FX Daily Strategy: North America, August 29th

German CPI data ulls EUR/USD lower

EUR/USD looks fair based on current yield spreads

GBP supported by relatively hawkish BoE, but looks expensive

USD may have upside scope as data continues to show solid growth

German CPI data ulls EUR/USD lower

EUR/USD looks fair based on current yield spreads

GBP supported by relatively hawkish BoE, but looks expensive

USD may have upside scope as data continues to show solid growth

Preliminary August CPI from Spain and Germany, the August EU Commission survey and revised US Q2 GDP data are the main data on Thursday. There is also revised Q2 GDP data for Sweden and the latest Swedish economic tendency survey.

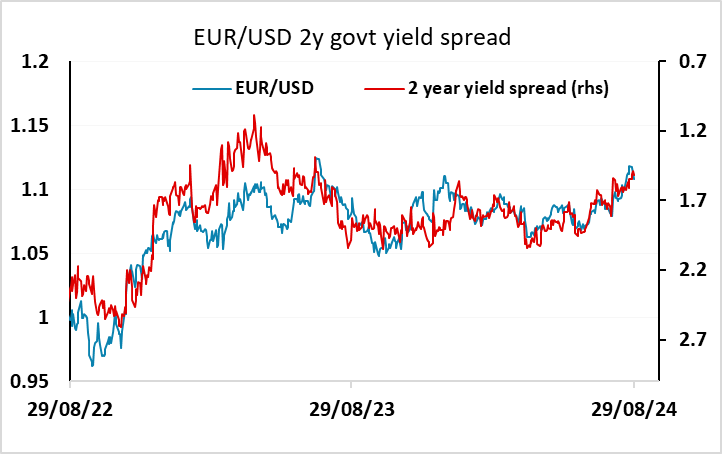

Generally weaker than expected German state CPI numbers, coming on the back of weaker than expected Spanish CPI numbers earlier, have pulled the EUR below 1.11 as markets price in more aggressive ECB easing. The consensus for German national CPI was for the y/y rate to fall 0.2% to 2.1% (0.3% to 2.3% on an HICP basis). The state CPIs suggests a much bigger fall in the region of 0.6%. The y/y rates of both the NRW and Baden-Wuerttemburg CPIs are down 0.6% in August from July to 1.7% and 1.5% respectively. Declines in the other states are generally slightly smaller, but the national number looks like falling 0.5% to 1.8%. Whether this has much influence on policy is unclear. Certainly it is unlikely to mean more than a 25bp cut in September, and this was already priced in. Going forward, slightly faster easing is possible, but the market will take some convincing to put the terminal rate much below 2%. So we wouldn’t expect a particularly large impact on EUR yields or EUR/USD, and while the softer numbers are enough to take EUR/USD sub-1.11, yield spreads don’t suggest progress sub 1.1050.

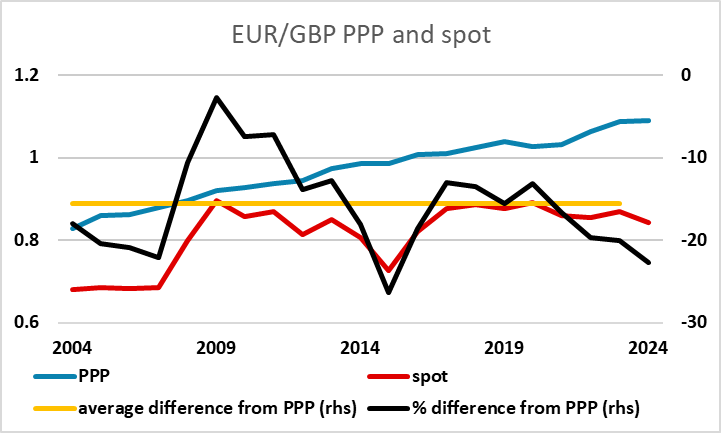

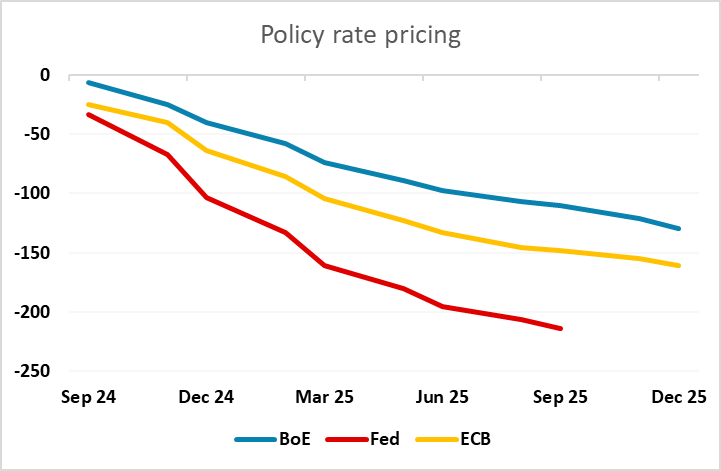

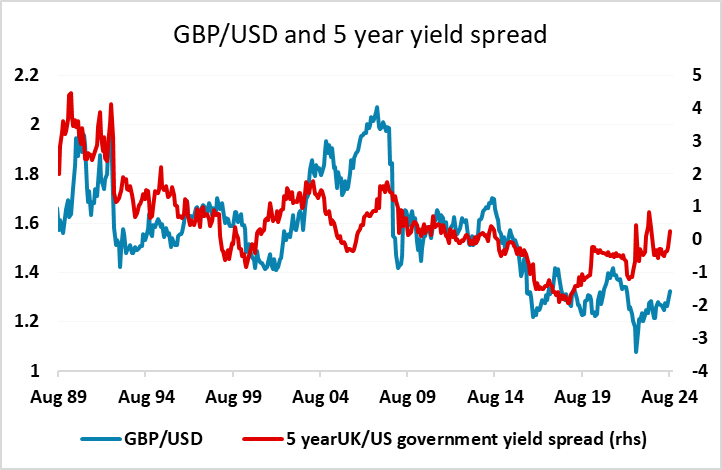

There is more uncertainty about the Fed and Bank of England policy paths, given the higher starting points and the greater typical volatility. As it stands, the Fed is expected to ease a lot more quickly than the BoE, and although this relates partly to the BoE’s earlier start, it does suggests that there is scope for some convergence in the pace of easing. As it stands, EUR/USD looks close to fair based on the steady relationship with 2 year government yield spreads. GBP has performed better in the last couple of weeks as BoE governor Bailey has discouraged expectations of early or rapid easing, and there does look to be some scope for GBP/USD gains based on the historic relationship with yield spreads. This relationship is easier to assess in the long term than EUR/USD, as inflation has been more similar in the US and UK, while Eurozone inflation has generally been lower historically. So while EUR/GBP weakness looks justified based on historic nominal yield spreads, the picture is very different when relative inflation is taken into account. The real EUR/GBP exchange rate is low by historic standards, and this, combined with the potential for the BoE to ease more rapidly than the market is currently pricing in, suggests to us that EUR/GBP will struggle to extend recent losses.

We don’t expect any significant change in the US Q2 GDP data, but the fact that it is likely to be close to 3% annualised emphasises the fact that there isn’t a very strong case for more rapid Fed easing at this point. With the market still pricing around a 30% chance of a 50bp Fed rate cut in September, the risks look to us to be on the upside for the USD in the short term.