FX Daily Strategy: Europe, September 10th

GBP has some downside risks on UK labour market data

NOK still looks cheap unless CPI surprises on the downside

JPY remains well bid but upside break unlikely short term

GBP has some downside risks on UK labour market data

NOK still looks cheap unless CPI surprises on the downside

JPY remains well bid but upside break unlikely short term

Tuesday sees UK labour market data and CPI data from Norway, both of which have potential to have market impact.

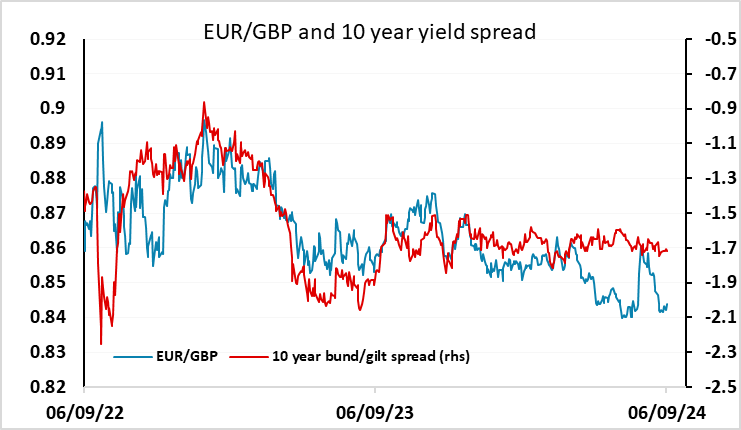

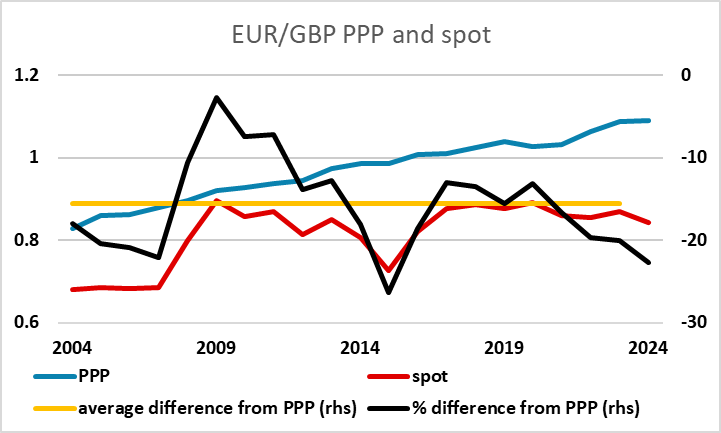

The risks for GBP look to be mainly on the downside as the BoE meeting on September 19 is priced as only having around 27% chance of delivering a 25bp rate cut. GBP is already trading at levels that look expensive from a long run perspective, and recent GBP gains against the EUR have come without support from moves in yield spreads. The labor market data may show a rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested clearer slowing in private sector employment, if not an actual contraction, thereby painting a conflicting picture to that of the recent strength in the GDP numbers. However, the average earnings figures will be the most closely watched. We see a further discernible slowing in both regular pay growth (3 mth mov avg) down to 5% and the headline rate down to around 4% on base effects., a slightly larger slowing than the market expectation of a drop to 4.1%. This weaker data should lead to the market pricing in some increased risk of a rate cut, and should mean EUR/GBP trades up towards 0.85.

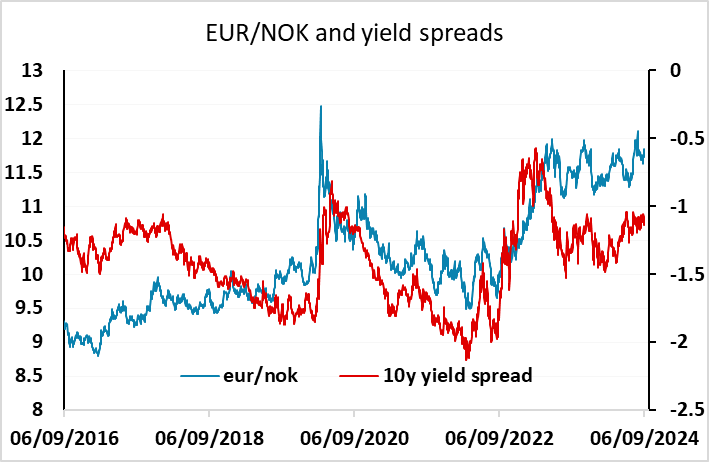

The NOK remains one of the weakest of the G10 currencies, even though Norges Bank remains one of the most hawkish of the G10 central banks. EUR/NOK is once again testing the 12 area, without any real support from moves in yield spreads, even on a day like Monday where risk sentiment was showing some recovery. However, we regard the latest weakness as largely technical, and any approach to 12 should be seen as a selling opportunity provided that the CPI data doesn’t come in significantly below the market consensus of 2.7% y/y (3.2% core).

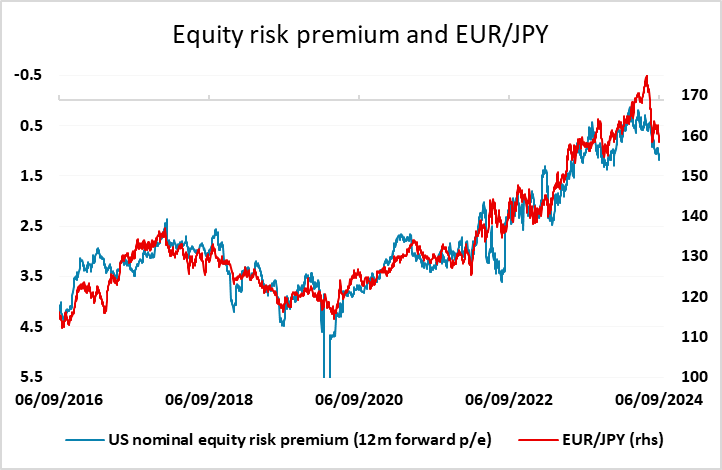

Despite some initial JPY weakness on Monday in response to a better tone in global equities, USD/JPY’s gains proved relatively short-lived, with the move above 143 fully reversed by the end of the European day. EUR/CHF gains also faded, but there is less reason for the CHF to recover than the JPY, with EUR/CHF already on the cheap side on a 0.93 handle. However, for now we wouldn’t expect any major JPY or CHF break higher, with the market awaiting more evidence of US weakness and/or a rationale for further equity losses. This seems unlikely to be seen this side of the US CPI data on Wednesday. The Fed may well be more focused on the labour market than CPI ta the moment, but stronger than expected CPI could still be dangerous for equities as it would limit the Fed’s ability to react to any real sector weakness.