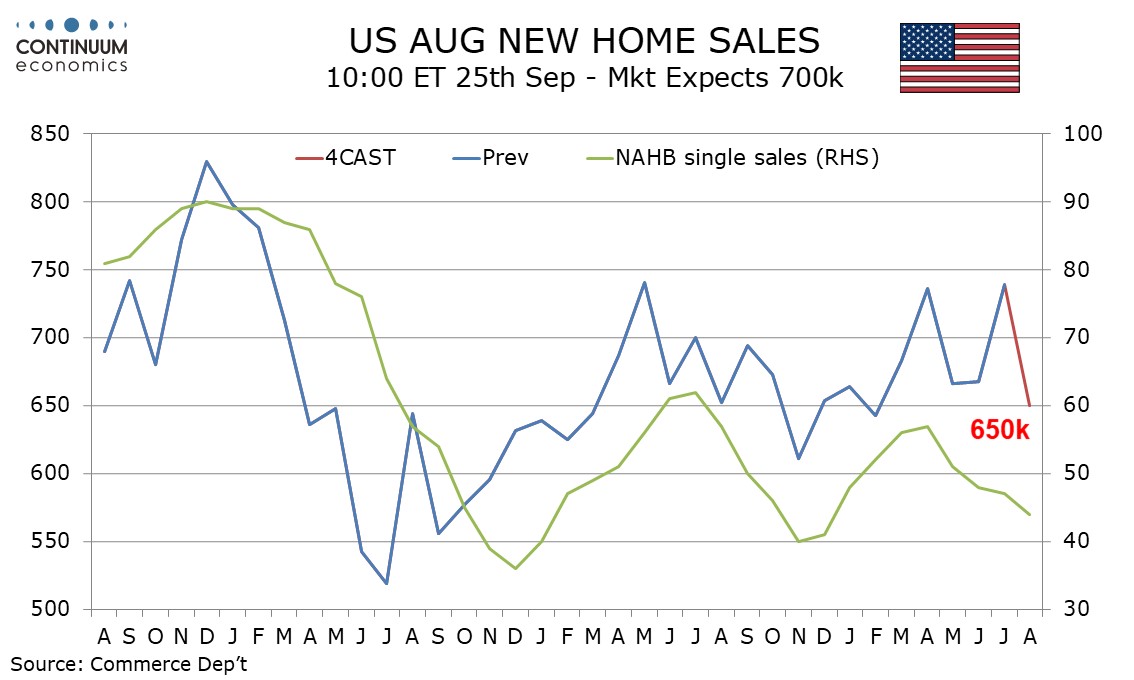

Preview: Due September 25 - U.S. August New Home Sales - July bounce unlikely to be sustained

Senior Economist , North America

3

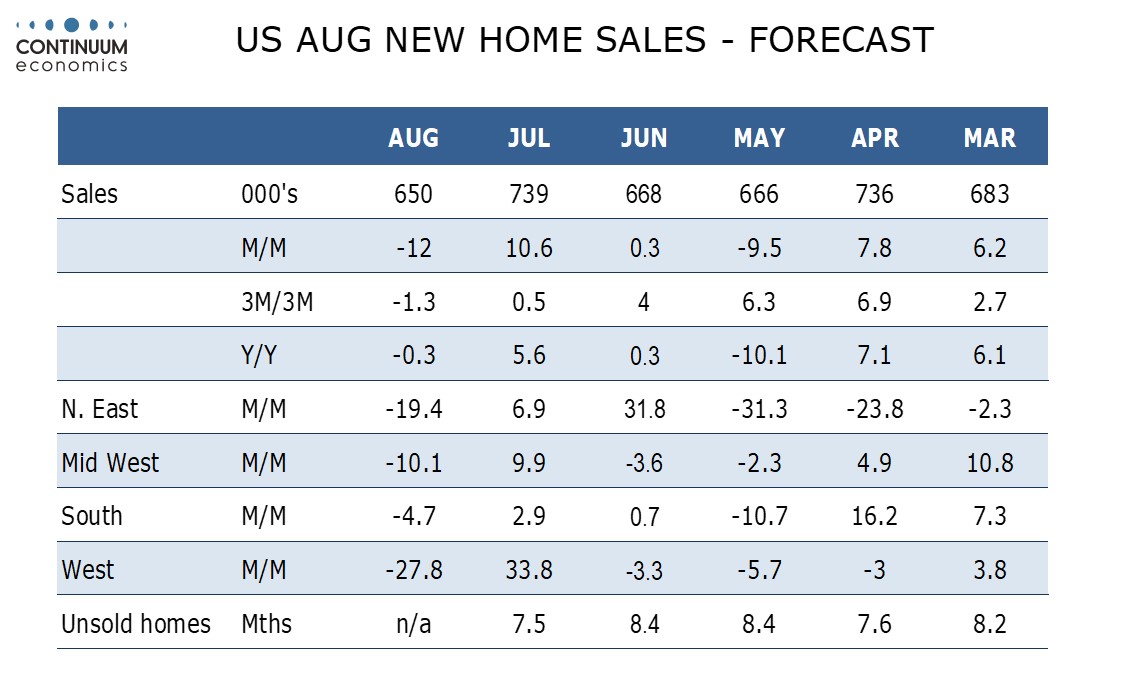

We expect August new home sales to fall by 12.0% to 650k, more than fully reversing a 10.6% July increase that was inconsistent with most signals of housing sector demand.

A 12.0% decline implies no revisions from July, though risk to July’s revision is on the downside with survey evidence having shown little evidence of stronger home sales in July. Expectations for Fed easing may support demand, but we doubt there would be much impact on August sales.

Sales are likely to slip in all four regions after rising in all four in July. The West is particularly vulnerable after a 33.8% July increase and the South the least vulnerable after rising by only 2.9% in July,

We expect both the median and average prices to slip by 1.0% after above trend respective July gains of 3.1% and 2.6%. This would leave yr/yr changes at -3.5% for the median and -3.9% for the average. In July the median saw a 1.4% yr/yr decline and the average a 1.4% yr/yr increase.