U.S. August ISM Manufacturing - Still weak, if a little less so

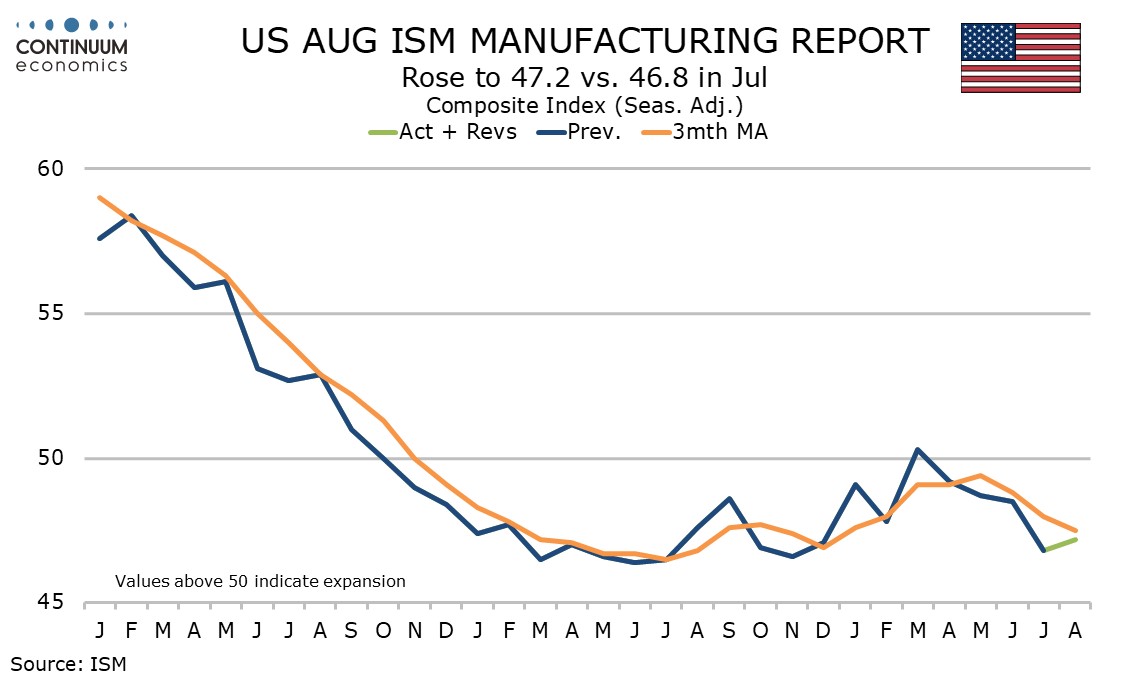

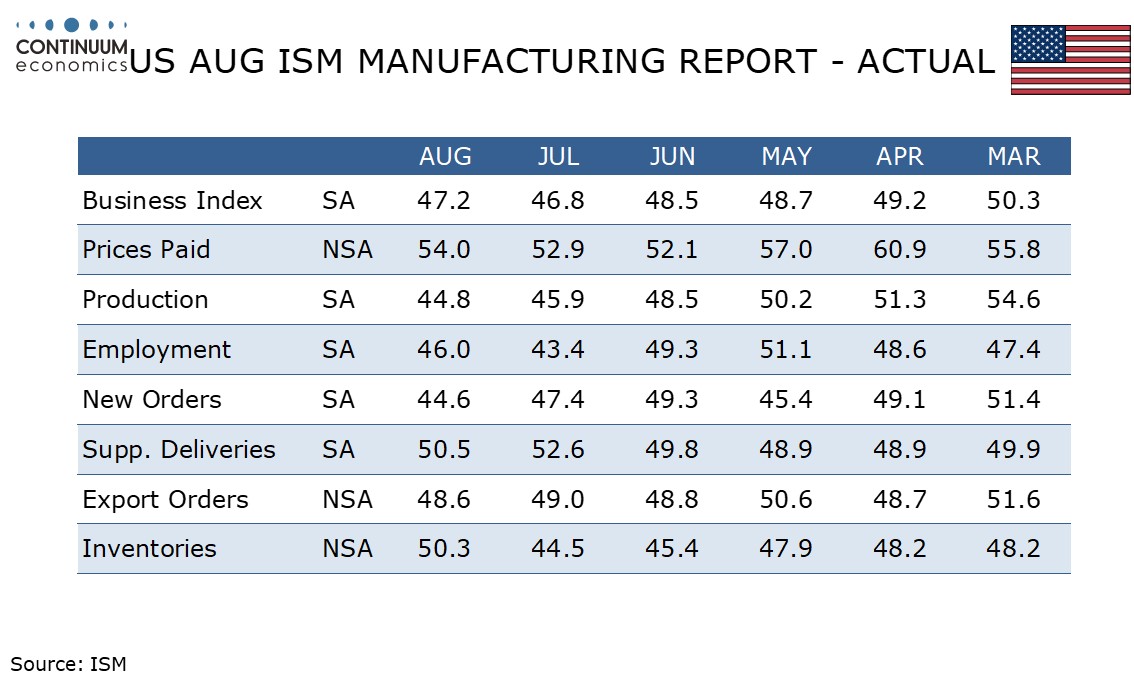

August’s ISM manufacturing index at 47.2 is up from July’s 46.8 but still quite weak, with the first two months of Q3 weaker than each of the six months in the first half of the year. New orders at 44.6 from 47.4 are the weakest since May 2023.

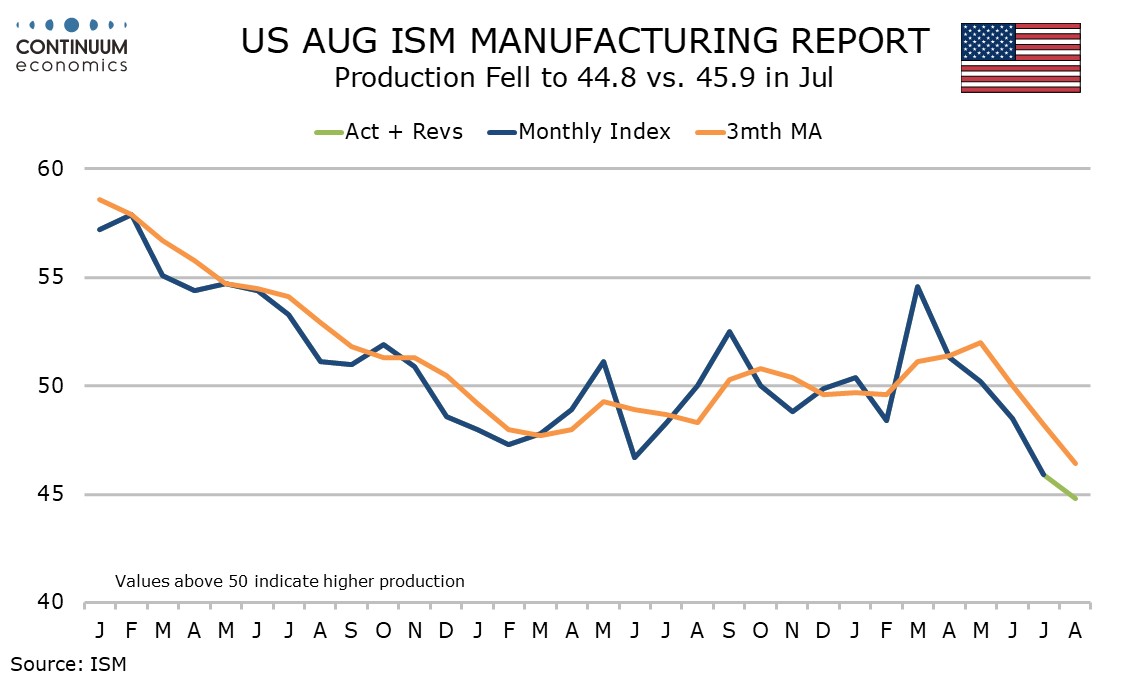

Production also weakened to 44.8 from 45.9, this the lowest since May 2020 at the height of the pandemic. The gain in the composite was led by inventories, which saw a sharp rise to 50.3 from 44.5.

Employment also rose, to 46.0 from 43.4, but remains well below June’s 49.3. The final component of the composite, delivery times, corrected lower to 50.5 from a firmer 52.6 in July.

Prices paid not contribute to the composite, but increased to 54.0 from 52.9, continuing to show little real direction.

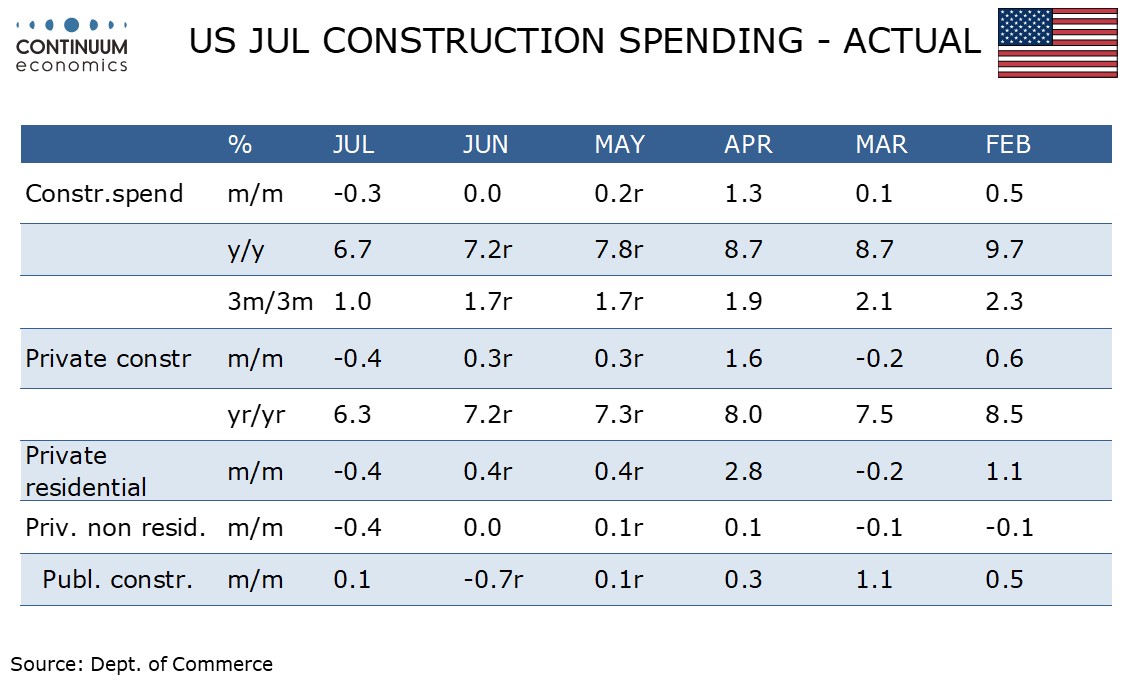

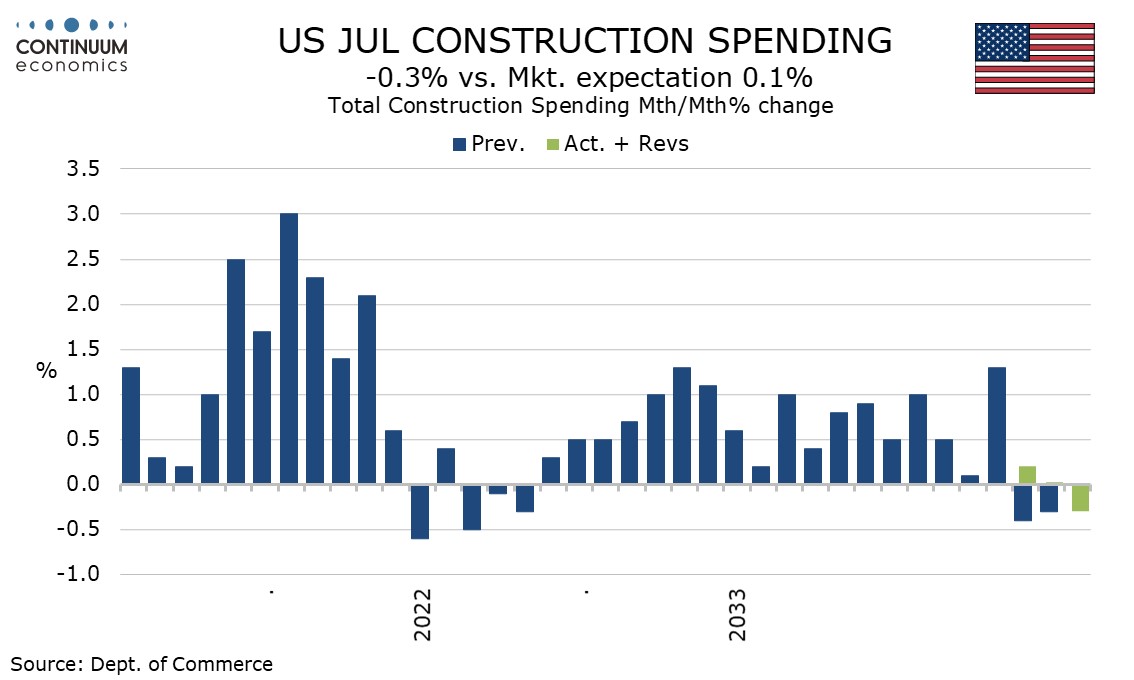

July construction spending was weaker than expected at -0.3% but June was revised up to unchanged from -0.3% and May was revised up to a 0.2% increase from -0.4%, leaving the net figure positive.

Private spending fell by 0.4% after two straight gains of 0.3% but public spending rise by 0.1% after a 0.7% June decline. Private residential and non-residential spending both fell by 0.4% in July.