Published: 2024-09-05T18:45:35.000Z

Preview: Due September 17 - Canada August CPI - Strong year ago data to see yr/yr growth fall further

Senior Economist , North America

12

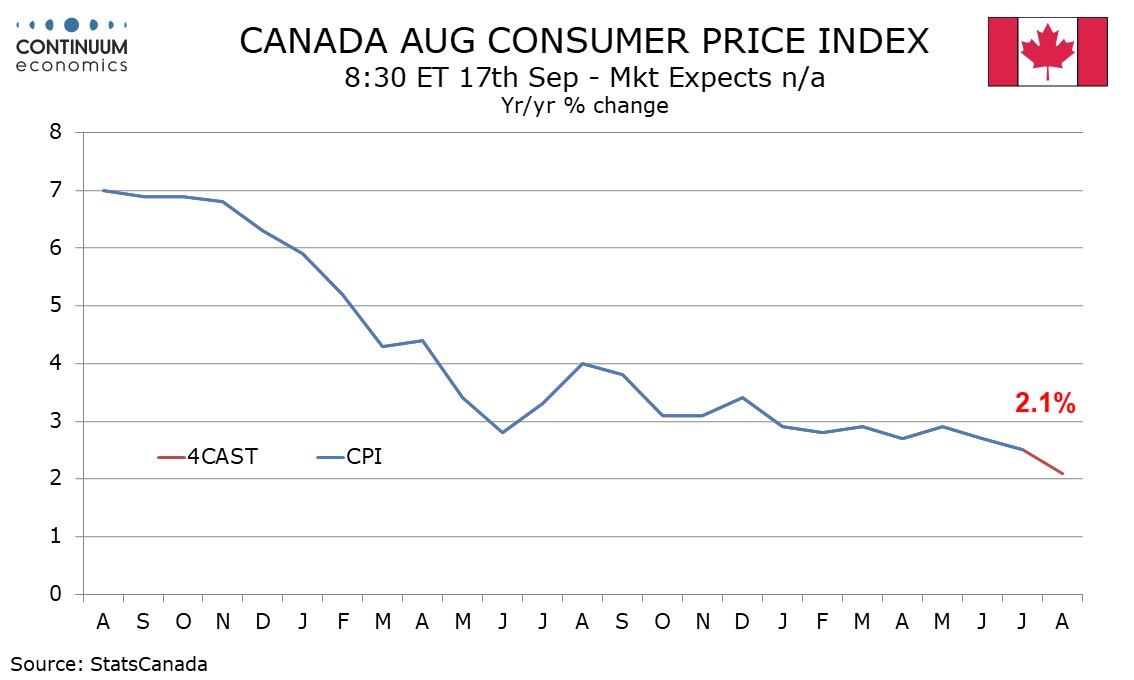

We expect August Canadian CPI to slip to 2.1% yr/yr from 2.5% as year ago strength drops out, reaching its lowest level since February 2021. While progress on the Bank of Canada’s core rates will be a little less sharp, we expect the rates to continue moving lower.

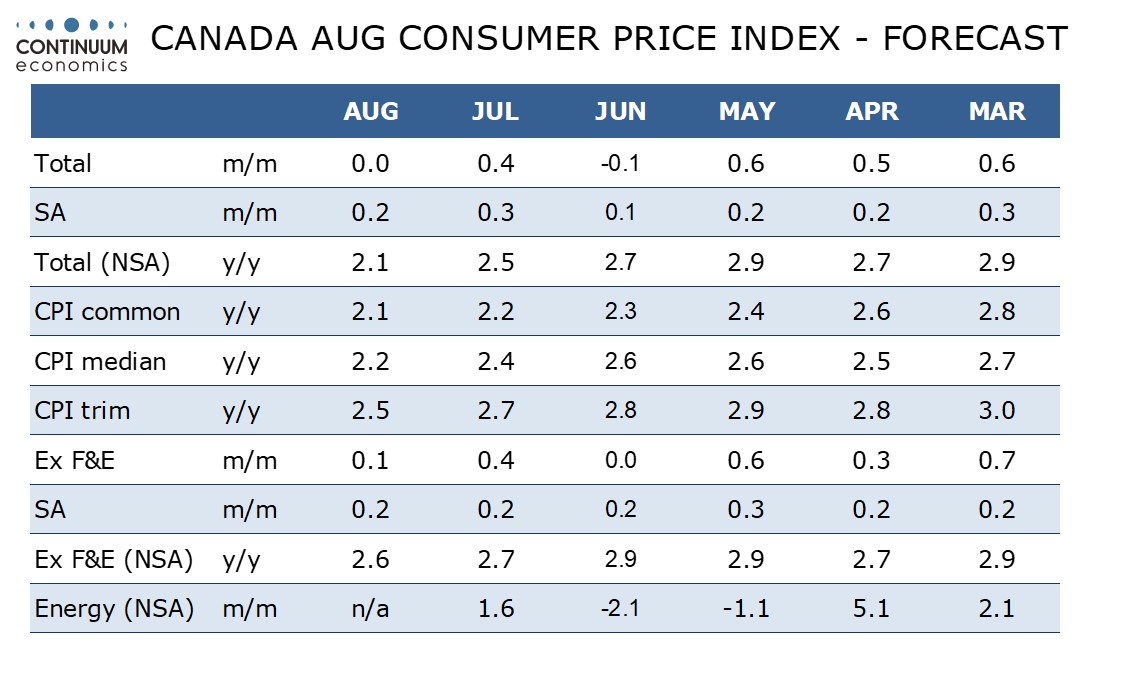

Seasonally adjusted we expect monthly gains of 0.2% both overall and ex food and energy, with the ex food and energy gain matching those of June and July.

However before seasonal adjustment we expect CPI to be unchanged overall with a 0.1% increase ex food and energy. We expect the ex food and energy yr/yr pace to slow to 2.6% from 2.7% but this is not one of the BoC’s three core rates.

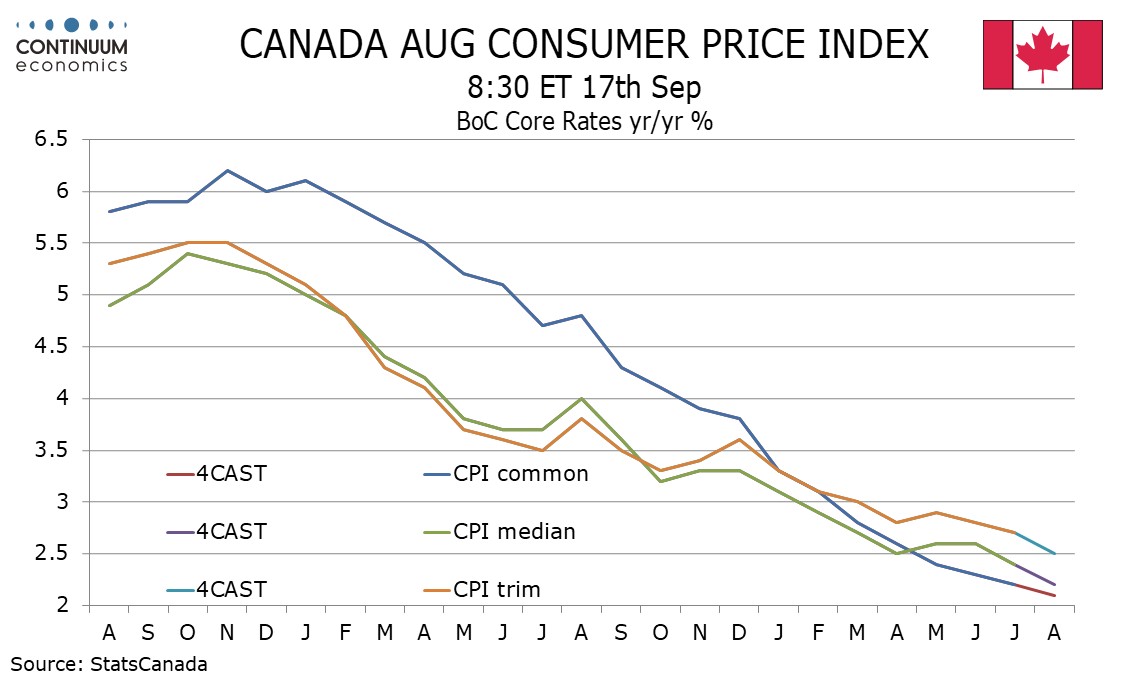

Here we expect CPI-trim to fall to 2.5% from 2.7%, CPI-median to fall to 2.2% from 2.4%, and CPI-common to fall to 2.1% from 2.2%. This would leave the average at 2.3%, only modestly above the BoC’s 2.0% target and the lowest since April 2021.