U.S. Q2 GDP revised even higher on consumer spending, July trade deficit widens but initial claims stabilizing

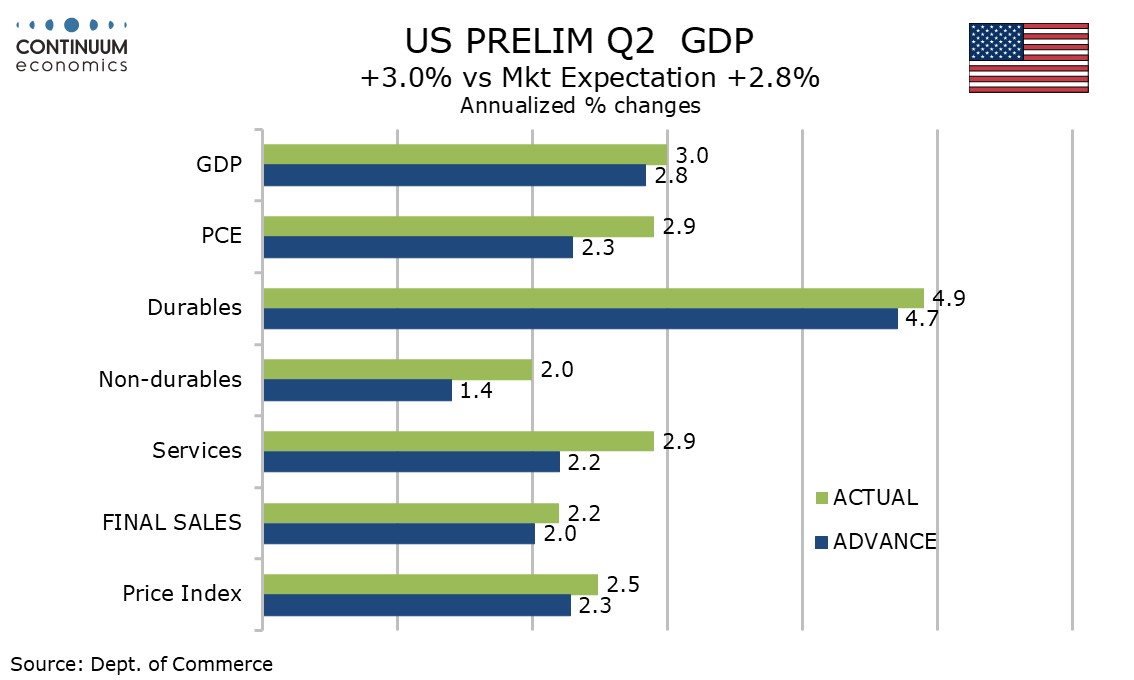

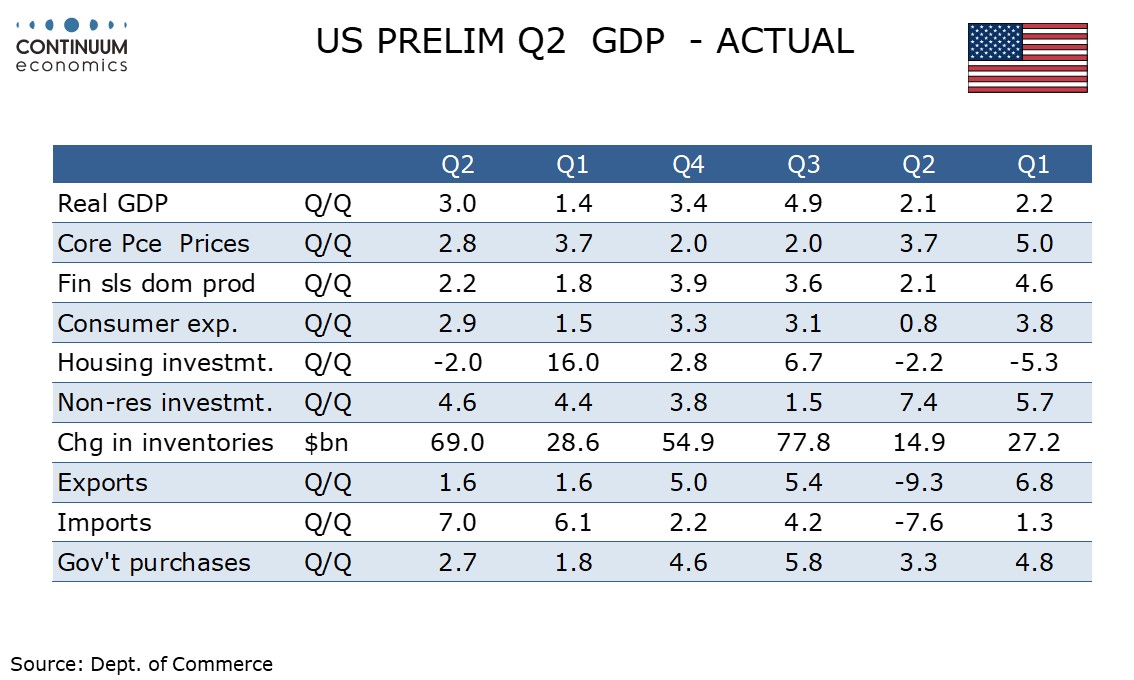

Q2 has seen a marginal upward revision to 3.0% from an already strong 2.8% with the revision due to consumer spending, now at 2.9% from 2.3% and maintaining a picture of surprising resilience. Core PCE prices were revised slightly lower to 2.8% from 2.9%. While Q2 GDP is strong a wider advance July goods trade deficit of $102.7bn from $96.6bn is negative for Q3. Initial claims at 231k are slightly down from 233k and do not suggest any further weakening in the labor market.

The upward revision to consumer spending was broad based and unexpected, goods to 3.0% from 2.5% and services to 2.9% from 2.2%.

This puts consumer spending well ahead of real disposable income, which was unrevised at 1.0% and that raises questions over how long consumer resilience can persist. Gross domestic income at 1.3% in Q2 (this the first estimate) matched the gain in Q1 and significantly underperformed GDP in Q2.

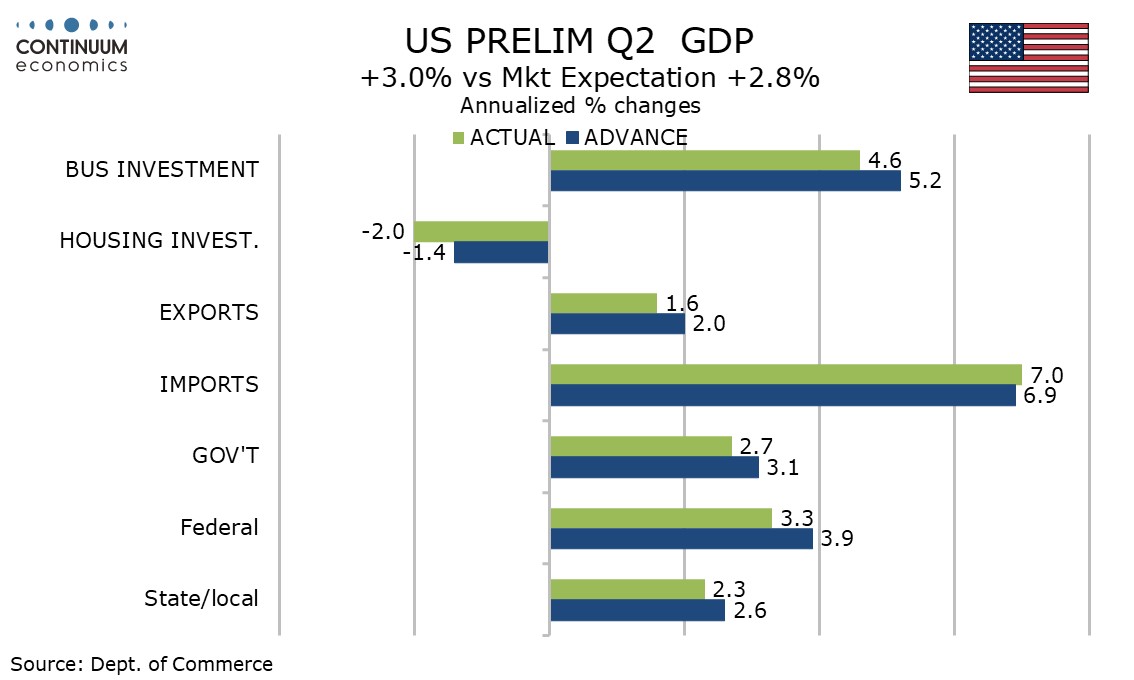

Excluding the revision to consumer spending, GDP revisions were modestly negative, with business investment at 4.6% from 5.2%, housing at -2.0% from -1.4%, and government at 2.7% from 3.1%. Exports were revised down to 1.6% from 2.0% and imports revised up to 7.0% from 6.9%. Inventories also saw a small downward revision.

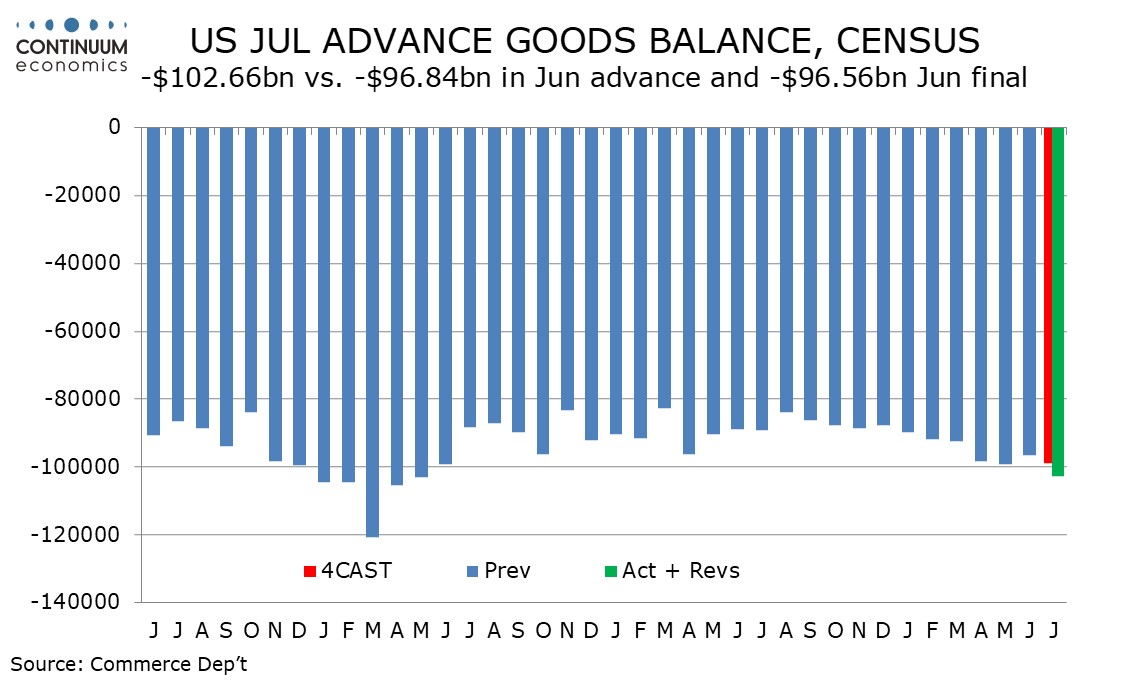

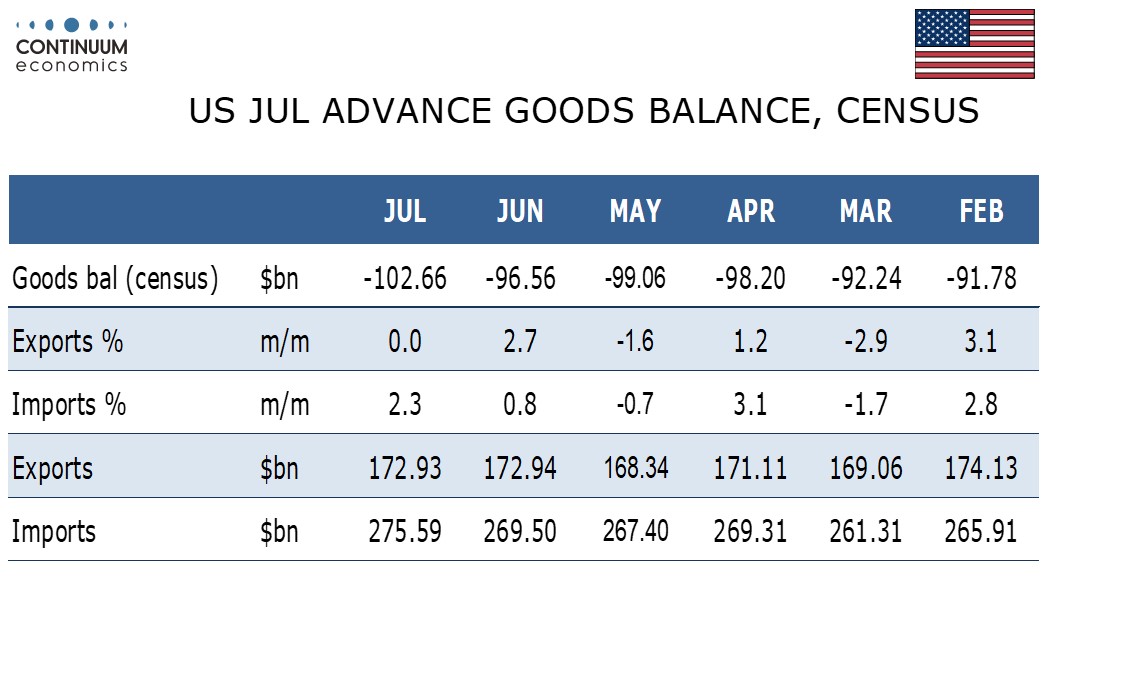

July’s advance goods trade balance has renewed a deteriorating trend after a modest improvement in June, the deficit reaching its highest since May 2022. Exports were unchanged while imports rose by 2.3%. Exports were restrained by a sharp drop in autos. Imports were generally strong though autos saw a marginal dip.

While the trade data is negative for the Q3 GDP picture a 0.8% rise in advance retail inventories in July provides some offset. Advance wholesale inventories saw an as expected modest rise of 0.3%.

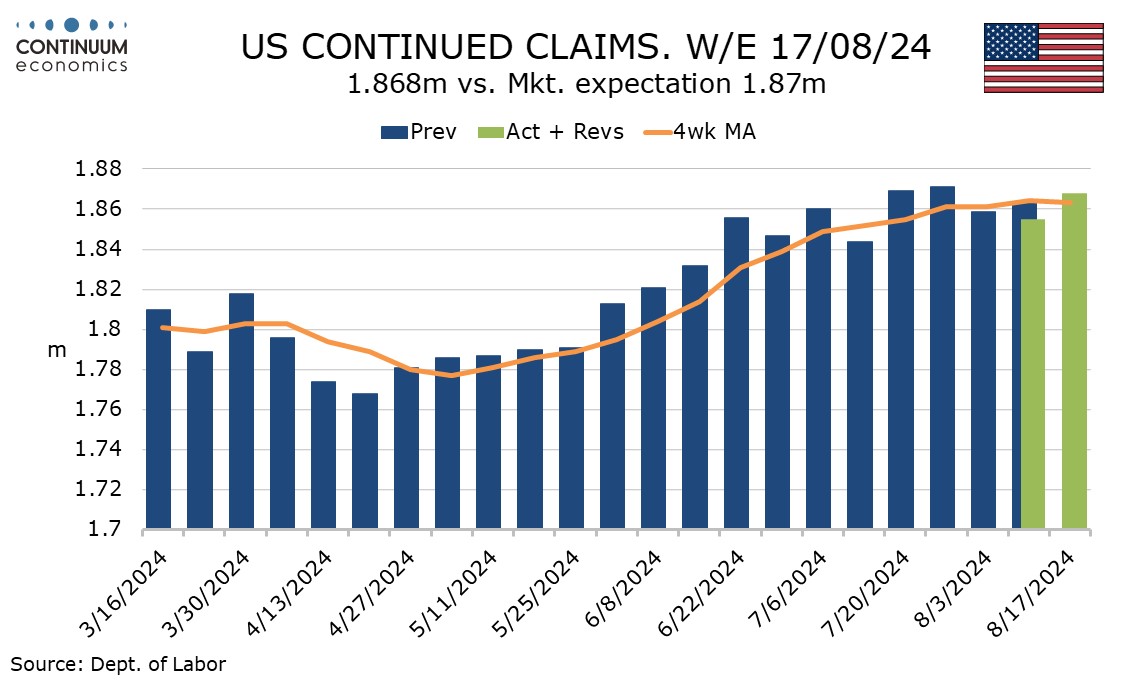

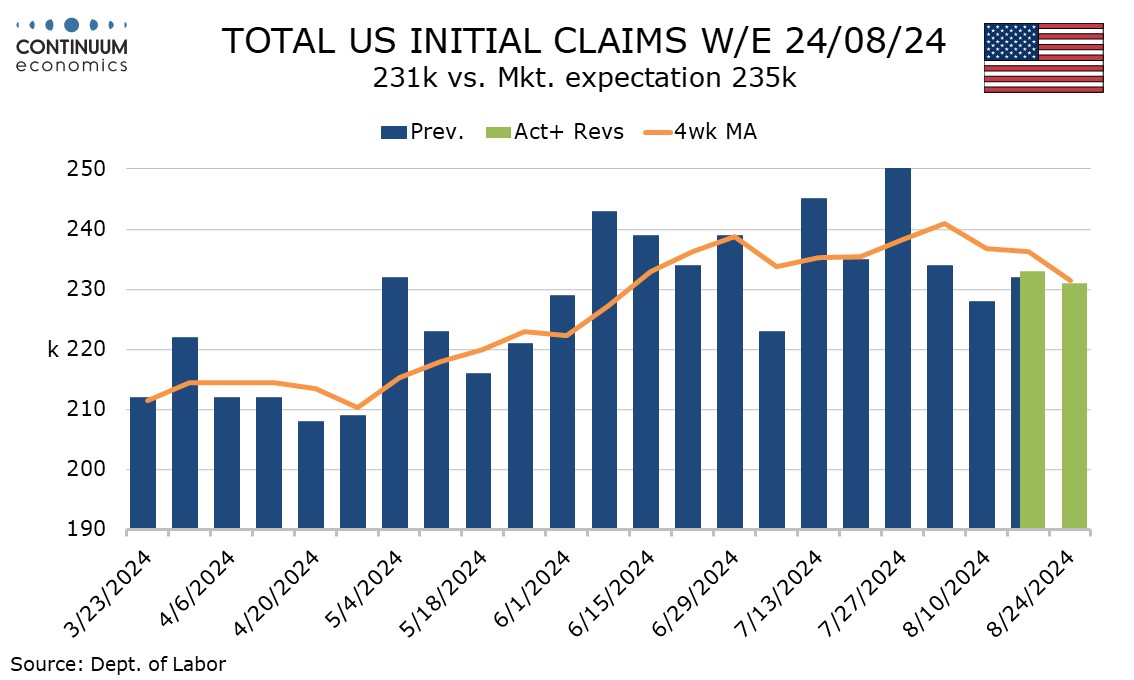

A recent uptrend in initial claims appears to have stabilized in August, with the latest dip to 231k from 233k seeing the 4-week average move further below a peak of 241k seen three weeks ago, suggesting August payrolls may be a little stronger than the surprisingly weak July.

Continued claims, covering the week before initial claims, and also the survey week for August’s payroll, rose by 13k to 1.868m though did not fully reverse two preceding declines and the 4-week average appears to be stabilizing after a move higher here too.