FX Daily Strategy: APAC, August 28th

Quiet calendar on Wednesday suggests no major moves

CHF and GBP strength have been notable in recent days

CHF strength hard to justify, but could extend a little further on technical

GBP benefiting from relative hawkish expectations on policy, but looks toppy

Quiet calendar on Wednesday suggests no major moves

CHF and GBP strength have been notable in recent days

CHF strength hard to justify, but could extend a little further on technical

GBP benefiting from relative hawkish expectations on policy, but looks toppy

Wednesday is another very quiet day on the data and events calendar, so major FX moves seem unlikely. However, there have been a couple of notable trends developing this week, which bear further analysis.

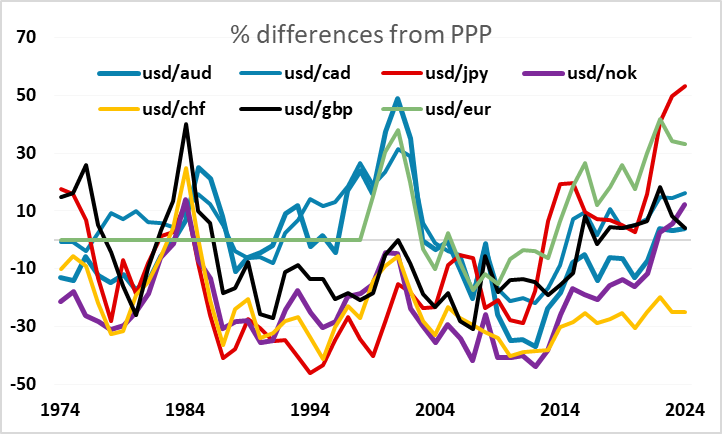

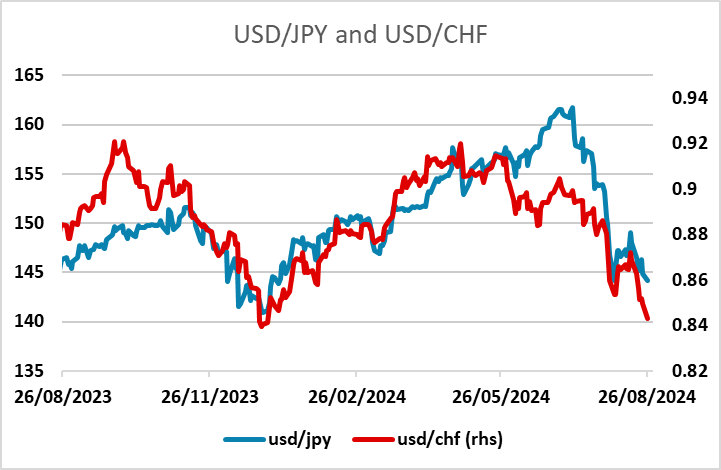

CHF strength has been one of the most striking moves this week, with USD/CHF hitting its lowest in January and EUR/CHF back to its lowest since August 8. The strength of the CHF is out of kilter with the generally positive risk tone seen since the equity lows on August 5. Although we have also seen JPY strength over this period, which would normally also be associated with a more risk negative market, this has also been supported by narrowing yield spreads, BoJ intervention and a big initial JPY undervaluation. These factors are not similarly supportive of the CHF, but CHF strength has outpaced JPY strength in the last few days, and USD/CHF has moved to new post-January lows while USD/JPY has held above the August 5 lows. To some extent USD/CHF has been dragged by the rise in the EUR, but this makes it hard to understand why EIR/CHF is moving lower. Part of the explanation might be that the market is concerned about geopolitical risk after the Israel/Hezbollah exchange of fire, but this hasn’t had a notably negative impact on risk assets in general.

The simplest explanation is technical, with EUR/CHF correcting the recovery from the August 5 low of 0.9210 to the August 15 high of 0.9581. This suggests there may be scope to move down to around 0.9350 before the correction is over. Nevertheless, it’s hard to find a strong rationale for CHF strength in current conditions, and dips below 0.94 should represent a buying opportunity in EUR/CHF in the absence of clearly risk negative developments. The SNB will certainly not be in favour of the latest CHF rise with inflation moving below target.

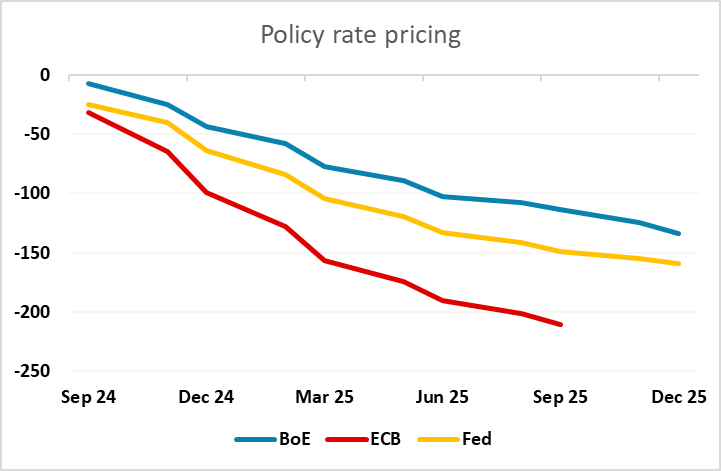

The other notable trend has been the strength of GBP, with EUR/GBP reaching its lowest since August 1 with 5 consecutive days of decline. Some of this is related to modestly less dovish talk from the BoE, which has meant that the market is now pricing a UK rate cut in September as less than a 30% chance, while the ECB is fully priced to cut 25bps and the Fed is priced as having a 30% chance of cutting 50bps. But even with this relatively hawkish view of the BoE, GBP has outperformed moves in yield spreads. Surprisingly, GBP has also been the best performer in real terms against the USD in recent years, being little changed since 2016. There has certainly been some improvement in GBP sentiment in recent weeks in response to the better than expected H1 growth performance, and possibly also due to some optimism about economic prospects under the new government. But with a tight budget expected in the autumn the upside should now be quite limited and we would see GBP as toppy here.