FX Daily Strategy: N America, September 10th

GBP slightly firmer after UK labour market data

NOK bounces after short lived dip on weaker CPI

JPY remains well bid but upside break unlikely short term

GBP slightly firmer after UK labour market data

NOK bounces after short lived dip on weaker CPI

JPY remains well bid but upside break unlikely short term

Tuesday in Europe saw UK labour market data and CPI data from Norway, both of which had potential to have market impact.

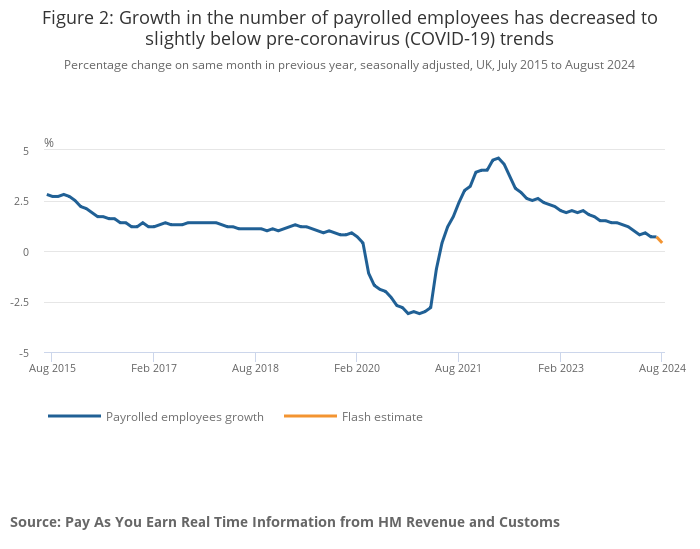

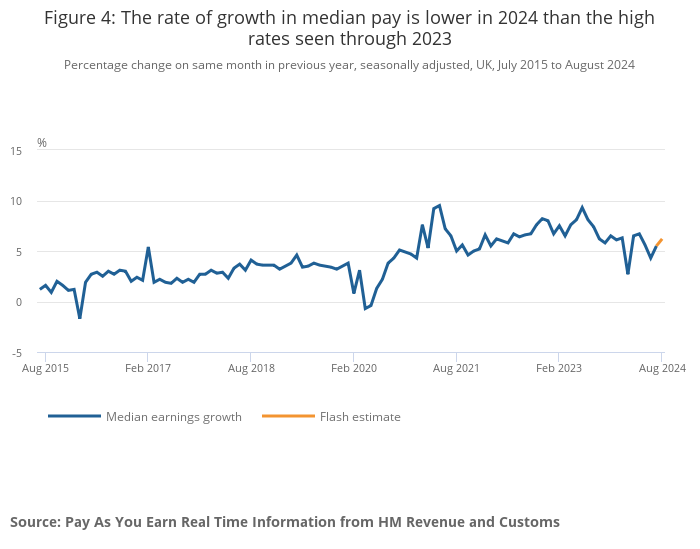

GBP is slightly firmer after the UK labour market data, although the data itself was mixed. While the official ONS data showed a larger than expected rise in employment in the 3 months to July, they also showed slightly lower than expected average earnings growth at 4.0% y/y (including bonuses). Meanwhile, the more up to date and nowadays perhaps more significant HMRC pay as you earn (PAYE) data on payrolled employment as weaker than expected, showing a provisional 59k decline in August and a downward revision to the July data to a decline of 6k from a rise of 24k in the provisional numbers. However, earnings growth rose to 6.2% y/y in August in the PAYE data from 5.5% in July.

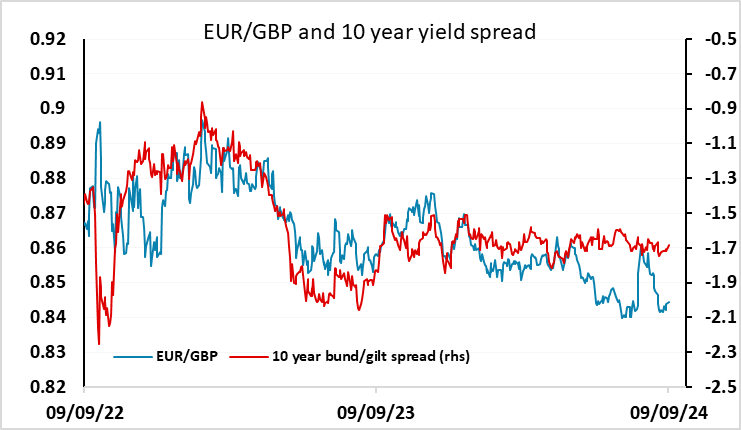

All in all the UK data looks fairly neutral, and shouldn’t have a significant effect on MPC thinking on next week’s rate decision. EUR/GBP has dipped slightly on the news, but should hold well above 0.84 and the risks still look weighted towards a move higher in the run-up to the MPC meeting.

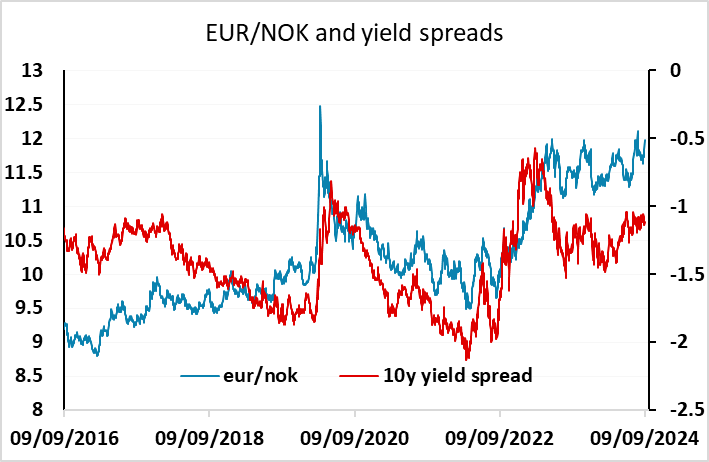

The NOK remains one of the weakest of the G10 currencies, even though Norges Bank remains one of the most hawkish of the G10 central banks. EUR/NOK was once again testing the 12 area, without any real support from moves in yield spreads, even on a day like Monday where risk sentiment was showing some recovery. However, we regard the latest weakness as largely technical, and any approach to 12 should be seen as a selling opportunity.

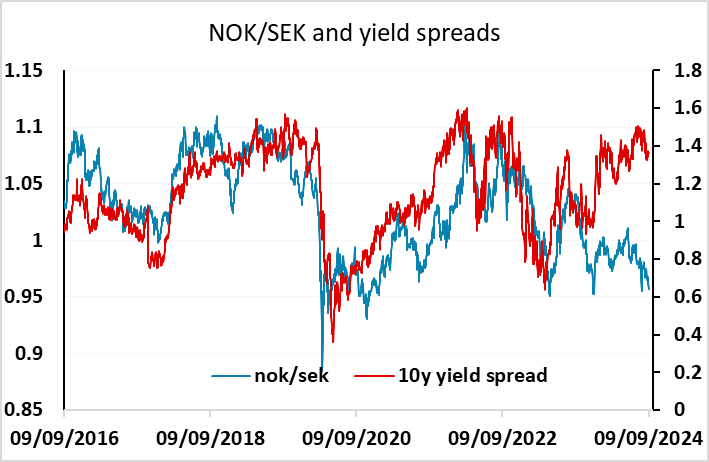

EUR/NOK initially blipped slightly higher after this morning’s Norwegian CPI data, which came in slightly weaker than expected, but has quickly reversed gains and now sits 3 figures lower than opening levels. The lower than expected CPI number might marginally increase the prospects of Norges Bank easing this year, but this doesn’t change the fact that the NOK looks too weak relative to yield spread moves given the relative hawkishness of Norges Bank. The weakness is perhaps most obvious against the SEK, but is also evident against the EUR. The NOK continues to struggle with other commodity currencies whenever there is any weakening in risk sentiment, but has also struggled to make gains in risk recoveries. Nevertheless, EUR/NOK levels near 12 look overextended, and NOK/SEK looks notably cheap at 0.96.

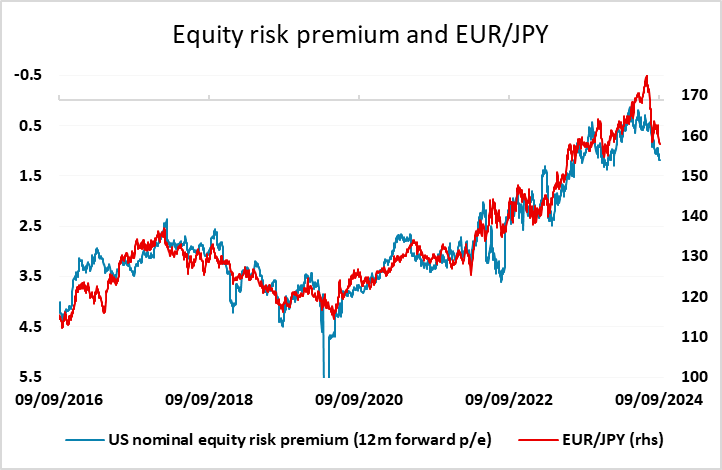

Despite some initial JPY weakness on Monday in response to a better tone in global equities, USD/JPY’s gains proved relatively short-lived, with the move above 143 fully reversed by the end of the European day. EUR/CHF gains also faded, but there is less reason for the CHF to recover than the JPY, with EUR/CHF already on the cheap side on a 0.93 handle. However, for now we wouldn’t expect any major JPY or CHF break higher, with the market awaiting more evidence of US weakness and/or a rationale for further equity losses. This seems unlikely to be seen this side of the US CPI data on Wednesday. The Fed may well be more focused on the labour market than CPI ta the moment, but stronger than expected CPI could still be dangerous for equities as it would limit the Fed’s ability to react to any real sector weakness.