EUR flows: EUR dips on soft German state CPI

German state CPI falls more than expected in August, taking EUR/USD sub-1.11

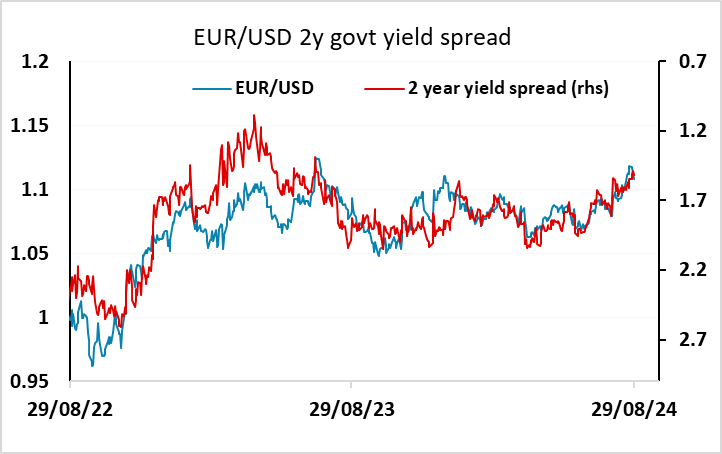

Generally weaker than expected German state CPI numbers, coming on the back of weaker than expected Spanish CPI numbers earlier, have pulled the EUR below 1.11 as markets price in more aggressive ECB easing. The consensus for German national CPI was for the y/y rate to fall 0.2% to 2.1% (0.3% to 2.3% on an HICP basis). The state CPIs suggests a much bigger fall in the region of 0.6%. The y/y rates of both the NRW and Baden-Wuerttemburg CPIs are down 0.6% in August from July to 1.7% and 1.5% respectively. Declines in the other states are generally slightly smaller, but the national number looks like falling 0.5% to 1.8%. Whether this has much influence on policy is unclear. Certainly it is unlikely to mean more than a 25bp cut in September, and this was already priced in. Going forward, slightly faster easing is possible, but the market will take some convincing to put the terminal rate much below 2%. So we wouldn’t expect a particularly large impact on EUR yields or EUR/USD, and while the softer numbers are enough to take EUR/USD sub-1.11, yield spreads don’t suggest progress sub 1.1050.