U.S. August ADP Employment - Losing momentum, but initial claims suggest a healthy labor market

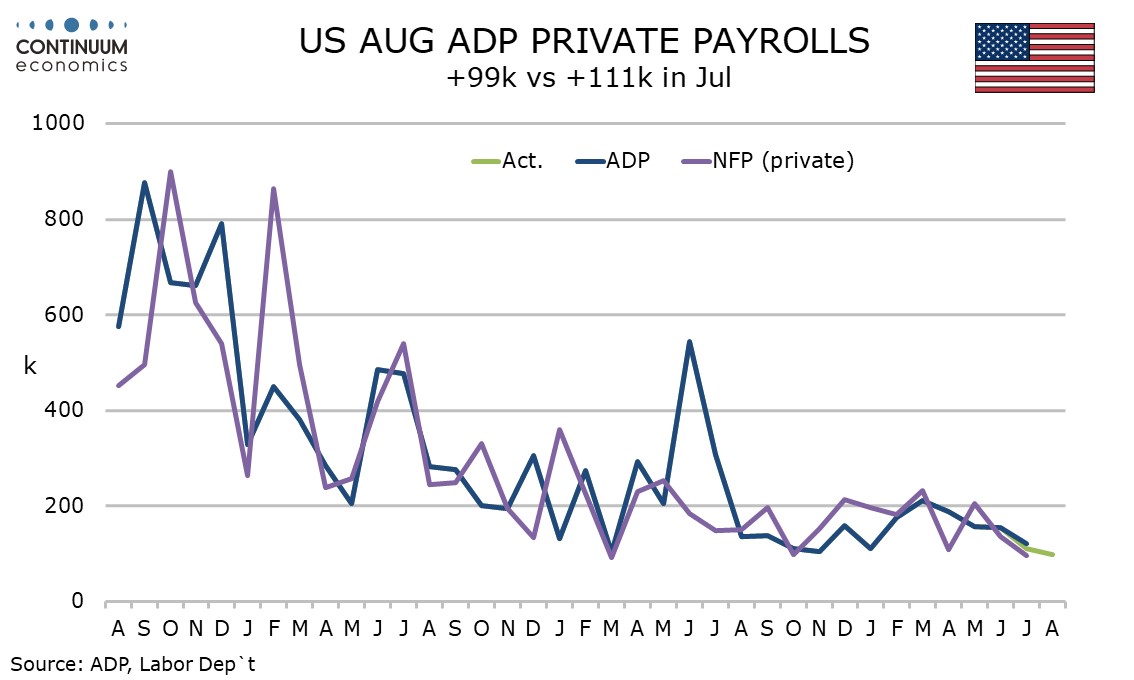

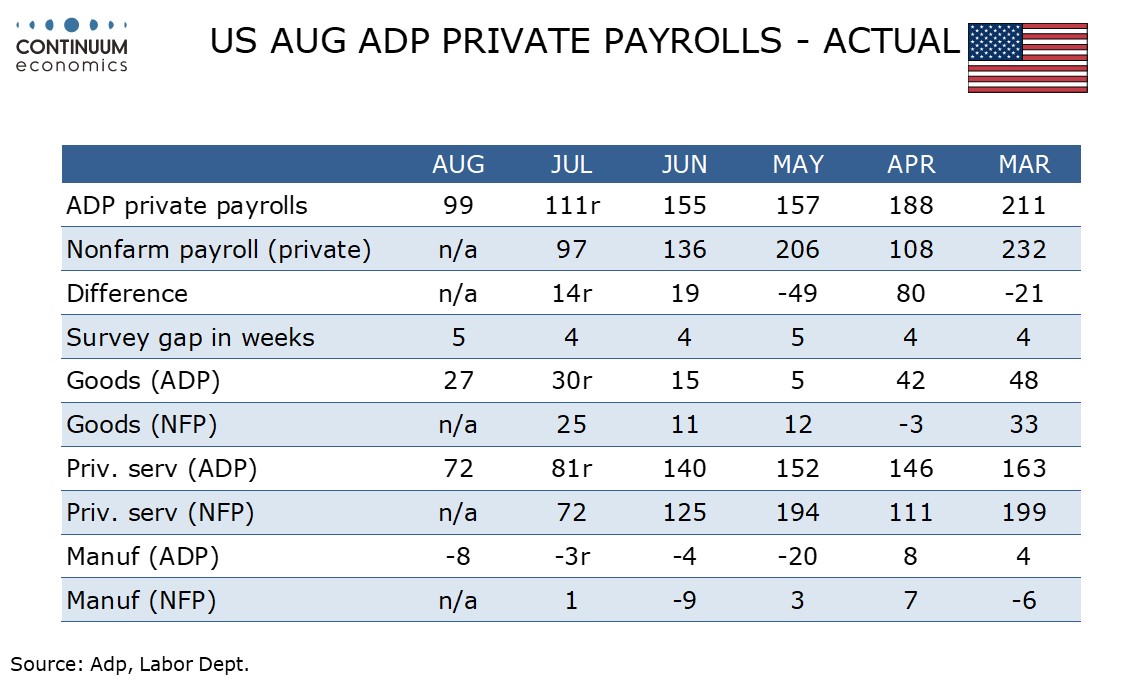

ADP’s August estimate for private sector employment growth of 99k is below expectations and consistent with a continued slowing of the labor market, with the gain being the slowest since January 2021. While the data suggests some downside risk to non-farm payrolls, our private sector payrolls call of 135k would to be a dramatic outperformance of the ADP data. We expect overall payrolls to rise by 160k. Initial claims at 227k from 232k still suggest quite a strong labor market.

August’s ADP data shows education and health up by only 29k. This sector has been leading recent non-farm payroll gains and while some slowing is possible it is still likely to outperform the ADP data. The ADP data also showed leisure and hospitality, a sector which until quite recently was leading ADP gains, with a second straight subdued month, up by 11k.

One sector to look quite strong in the ADP report is construction, up by 27k. Declines were seen in manufacturing by 8k and business and professional by 16k. ADP data signaled some stabilization in wage growth with yr/yr gains of 4.8% for job stayers and 7.3% for job changers both unchanged from July, a pause in what had been a steady slowing in trend.

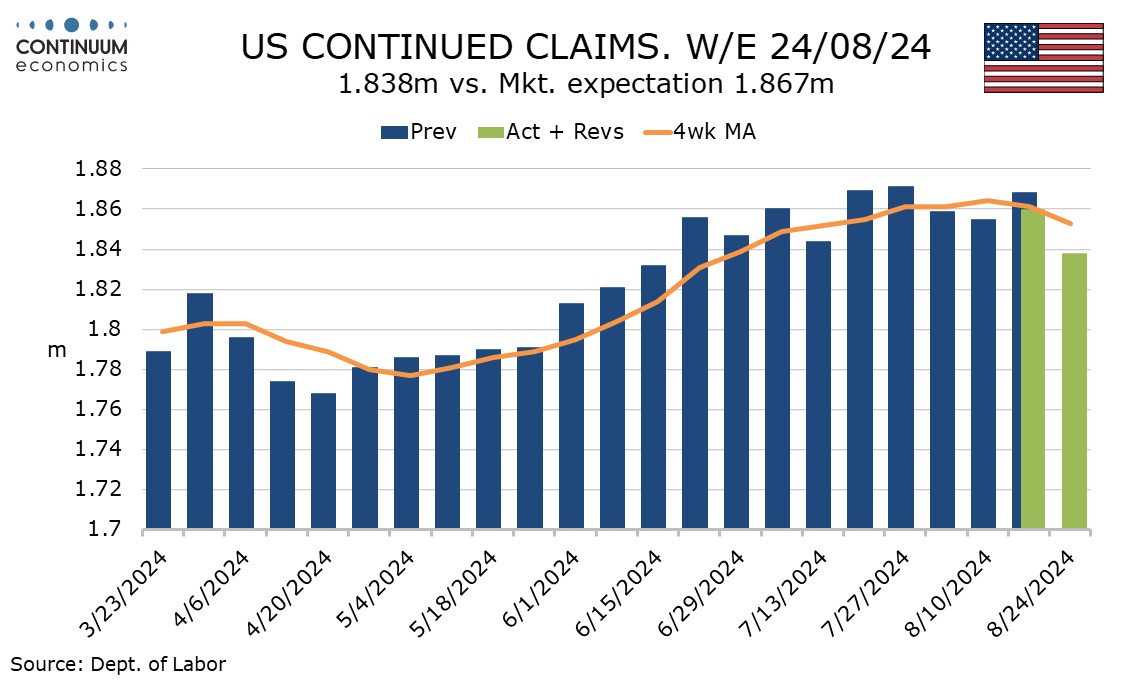

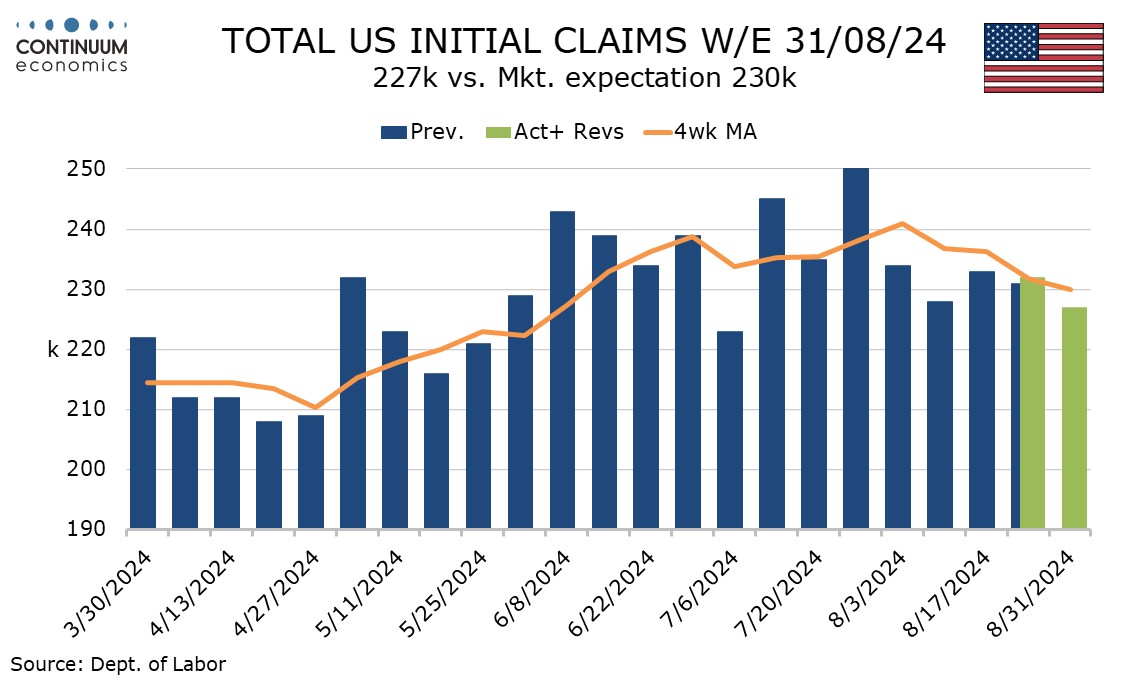

Initial claims and continued claims are both lower than expected, with continued claims also slipping, to 1.838m from 1.860m. Both these figures were surveyed after the non-farm payroll so carry few payroll implications, though initial claims are at an 8-week low and continued claims are at a 10-week low. The 4-week averages, after trending higher into early August, have started to slip.

Q2 unit labor costs at 0.4% have been revised down from 0.9%, a larger downward revision that the GDP-implied upward revision to productivity to 2.5% from 2.3% explains. Compensation was revised down to 3.0% from 3.3%. Non-labor cists however were revised up to 4.3% from 3.2%, meaning the overall deflator was revised up to 2.1% from 1.9%, still not far from the Fed’s inflation target.