U.S. August PPI - Ex Food, Energy and Trade a little too high for comfort

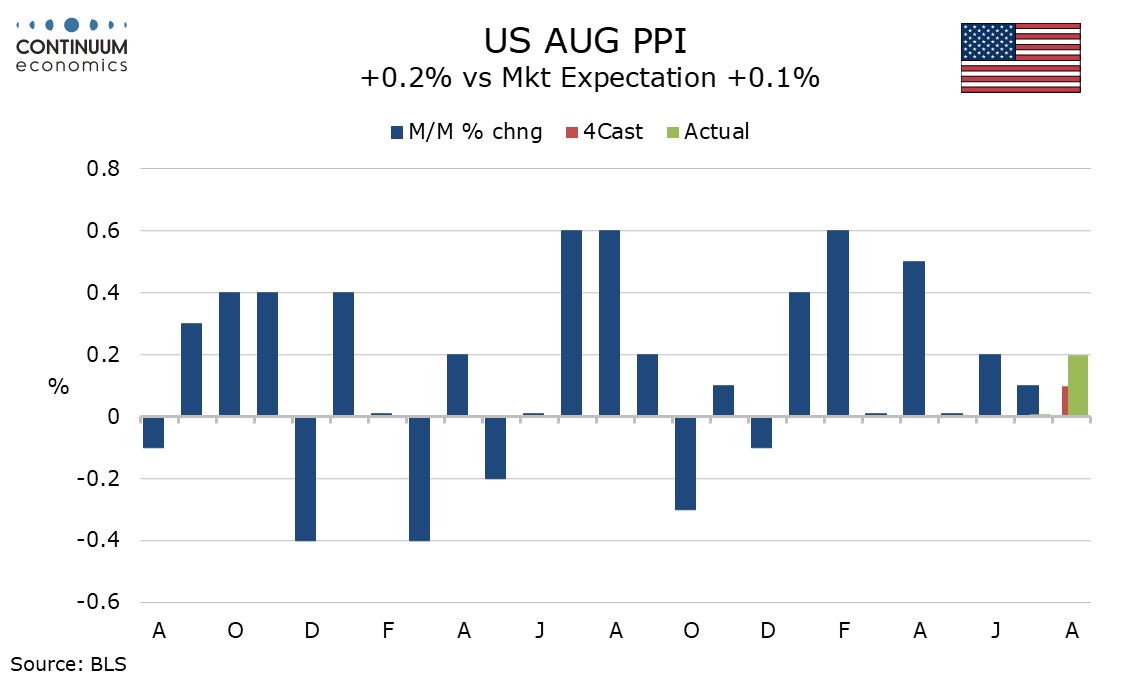

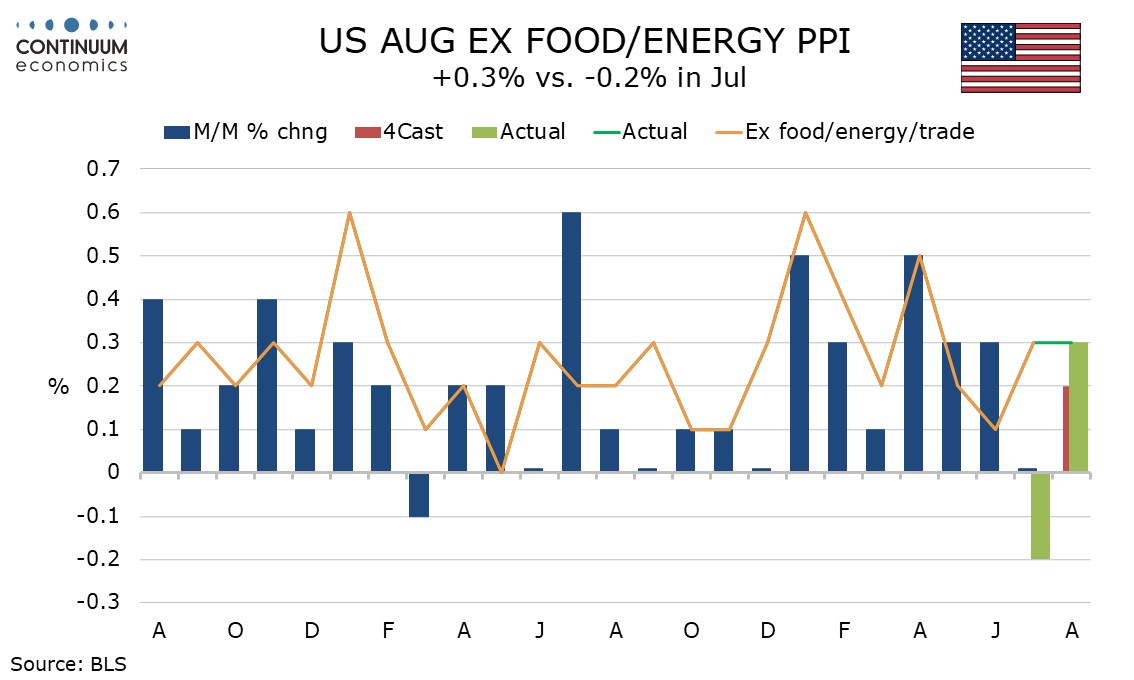

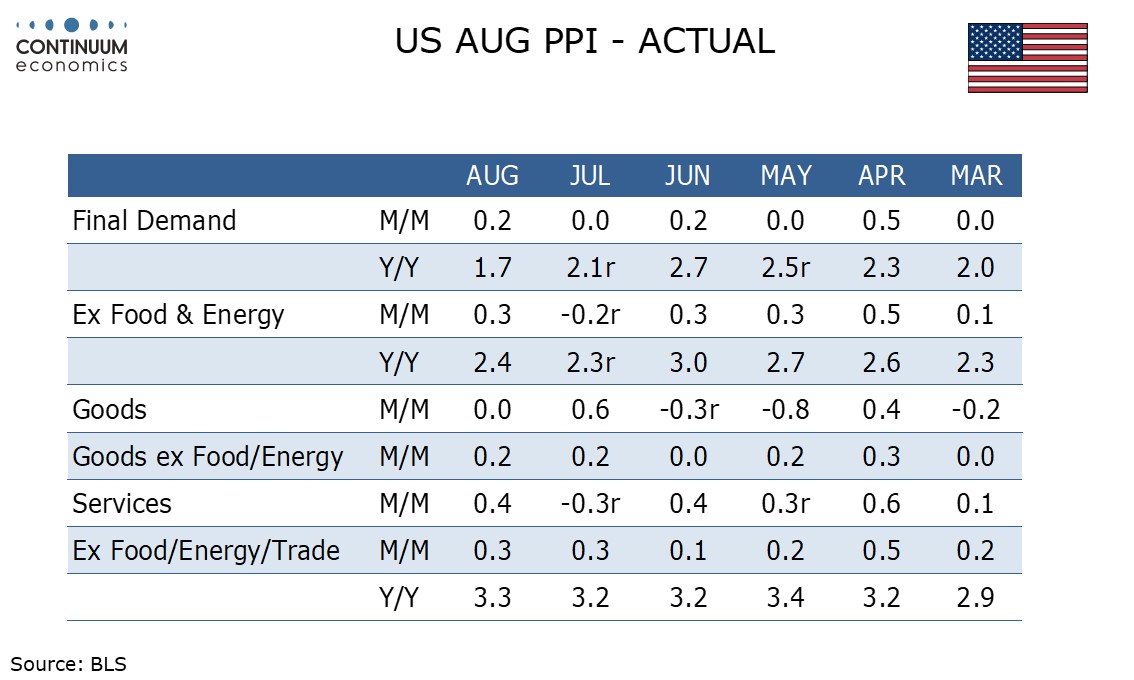

Like the CPI, August PPI was on the firm side of expectations, up by 0.2% overall and 0.3% in both the core rates, ex food and energy and ex food, energy and trade. The data confirms that while inflation has fallen significantly, it is not yet consistent with target. Initial claims provided few surprises, up a modest 2k to 230k.

The details look similar to the CPI with food up a marginal 0.1% and energy falling by a modest 0.9%. Goods ex food and energy showed a second straight modest 0.2% increase while services increased by 0.4%, with trade up 0.6%, transportation and warehousing down by 0.1% and other services up by 0.3%.

A 0.3% rise ex food and energy does not look too concerning coming after a 0.2% decline in July, though July’s weakness was largely due to a correction lower in trade from a strong June. Ex food, energy and trade services saw a second straight 0.3% rise, and that is disappointing.

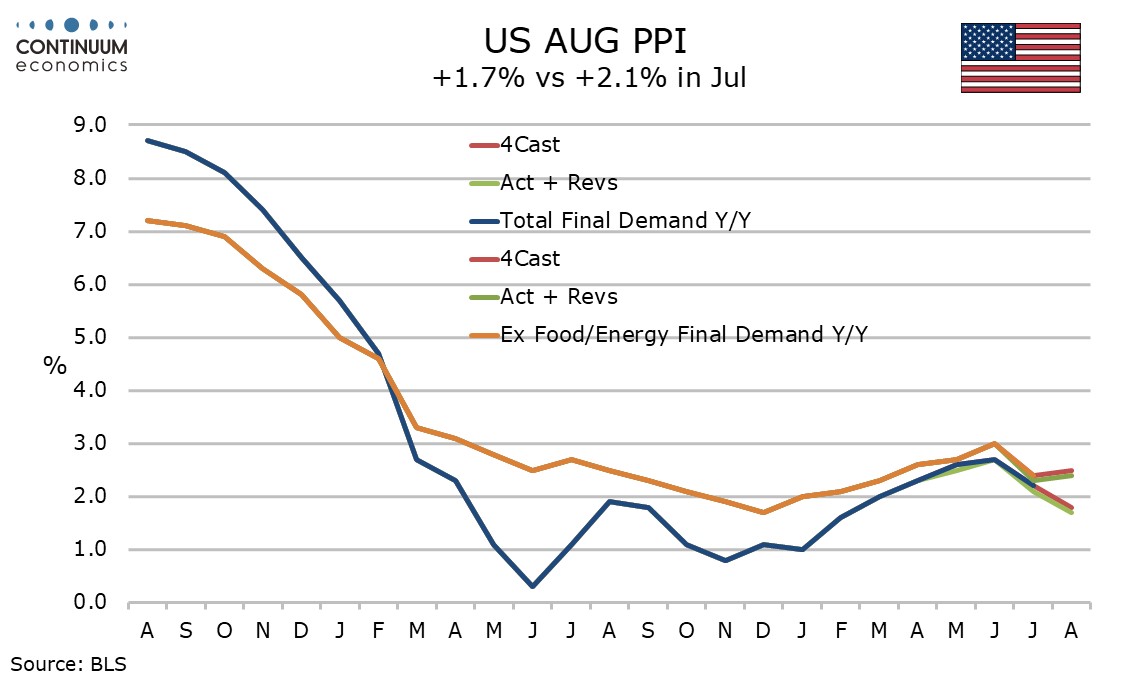

Yr/yr PPI slipped to 1.7% from 2.1% as year ago strength in energy dropped out but ex food and energy rose to 2.4% from 2.3% and ex food, energy and trade rose to 3.3% from 3.2% and that is a little too high for comfort. Yr/yr PPI ex food, energy and trade PPI has been above 3.0% for five straight months after having spent the preceding eleven straight months marginally below 3.0%.

Intermediate PPI data is more encouraging, processed goods down by 0.1% and up by only 0.1% ex food and energy, with unprocessed goods down by 3.7% with ex food and energy down by 1.1%. Intermediate services fell by 0.1%, the first monthly decline in twelve months.

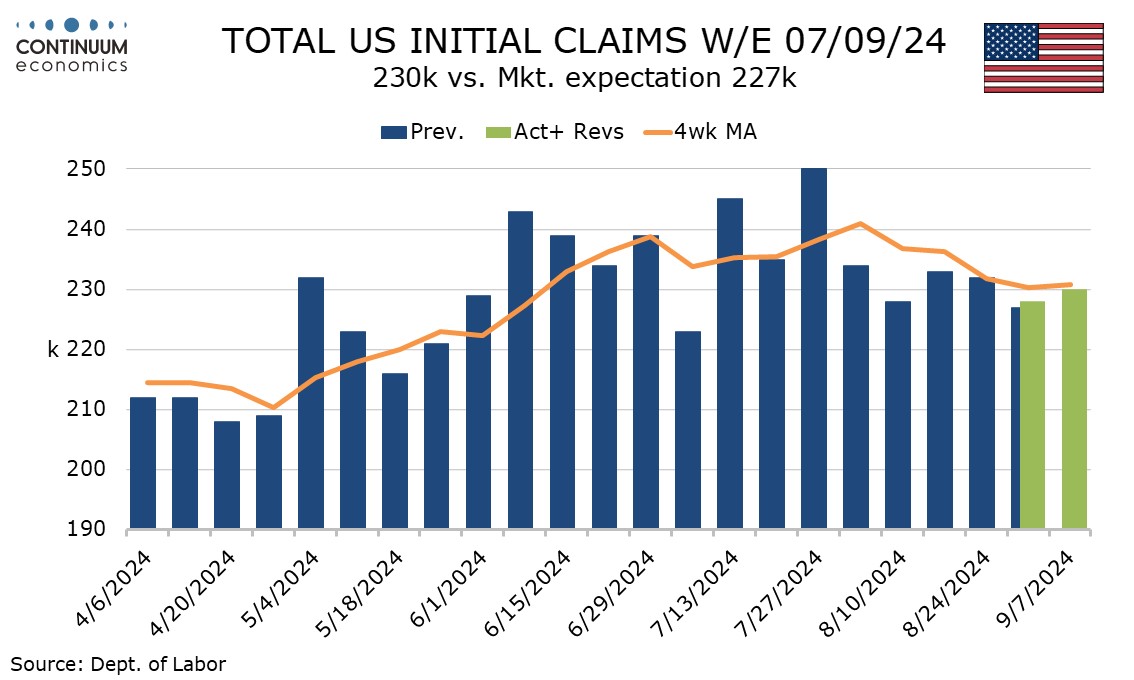

The 2k increase in initial claims corrects a preceding 4k decline and the 4-week average is entering September slightly below where it started August, a positive hint for September’s payroll which will be surveyed next week.

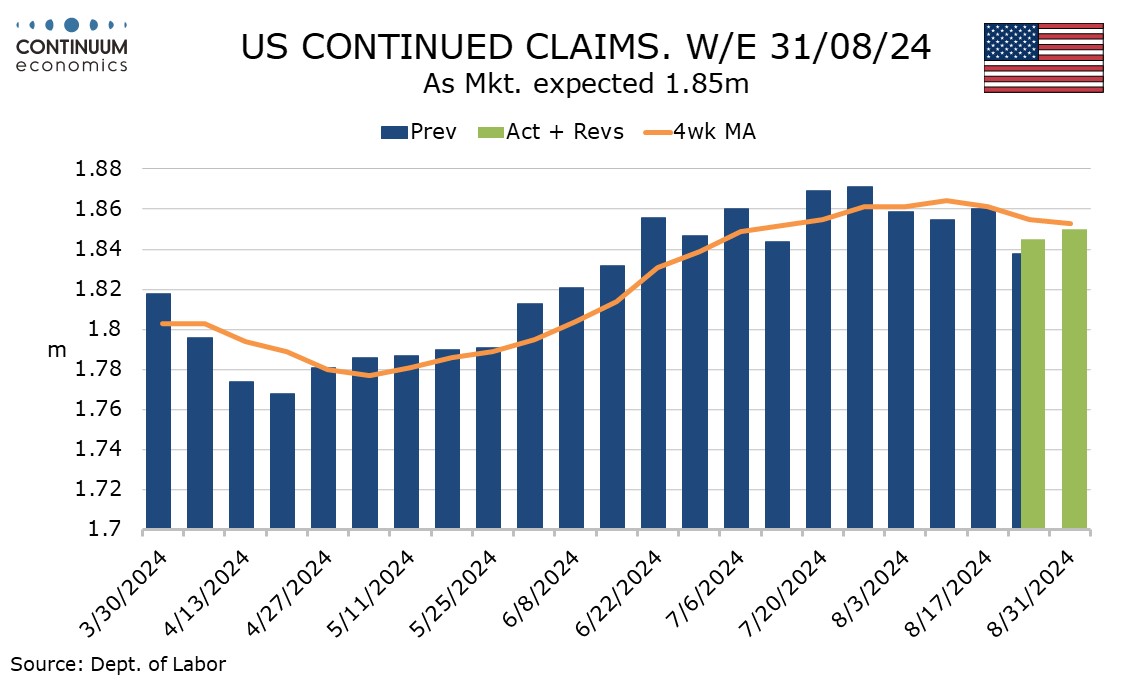

Continued claims, covering the week before initial claims, rise by 5k to 1.85m to correct a preceding 15k decline. The 4-week average has edged lower in recent weeks here too.