FX Daily Strategy: Asia, August 30th

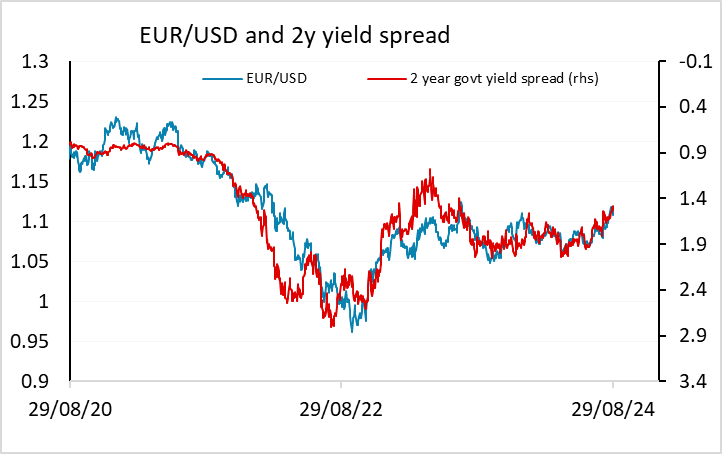

German CPI data ulls EUR/USD lower

EUR/USD looks fair based on current yield spreads

GBP supported by relatively hawkish BoE, but looks expensive

USD may have upside scope as data continues to show solid growth

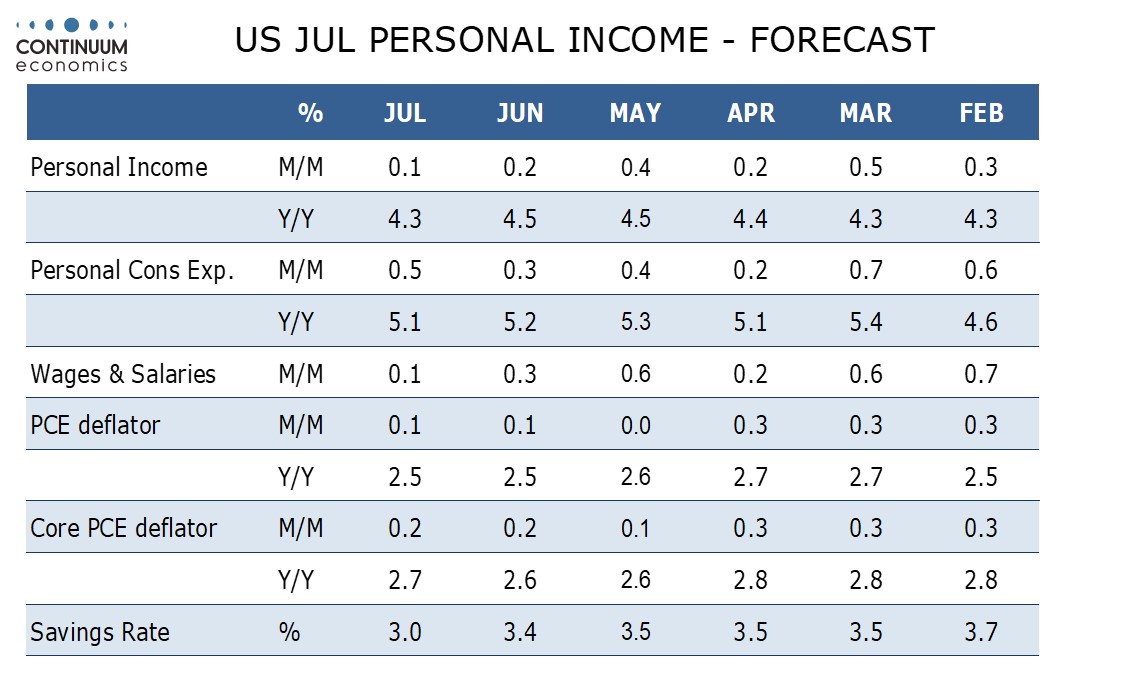

Eurozone CPI and US PCE prices the main data on Friday

Hard to see major changes in market expectations for ECB or Fed policy

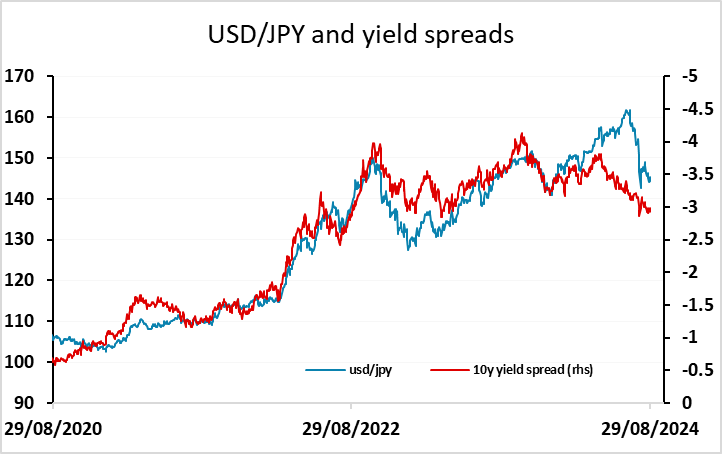

Some upside risks for the JPY on Tokyo CPI data

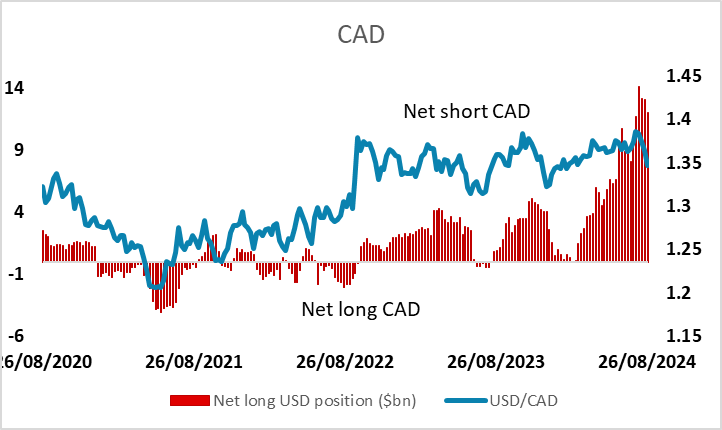

CAD may renew gains on Canadian GDP

Friday is a busy day for data, with the Eurozone CPI number sand the US PCE price index having the most potential for global market impact, but the Tokyo CPI data for August can potentially have an impact on the JPY, and Canadian Q2 GDP could affect the CAD.

The market consensus anticipates no change in the August Tokyo core CPI y/y rate, which is expected to stay at 2.2%. The recent comments from Ueda suggests that the BoJ may be more open to more tightening than is currently priced into the market, and higher than expected inflation numbers would certainly contribute to the potential for further hikes. As it stands, there are only 6.5 bps of tightening priced by the end of the year, which looks too little given Ueda’s indication that further tightening is on the cards, and these expectations are consequently vulnerable to any overshoots in inflation. The risks on the data should therefore be on the JPY upside, give the lack of tightening priced into the curve.

Eurozone CPI looks likely to come in below the published consensus of 2.2% after the German and Spanish data on Thursday both undershot expectations. This should to some extent be in the market, and there may be upside risks on French CPI released on Friday due to the Olympics. In any case, we don’t see a great deal of scope for the market to shift policy expectations for the ECB at this stage. While the risks for yields may be slightly on the downside, the market is already pricing a terminal rate a little below 2%, and it will be hard to price rates to move lower than that until or unless we get a recession or an extended period of below target inflation. These may come, but they don’t seem imminent, suggesting that front end yields in the eurozone are not set to move a great deal in the near term. The EUR already saw some weakness son Wednesday after the German data, and we doubt there will be a much followthrough on the back of Friday’s data.

Similarly, it will be had for the US July PCE price index data to be far enough away from expectations to shift market expectations for the Fed. These already look to be a little on the dovish side in the short run with a 50bp September rate cut priced as slightly better than a 30% chance. With the Q2 GDP data on trend, initial claims still subdued and the equity market pressing its highs it’s hard to construct a case for aggressive Fed easing, despite some weakness evident in the housing sector. So there is more scope for US short term yields to rise than fall on the data, but we see the risks to the data as being on the low side, so we doubt there will be a big reaction.

We see the risks for Canadian Q2 GDP as being on the high side of the market consensus of 1.6% annualised, suggesting there is potential for the CAD to extend the long run of strength we have seen this month. Much of this may reflect position unwinding, as the CFTC data showed record high speculative CAD short positions at the beginning of them month, and even now positioning remains historically very extended. We did see some corrective USD/CAD gains Thursday, but we would expect selling interest to emerge near 1.35.