Preview: Due September 26 - U.S. August Durable Goods Orders - Aircraft to lead dip, modest slippage seen ex transport

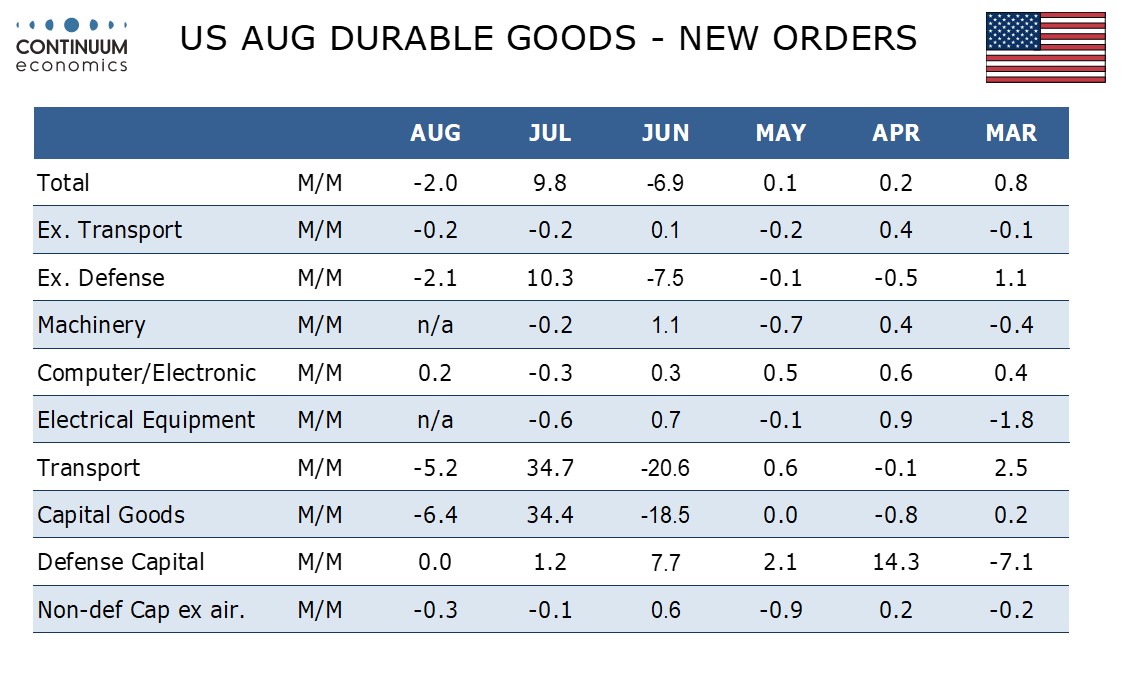

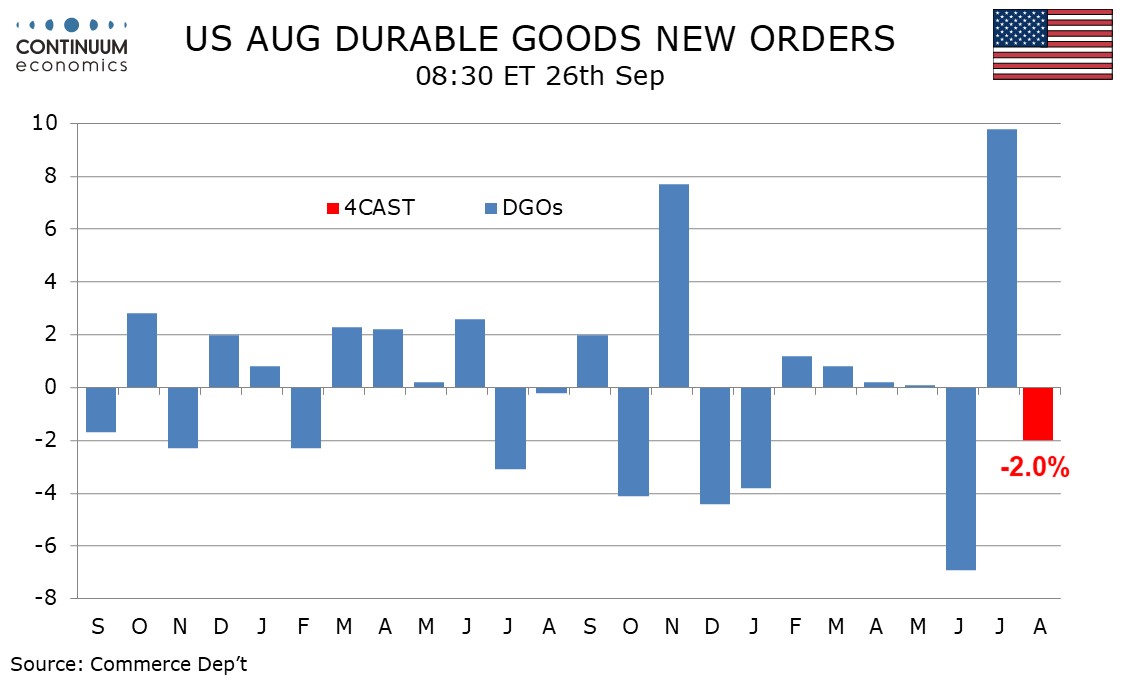

We expect August durable orders to fall by 2.0% overall as aircraft return to more normal levels after an extremely weak June was followed by a strong July. Ex transport we expect a second straight 0.2% decline, which would imply some loss of underlying momentum.

A sharp plunge in June aircraft orders was exaggerated by seasonal adjustments, as was the rebound in July, though Boeing orders were quite strong in July too, with August Boeing data being more subdued. This suggests a significant fall in aircraft which will outweigh a correction higher in autos from a weak July. We expect defense, which has a large overlap with transport, to be unchanged, and orders to fall by 2.1% excluding defense.

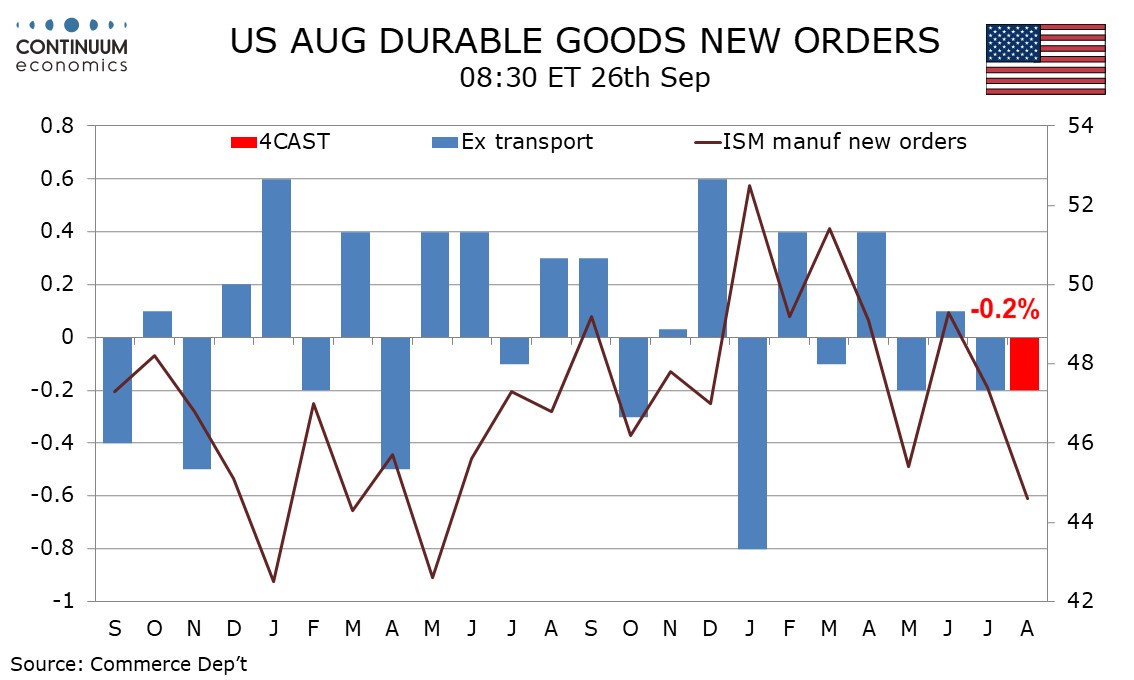

Weakness in ISM manufacturing new orders leads us to forecast a second straight 0.2% decline ex transport and this would be the first time since September 2022 that the ex transport series records two straight declines. Trend however remains near flat, with a monthly move in either direction reaching 1.0% not seen for over two years.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to fall by 0.3% after a 0.1% July decline. Trend here is also close to flat but the series is a little more volatile than the ex transport one.