GBP flows: GBP softer after flat GDP

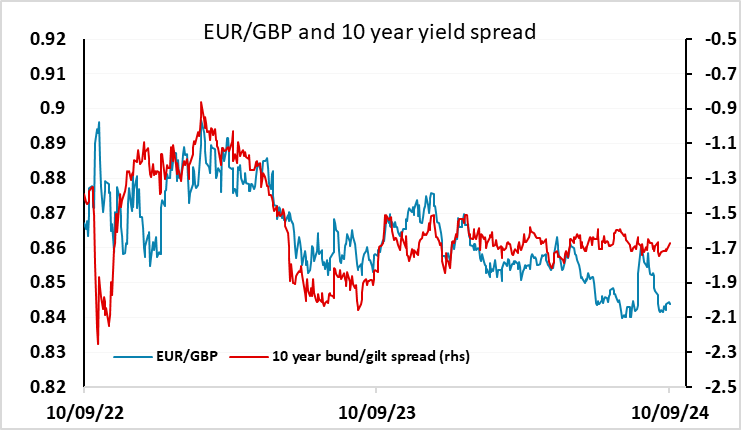

GBP softens after July GDP comes in unchanged m/m, below market expectations of a 0.2% rise.

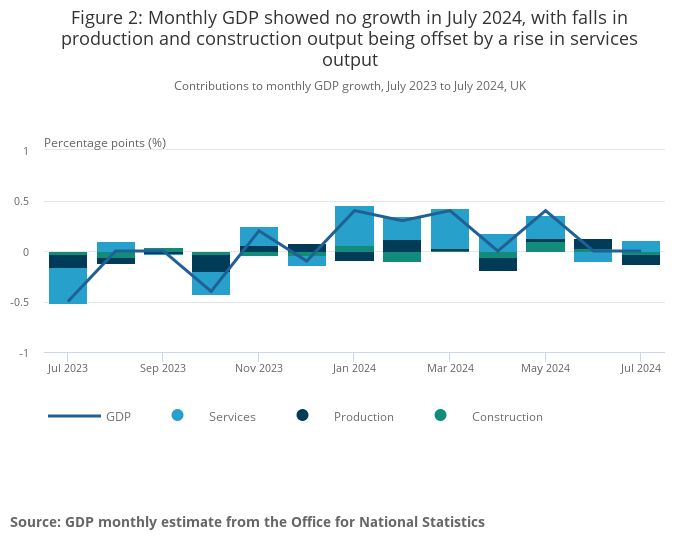

GBP has dipped after UK July GDP came in weaker than expected at unchanged m/m. This follows a similarly unchanged number in June, and suggests that the stronger momentum to the economy seen in H1 is fading. Whether it is enough to convince the BoE to cut rates next week is less clear. The BoE is focused more on inflation trends and the labour market than short term GDP indicators, and yesterday’s labour market data was mixed. The dip in average earnings growth in the official ONS data to 4.0% y/y in the 3 months to July was encouraging, but due largely to base effects, and the more up to date HMRC data showing a pop higher to 6.2% y/y in August. Against this, the HMRC data showed a second consecutive month of decline in payrolled employment, and vacancies declined for the 26 consecutive month.

The market prices a 25bp cut at next week’s meeting as only a 22% chance, and this looks a little too low in our view, suggesting there is scope for UK yields to edge lower and GBP to edge higher before the meeting. Next week’s August CPI data may be key, and we see some downside risks, with the July data having shown weakness in the key services measure and already below BoE projections. EUR/GBP should have scope to press back up to 0.8450 near term, especially since the risk environment continues to show signs of weakness.