FX Weekly Strategy: September 16th-20th

Market focused on FOMC with significant risk of a 50bp cut still seen

USD upside looks quite limited given current yield spreads

GBP risks still mainly on the downside even if BoE leaves rate unchanged

Hard to oppose JPY strength

NOK weakness overdue a correction, but Norges Bank may not help

Strategy for the week ahead

Market focused on FOMC with significant risk of a 50bp cut still seen

USD upside looks quite limited given current yield spreads

GBP risks still mainly on the downside even if BoE leaves rate unchanged

Hard to oppose JPY strength

NOK weakness overdue a correction, but Norges Bank may not help

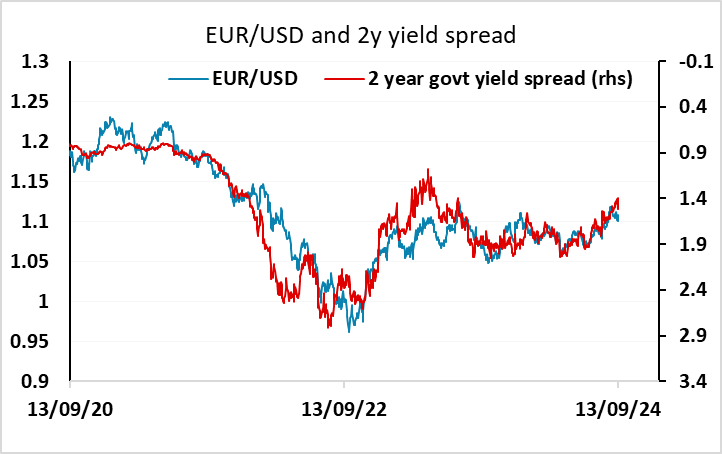

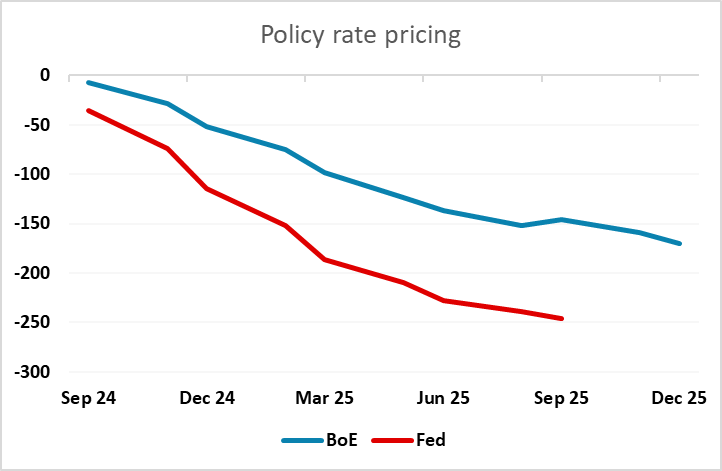

The week is dominated by central bank decisions, with the Fed on Wednesday, the Bank of England and Norges Bank on Thursday and the Bank of Japan on Friday. There is some uncertainty surrounding all the meetings. The FOMC decision seemed like a done deal after the higher than expected August CPI data last Wednesday, but subsequent press reports in the WSJ and the FT indicating that the decision was a close call between 25bps and 50bps have restored the uncertainty, with the market now pricing a 50 bp move as around a 45% chance. We still favour a 25bp cut, as do all but nine of 101 economists surveyed by Reuters, so the FX market may see a 50bp cut as being a little less likely than the money market pricing suggests. Even so, the USD would no doubt get knee-jerk support from a 25bp cut. But current yield spreads don’t suggest USD gains will be sustained, as unless the Fed suggests that the market is dramatically overpricing the scale of easing (and recent commentary from Powell and others suggests this is unlikely) yield spreads are still likely to point towards a slightly weaker USD across the board. The USD gained some benefit in recent weeks against the riskier currencies from the more negative sentiment in the equity market, but if equities continue to stabilize, the FX market may revert to looking at yield spreads, and these point towards a lower USD against almost everything, with the CAD and CHF being the only real exceptions. We would consequently expect any USD rally on the news of a 25bp cut to be modest and potentially quickly reversed, while USD weakness could be expected across the board on a 50bp move.

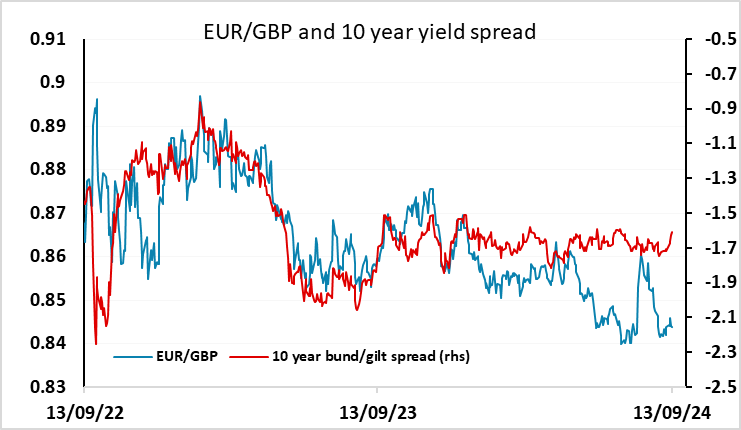

There is only a 27% chance of a 25bp rate cut priced in for the Bank of England meeting, and none of the 65 economists polled by Reuters are looking for a rate cut, so the FX market may be even less priced for a move than the money market suggests. This is likely to remain the case as long as the Fed only cuts 25bps, and the UK CPI data on Wednesday comes in in line with expectations. But we see some downside risks to the CPI data, and after mixed labour market data and weak GDP data last week, the risk of a cut may be significant if CPI also comes in below consensus, especially if the Fed cuts 50bps. GBP still looks to be trading on the strong side relative to yield spreads against the EUR, helped by some positive growth sentiment based on the stronger than expected H1 performance, but there does now seem to be a lot of good news priced in, so that the risks for GBP look to be mainly on the downside. Even if the BoE leave rates unchanged, there may be some negative GBP risk if there are more than 2 MPC votes for a cut.

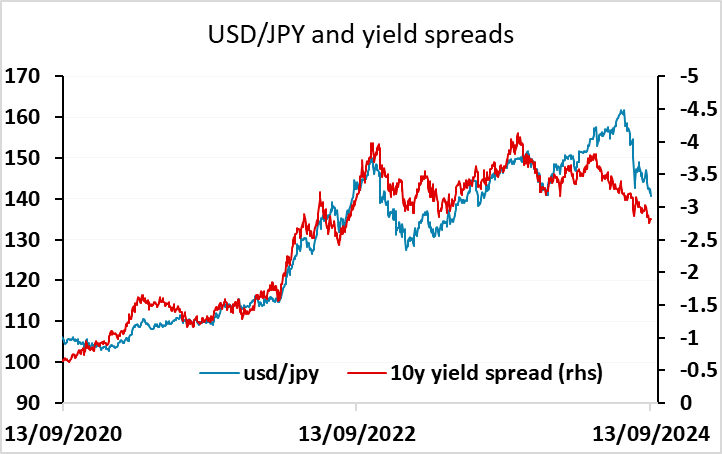

There is almost no risk of a rate hike priced in for the BoJ, and the Reuters survey also had all respondents looking for no change, so it does seem very unlikely that the BoJ will surprise. But they have a recent history of doing just that, and there have been several BoJ members talking hawkishly in recent days, suggesting there is scope for rates to rise to 1% and beyond in the longer run. Since the market is currently only pricing 0.5% rates by the end of 2025, we would anticipate more hawkish talk even if there is no move in rates. However, as we often note, while the BoJ’s stance may impact sentiment, it usually makes little practical difference to actual yield spread moves, which are dominated by moves on the other side of the spread. But with Japanese rates heading higher and rates elsewhere heading lower, and the JPY still dramatically undervalued with USD/JPY some 50% above Purchasing Power Parity (PPP), it’s very difficult to see anything other than more JPY strength.

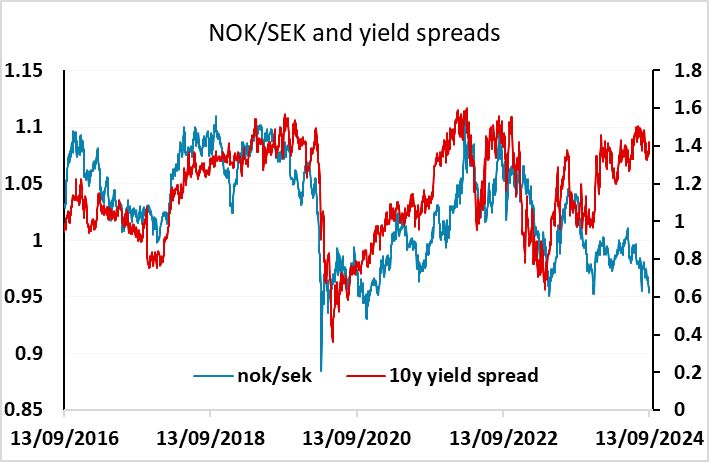

There is also no change expected from Norges Bank’s decision on Thursday from any forecasters, and this should maintain the case for a NOK recovery. However, this case has been in place for some time – indeed, pretty much the whole year – with NOK/SEK in particular trading very soft relative to the usual yield spread relationship. We have seen EUR/NOK come off the highs near 12 in the last week, suggesting there may be some scope for a more substantial recovery if risk sentiment continues to stabilize, and with 0.95 looking like good support in NOK/SEK, we do favour NOK upside. But we have favoured this for much of the year and been disappointed, and if anything Norges Bank may tone down its hawkish leanings and perhaps depart from its recent stress of ‘policy to stay on hold for some time ahead’. So there may even be a negative knee-jerk NOK reaction if this is the case, but we would see such a move as creating an opportunity for longer term buyers.

Data and events for the week ahead

USA

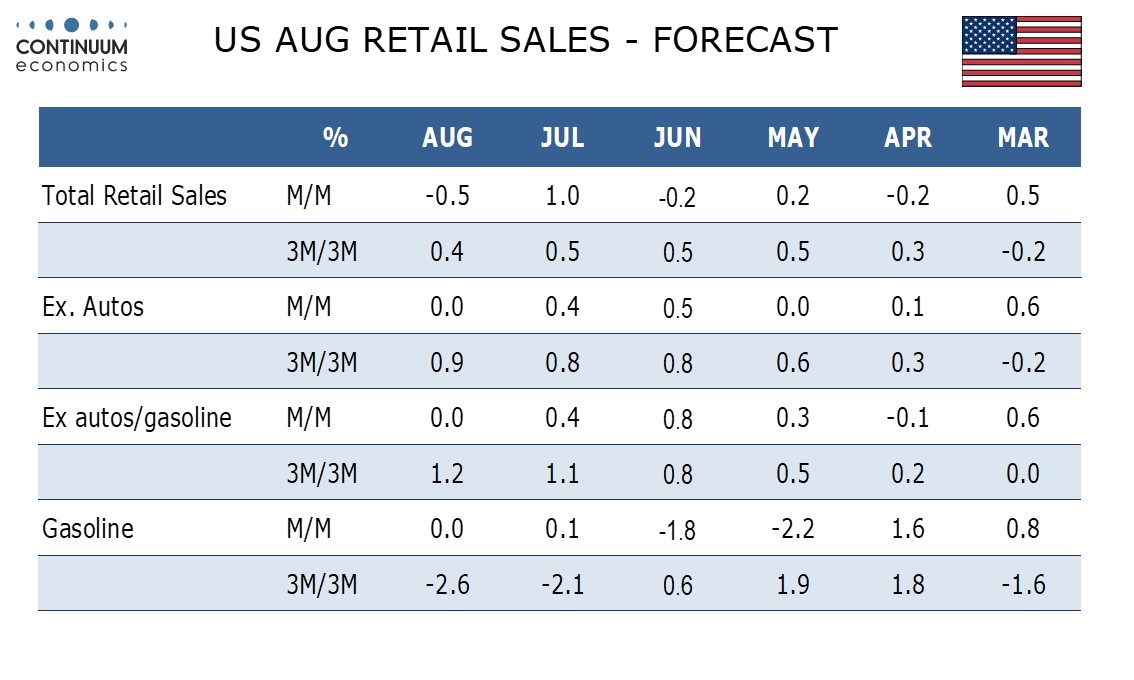

While Wednesday’s FOMC decision is the clear highlight of the US calendar there are some significant data releases due too. Monday sees September’s Empire Sate manufacturing survey. The most significant release is likely to be August retail sales on Tuesday, where we expect a weak month to follow a strong July, with overall sales down by 0.5% with unchanged sales both ex autos and ex autos and gasoline. Soon after however we expect a 0.5% increase in August industrial production, the rise led by a rebound in autos from a weak July. Also due on Tuesday are September’s NAHB homebuilders’ index, and July business inventories, which existing data suggests will rise by 0.3%.

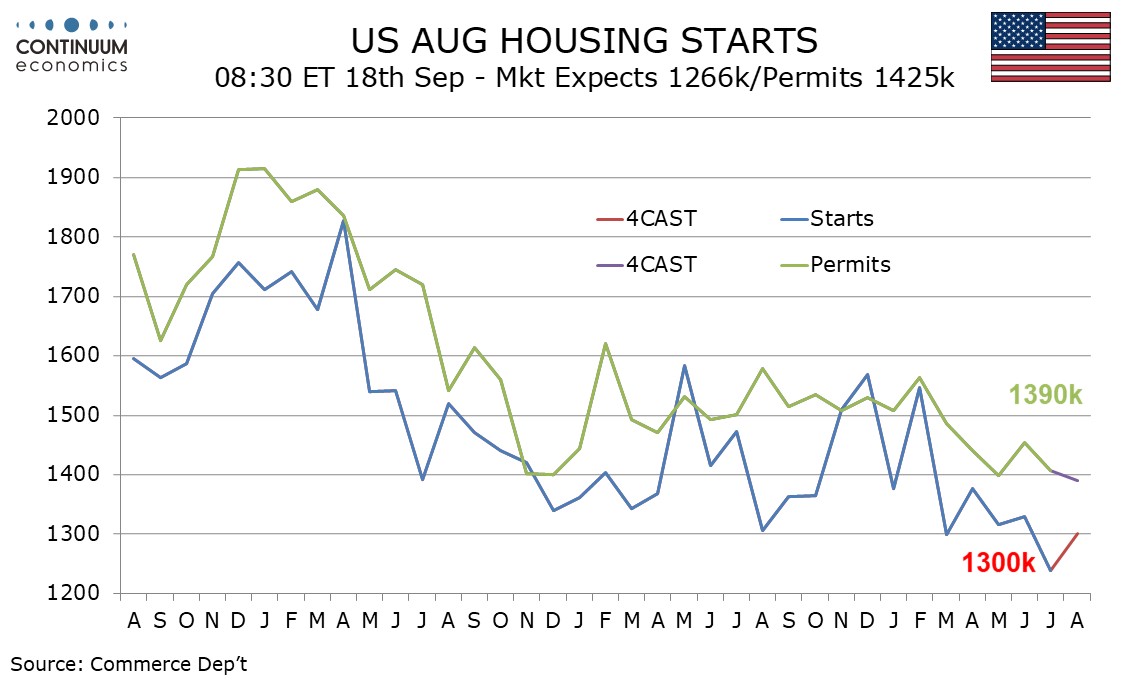

Early on Wednesday we expect August housing starts to rise by 5.0% to 1300k after a 6.8% July decline but permits to fall by 1.1% to 1390k. We expect the FOMC to ease by 25bps to a 5.0-5.25% target range. The statement is likely to be quite dovish, putting increased emphasis on downside employment risks, and the dots are likely to be significantly more dovish than those of June, we expect predicting a further 50bps of easing this year and 150bps of easing in 2025. However Powell’s press conference is likely to emphasize data-dependence, and leave the Fed with the option to either pause or accelerate the pace of cuts in upcoming meetings.

Thursday’s initial claims data will cover the survey week for September’s non-farm payroll. Also due on Thursday are September’s Philly Fed manufacturing survey and the Q2 current account where we expect the deficit to increase to $259bn from $237.6bn. August existing home sales follow, where we expect a 2.5% decline to 3.85m, as well as August leading indicators. Friday’s calendar is quiet.

Canada

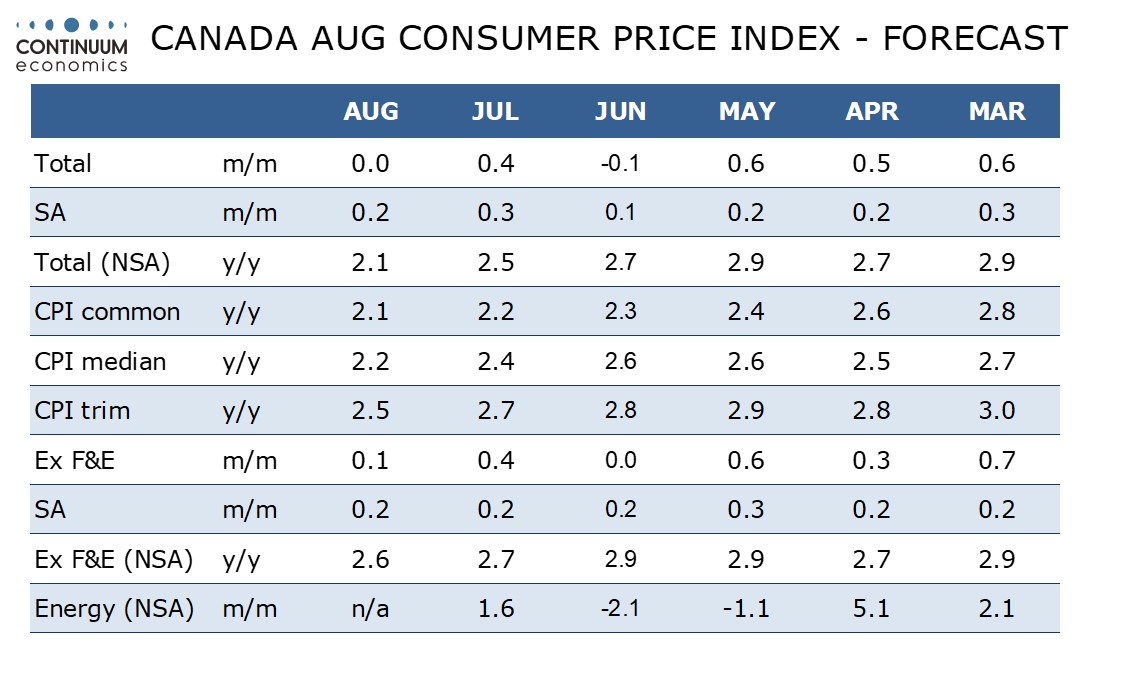

Canada releases July manufacturing shipments on Monday, where the preliminary estimate was for a 1.1% increase. August existing home sales are also due on Monday and August housing starts follow on Tuesday. Canada’s most significant release will be August CPI on Tuesday, where we expect the headline to slip to 2.1% yr/yr from 2.5% as year ago strength in energy drops out, though we should also see continued if moderate progress lower on the Bank of Canada’s core rates. Minutes from the September 4 BoC meeting are due on Wednesday, and likely to be dovish. July retail sales are due on Friday, for which the preliminary estimate was for a 0.6% increase, as well as August’s IPPI and RMPI data.

UK

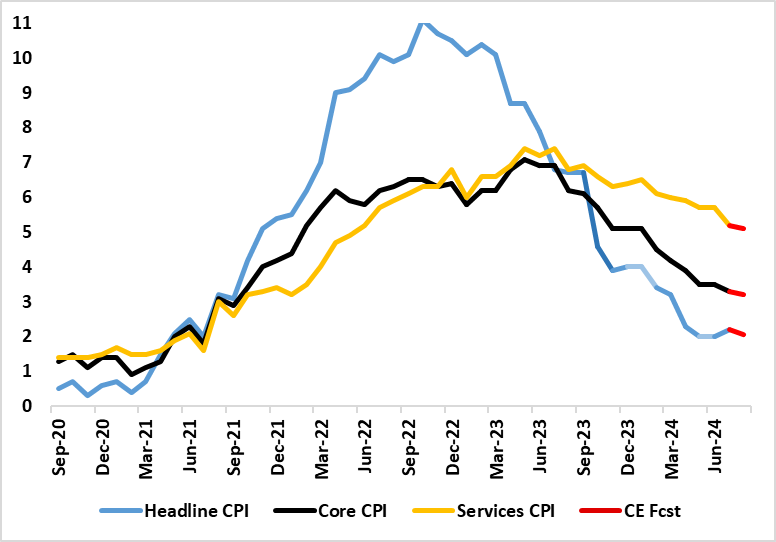

Two events dominate the week, both very much inter-related starting with CPI numbers (Wed). We see the July rise being partly reversed in August data, with a fall to 2.1%, this also seeing 0.1 ppt drops in both services and core inflation. If accurate, all these would be well below BoE projections. Given weakness in private sector jobs data that undermines BoE GDP optimism, and given those CPI figures we would not rule out a further BoE rate cut when the MPC gives it next verdict on Thursday. More likely, given reservations evident in the closeness of the MPC vote last month to cut Bank Rate by 25 bp to 5.0% caution will prevail with no cut this month but with more clear dissent. Either way, no policy guidance will be offered save to say (still) decisions ahead will be made on a meeting-by-meeting basis, albeit leaving the door open for a November cut.

Friday sees public borrowing numbers, all the more important given the so-called fiscal black hole which the Oct 30 Budget is going to address. The size if this black hole is not (yet) supported by official borrowing figures. These show borrowing in the first four months of FY 2024-25 totalled £ 51.4 billion, £ 0.5 billion below the same period last year but £ 4.7 billion above OBR thinking with this overshoot already reflecting strong growth in public sector pay. Released alongside will be retail sales data. August saw changeable but near-normal weather which we think will see a small m/m rise driven purely by food sales.

Eurozone

Datawise, some interest will be in EZ trade data (mon) which may show less import weakness while the ZEW data (Tue) may reflect recent soft data news already seen of late in Germany. Monday also bring EZ hourly labor costs data for Q2, likely to echo other softer wage pressures numbers seen of late. Otherwise there is an array of ECB speeches, some possibly offering both more hawkish and more dovish message to the recent Council press conference.

Rest of Western Europe

There is some data in Sweden, most notable on Monday where more weak jobs data may be in store. Otherwise in Norway, and as has been the case for the five previous policy meetings, the Norges Bank is almost certain to keep its policy rate at 4.5% when the Board offers its next verdict on Sep 19. But amid a slightly disappointing mainland real economy backdrop and what have been softer than (Norges Bank) expectations for CPI data of late, the Board will tone down its hawkish leanings and perhaps depart from its recent stress of ‘policy to stay on hold for some time ahead’.

Japan

National CPI on Friday will be the key focus despite it being on the same day of BoJ decision. National headline CPI has risen closer to 3% at 2.8% in July. It supported BoJ’s hawkish tilt in monetary policy but we are not forecasting an imminent hike in September with private consumption remains sluggish. The BoJ meeting on the same day would likely concur and signals a hike before year end. Trade balance on Wednesday will likely be overlooked.

Australia

GDP and employment report on Thursday. Moderate growth is expected for the Australian economy with domestic demand yet to recover from low real wage and household saving. The Australian market will be painting a similar picture, choppy but remain solid.

NZ

Consumer Survey on Friday and Business PSI on Monday.