Published: 2024-09-10T12:25:18.000Z

U.S. August NFIB survey - Loses momentum after stronger July

Senior Economist , North America

5

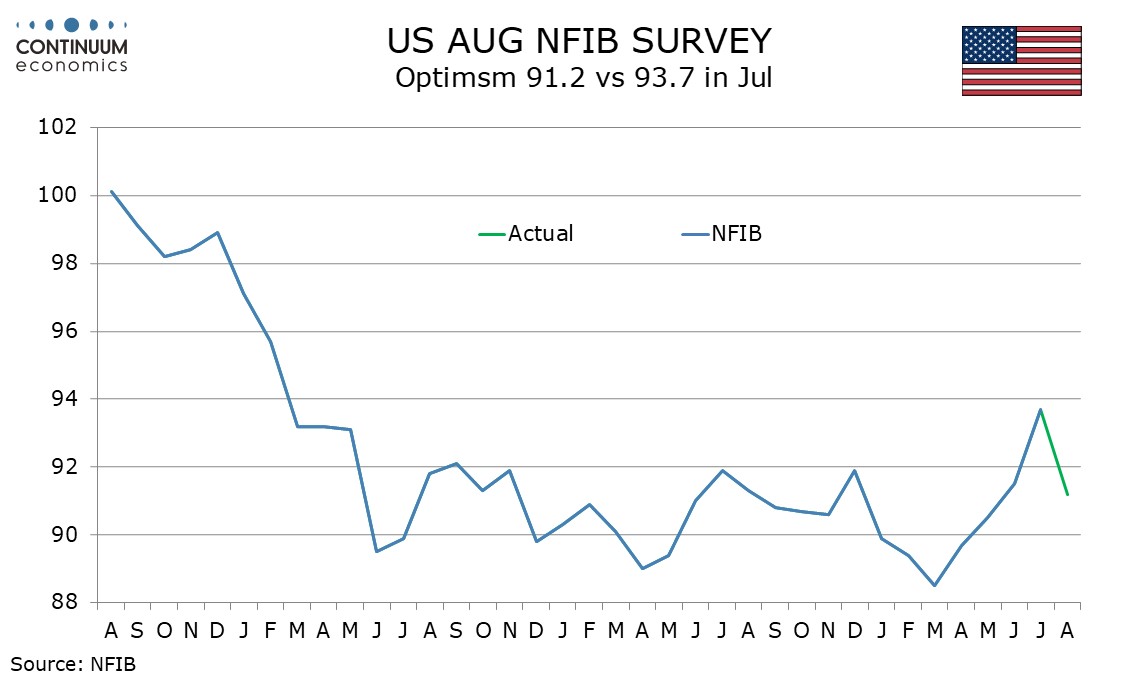

After picking up in the four months to July, which saw the highest level since February 2022, August’s NFIB Small Business Optimism Index has taken a hit, slipping to 91.2 from July’s 93.7, moving marginally below June’s 91.5 too.

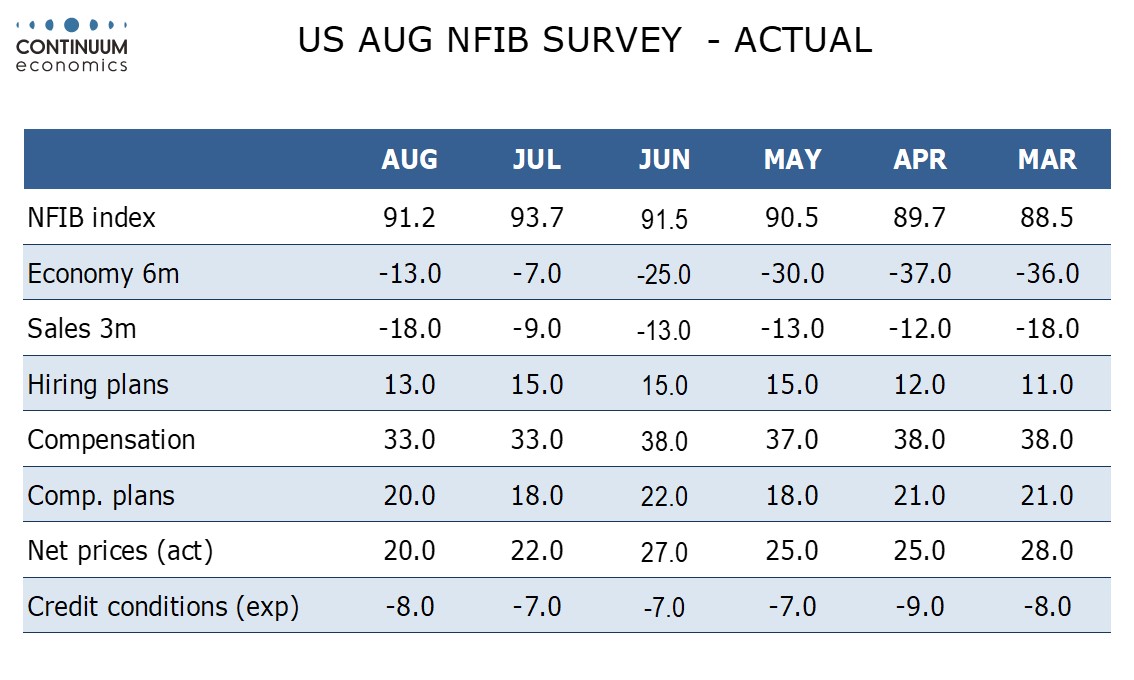

The index of net prices at 20 from 22 extended a sharp July slowing from June’s 27 and is the lowest since January 2021.

Hiring plans at 13 are down from three straight months at 15 though still stronger than in the first four months of the year. Compensation is steady at 33, though this sustains a July drop to the lowest level since April 2021. Compensation plans edged up to 20 from 18, but trend looks fairly stable.

One notable feature of July’s report was significantly improved optimism on the future, with 6 month expectations on the economy at -7 from -25, the highest since November 2020. August’s -13 is weaker than July, but still well above June. July saw 3 month sales expectations at -9 from -13, their highest since December 2023. August here saw more than a full reversal, to -18, the weakest since March.