Canada Q2 GDP lifted by government, but little momentum in monthly data

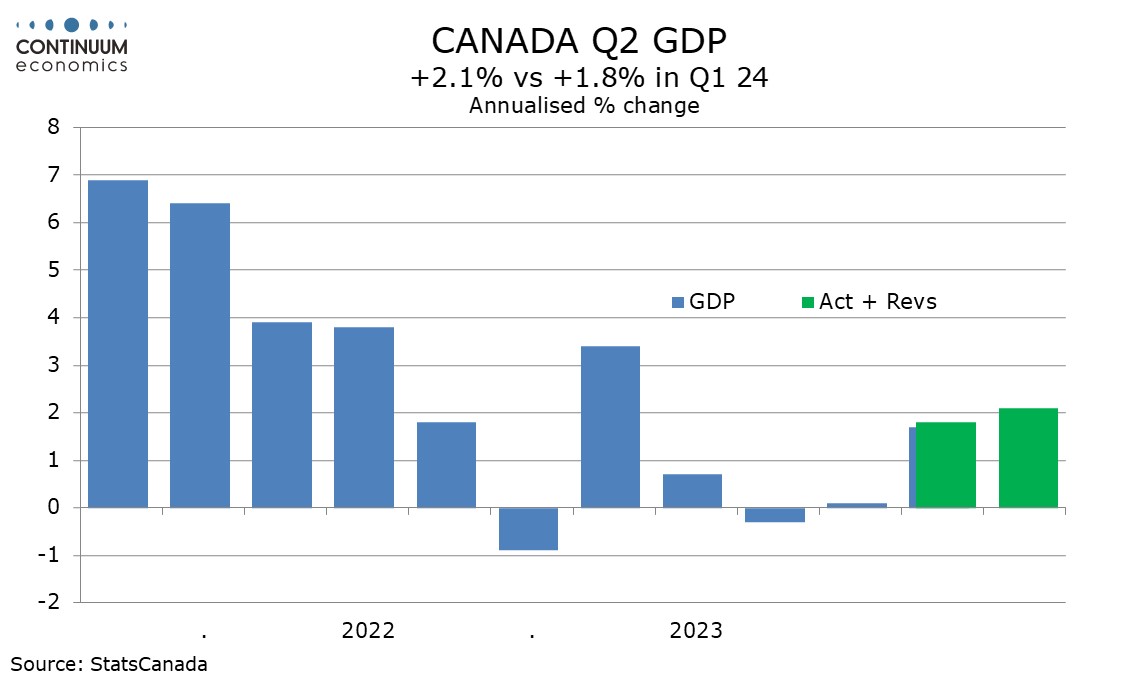

Canada’s Q2 GDP increase of 2.1% annualized is on the high side of expectations and above a 1.5% Bank of Canada estimate made with July’s monetary policy report. However with a flat June and the preliminary estimate for July also unchanged there does not appear to be much momentum entering Q3, so with the CPI falling the data does not appear to be an obstacle to an expected BoC easing next week.

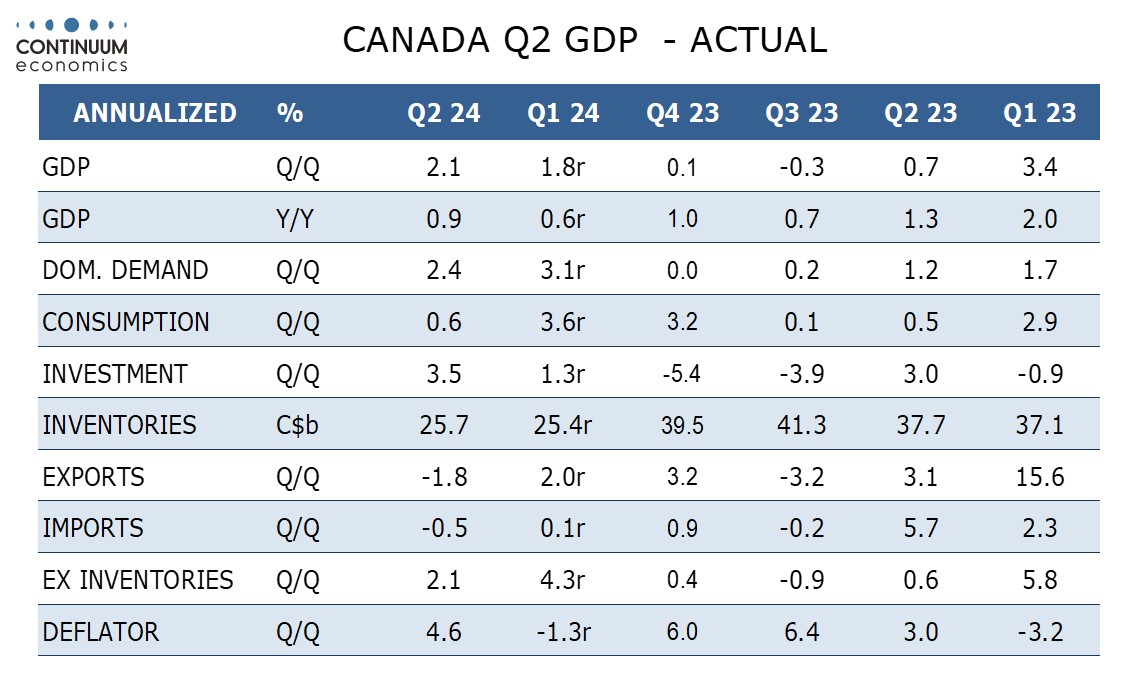

The quarterly data showed the growth led by strength from government. Final consumption spending was up by 2.1% with households at 0.6%, non-profits unchanged but government surging by 6.0% on higher public sector wages. Gross fixed capital formation rose by 3.5% with a 2.0% gain for businesses and a 11.0% surge from government. Business fixed capital showed weakness in housing but strength elsewhere.

Net exports took 0.3% off GDP with exports down by 1.8% and imports down by 0.5%. Inventories were neutral. The implicit deflator was quite firm up by 4.6% annualized and somewhat worryingly lifted by household services, but the BoC is more focused on recent CPI data, particularly a soft July. One item worth noting is that in a sharp contrast to the US, household savings are rising in Canada, the Q2 rate at 7.2%, up from 6.7% in Q1 and 4.5% in Q1 2023.

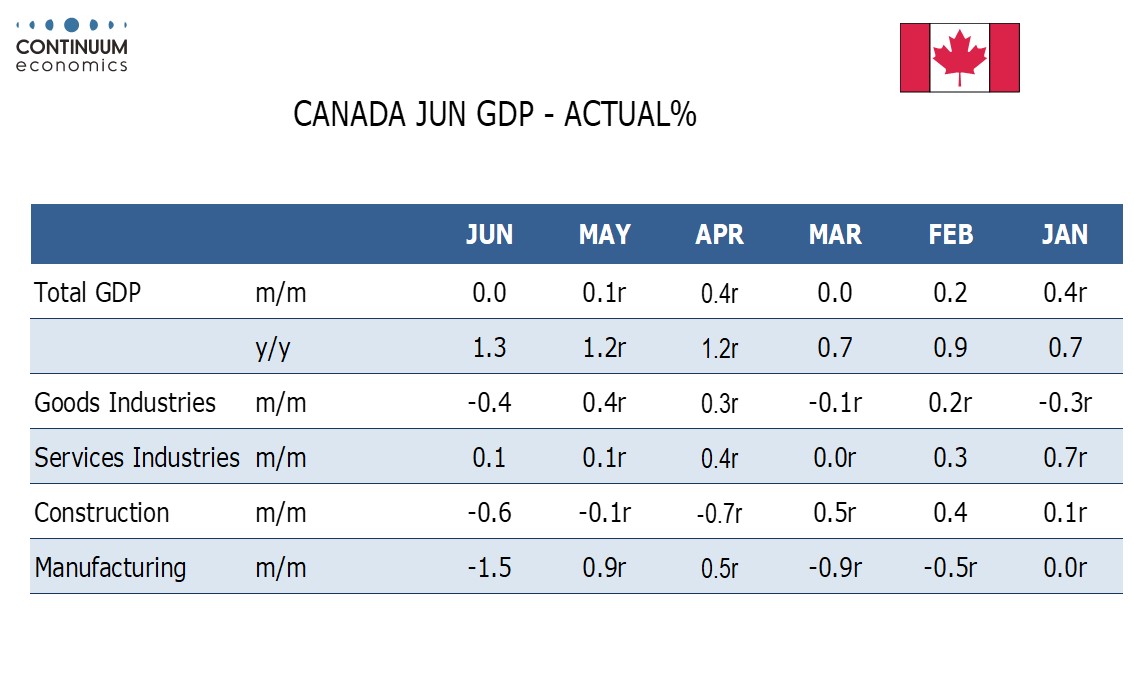

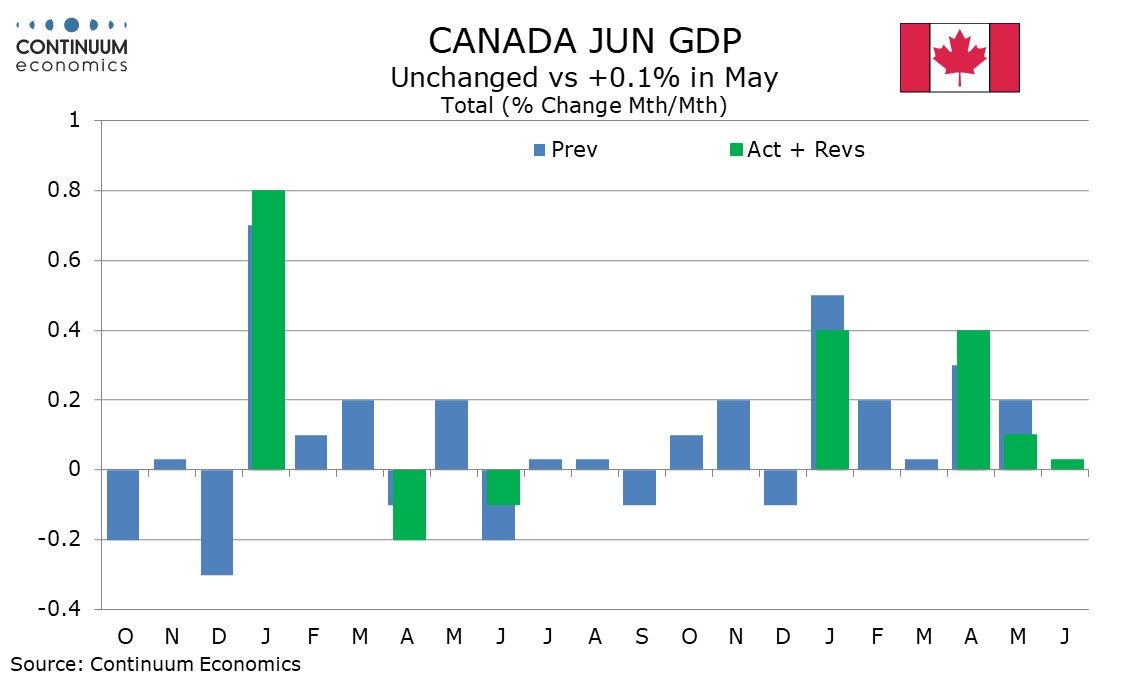

The flat monthly outcome is weaker than a preliminary 0.1% estimate made with May’s data, and May GDP was revised down to a 0.1% increase from 0.2%. The strength of Q2 came from an upward revision to April, to 0.4% from 0.3%, so the monthly detail suggests some fading of momentum, as does a preliminary estimate for another unchanged month in July.

June data showed a 0.4% decline in goods weighed down by declines in construction and manufacturing, and a generally subdued 0.1% increase in services. July is expected to see declines in construction, mining and wholesale, but gains in finance and retail.