FX Daily Strategy: Asia, September 13th

University of Michigan confidence data a focus in sparse calendar

Some risk that recent deterioration extends triggering risk negative reaction

JPY remains well supported, with valuation very attractive

EUR has some scope for modest gains after moderate ECB statement

University of Michigan confidence data a focus in sparse calendar

Some risk that recent deterioration extends triggering risk negative reaction

JPY remains well supported, with valuation very attractive

EUR has some scope for modest gains after moderate ECB statement

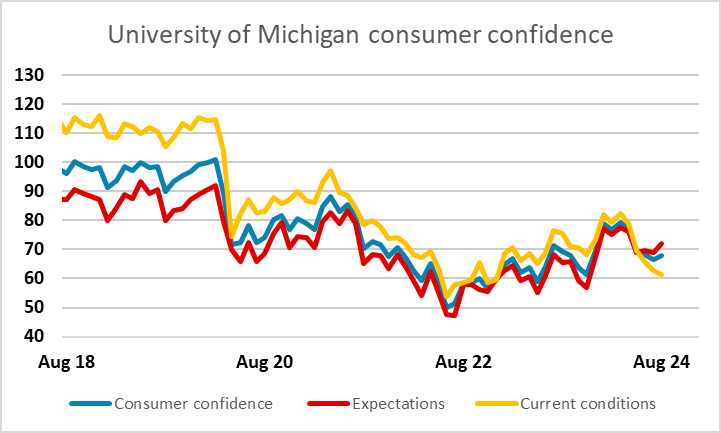

There isn’t a great deal on Friday’s calendar but there will no doubt be some interest in the preliminary University of Michigan consumer confidence survey. While we have seen a steady if shallow recovery in the main confidence index since the lows in mid-2022, the current conditions index has fallen for the last five months consecutively, and is approaching the June 2022 lows. Expectations have been better supported, but further weakness in current conditions might re-ignite some expectations of a hard landing. This might not be enough to get the Fed cutting 50bps this month, but could undermine risk sentiment and trigger further strength in the JPY, both against the USD and on the crosses.

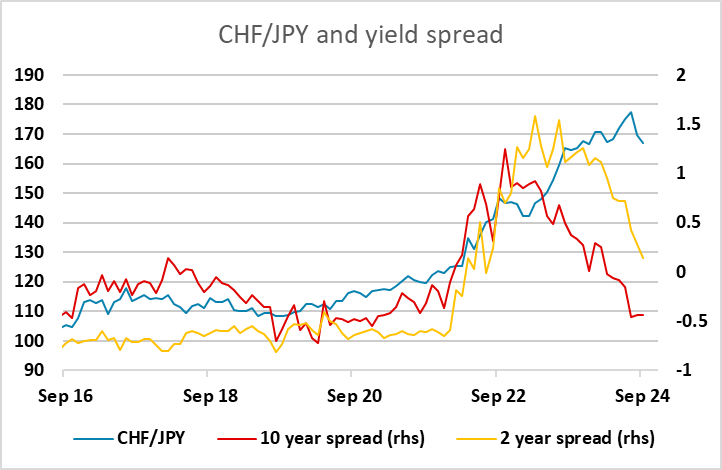

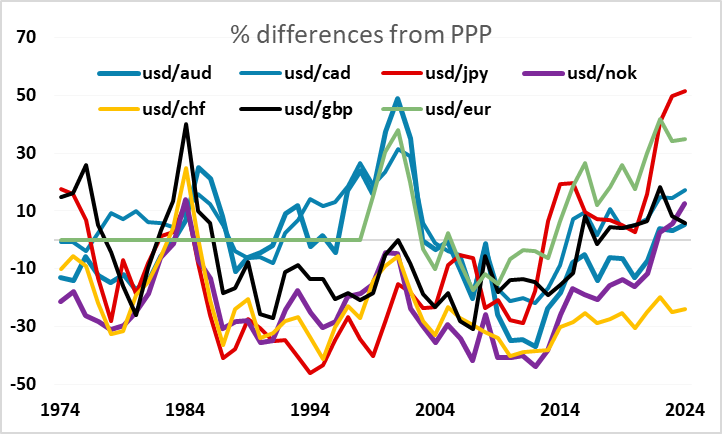

The JPY continued to perform well on the crosses on Thursday, despite some losses late in the US in Wednesday trigger by a tech stock rally. We continue to see scope for medium term JPY gains, both because there is likely to be further yield spread contraction between Japan and both the US and Europe, and because the JPY is still extremely cheap. Although the JPY is now not much changed from the beginning of the year, it’s recovery has only modestly reduced its undervaluation. An examination of relative inflation is necessary to appreciate its real terms weakness against the USD and most European currencies, but it’s easiest to see its weakness in nominal terms against the CHF. Since Japanese and Swiss inflation have generally been similar, nominal and real moves in CHF/JPY have been similar too. Even though CHF/JPY is now almost 14 figures off its highs, it is still up more than 50% in the last 5 years, in a period where long term yield spreads have been unchanged. Short term spreads remain slightly in favour of the CHF, but this is unlikely to last much longer either.

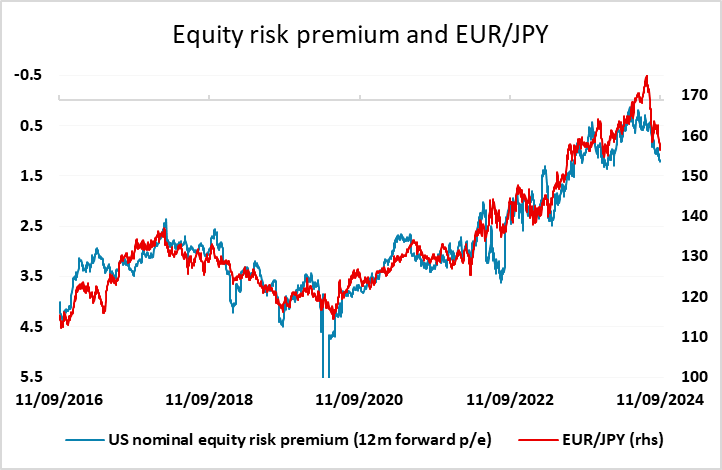

CHF/JPY consequently looks clearly biased lower, but we would point out that the CHF has only gained modestly in real terms against the EUR in recent years (although it remains very highly valued in absolute terms). From a valuation perspective there is therefore scope for similar JPY gains across the board. However, in the short run we may have seen the majority of JPY gains against the USD and EUR, with USD/JPY and EUR/JPY now approaching levels consistent with the short term metrics that have driven them in recent years. But there is still scope for a big valuation move in the JPY’s favour. The trigger for such a move is hard to predict, but it seems likely to come with a bigger turn lower in risk sentiment.

Elsewhere, the ECB meeting had the expected modest impact on Thursday, but the measured tone of the statement suggested to many that there was unlikely to be another rate cut in October. This is mildly supportive for the EUR, with short term yield spreads in any case looking supportive of some small EUR/USD gains. This may, however, be conditional on reasonably stable risk sentiment, as the EUR suffered a little in the equity downdraft of last week.