Preview: Due September 12 - U.S. August PPI - In line with a subdued underlying trend

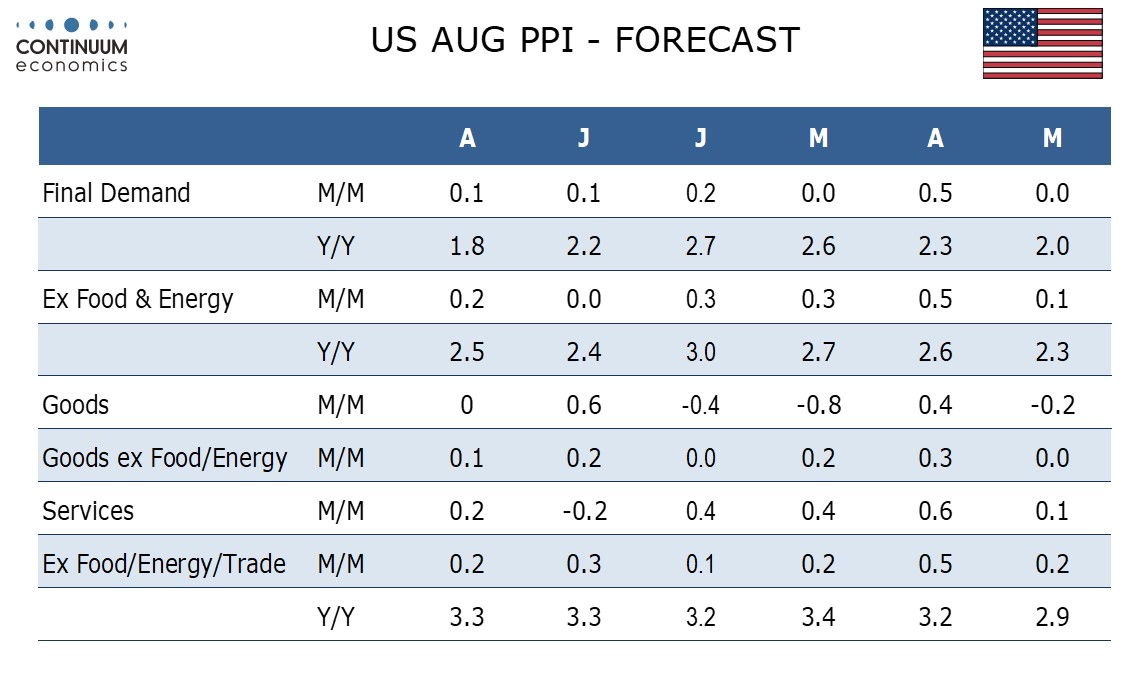

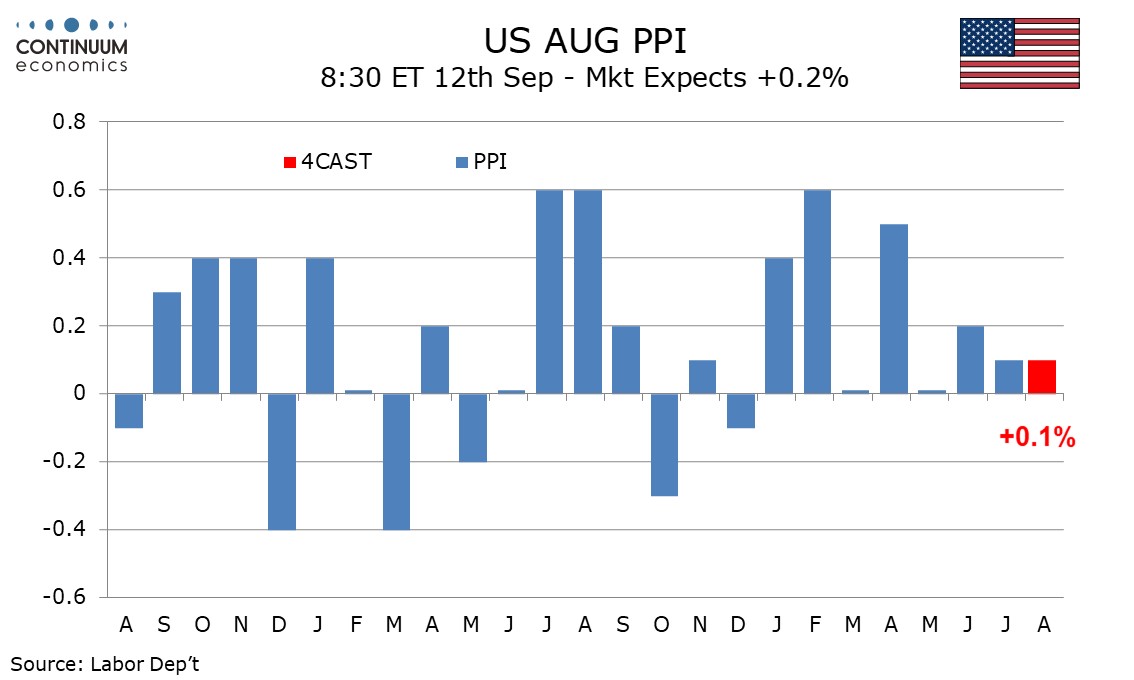

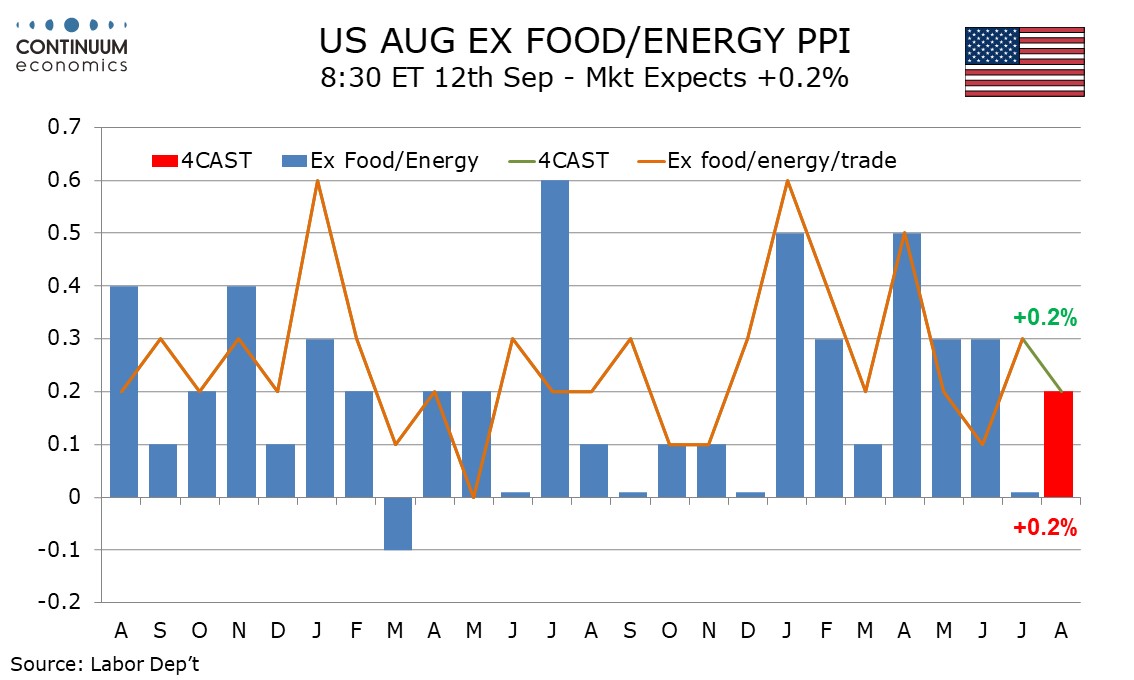

We expect a 0.1% increase in August PPI, matching the outcome of July, while the core rates ex food and energy and ex food, energy and trade both increase by 0.2%, all suggesting a subdued underlying picture.

Trade prices have recently shown some volatility, rising sharply in June before reversing in July. June ex food and energy PPI was lifted to 0.3% by trade while ex food, energy and trade rose by only 0.1%. In July the correction in trade saw ex food and energy PPI unchanged while ex food, energy and trade rose by 0.3%. Underling trend appears to be close to 0.2%.

We expect energy prices to be unchanged but food to correct lower from an above trend June leaving overall PPI slightly softer than the core rates in August. We see goods PPI unchanged with a 0.1% rise ex food and energy, while services increase by 0.2%.

Year ago strength in energy will see yr/yr PPI slip to 1.8% from 2.2%, reaching its lowest since February but we expect yr/yr growth ex food and energy to edge up to 2.5% from 2.4% while ex food, energy and trade PPI remains at July’s 3.3% pace.