FX Daily Strategy: Asia, August 23rd

Powell speech at Jackson Hole the focus

Risk of mildly more hawkish stance than the market is pricing in

EUR/USD may struggle to hold above 1.11

Ueda speech could moderate recent JPY weakness

Powell speech at Jackson Hole the focus

Risk of mildly more hawkish stance than the market is pricing in

EUR/USD may struggle to hold above 1.11

Ueda speech could moderate recent JPY weakness

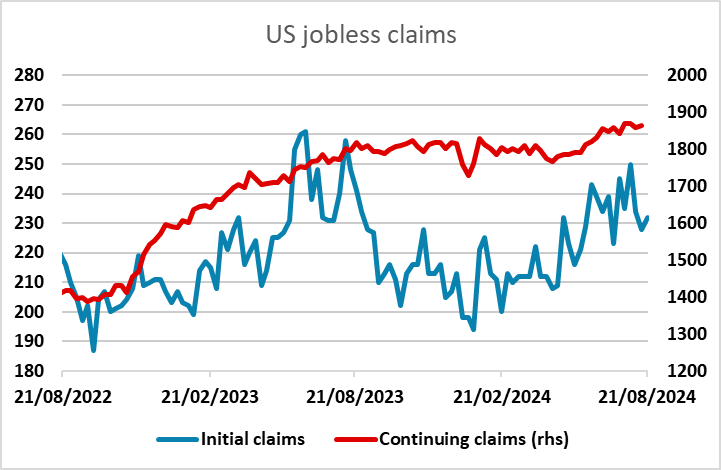

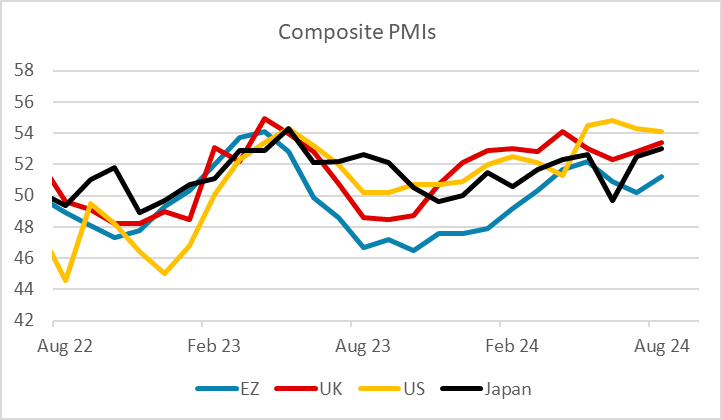

Powell’s speech at Jackson Hole will be the main focus on Friday. The latest US real sector data has been mixed. The latest employment report and the benchmark downward revisions to the 2023/4 data suggests some weakening, but the latest jobless claims data have still suggested a very resilient labor market. The PMI data released n Thursday also indicated that the economy was moving along steadily, but there have been signs of weakness in the housing sector where higher rates tend to bite first. The latest FOMC minutes suggested that the Fed is likely to be ready to ease in September, but there were enough voices warning of over rapid easing to suggests that a 50bp rate cut is unlikely unless there is much clearer evidence of significant weakness before the September 18 meeting.

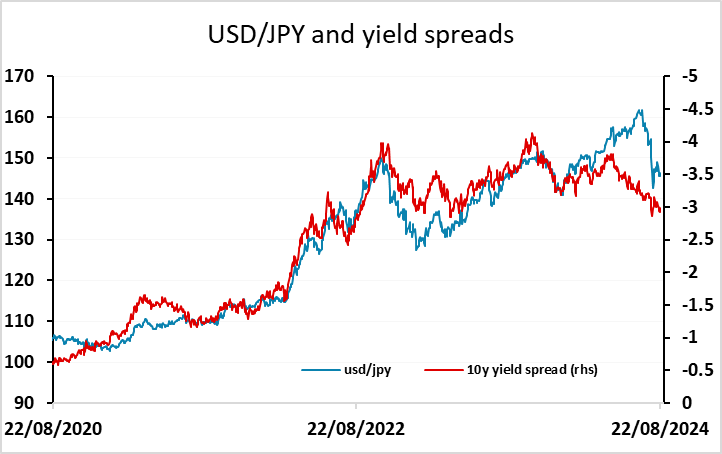

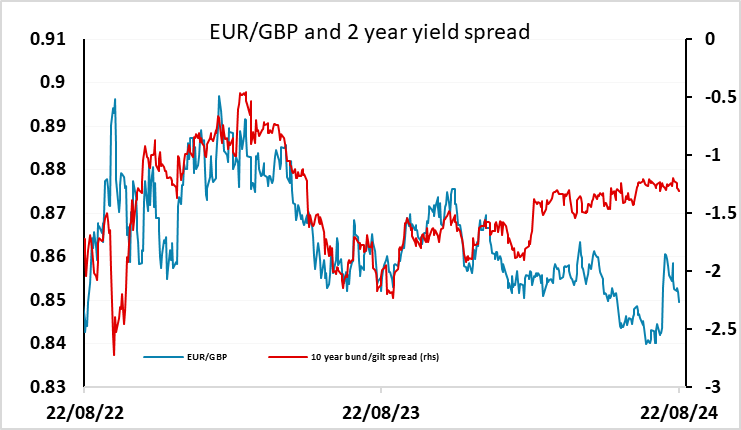

So if anything the risk from the Powell speech is that he indicates a slightly less dovish view than the market is pricing in. The current pricing of around a 26% chance of a 50bp cut in September looks excessive now that the equity market has recovered strongly after the post-employment report dip, and the S&P 500 is less than 1% below the all-time highs seen in July. Powell is likely to play down the chances of a 50bp cut, albeit probably not explicitly, and this may mean slightly higher US yields, and a generally stronger USD. This might also mean equities get knocked back a little. However, a 25bp cut in September does seem very likely, so there is isn’t going to be a lot of upside for US yields, and the impact may be quite modest. Nevertheless, EUR/USD looks a little stretched above 1.11, and while USD/JPY still looks like it has scope to move below 140 medium term, it is unlikely to decline if US yields edge up after Powell. GBP/USD and AUD/USD may be most resilient, with the RBA and BoE among the more hawkish central banks, while the higher yielders tend to benefit on the crosses from higher yields as they also tend to mean lower equity risk premia.

There is also a speech from BoE governor Bailey, but we doubt that he will say much to change the market’s view of a November rate cut, with the recent strength in UK data meaning there is little urgency for the BoE to move faster with rate cuts. Even so, GBP is at high levels against the EUR, and EUR/GBP progress below 0.85 is likely to be slow.

Before the Jackson Hole speeches, there is national CPI data in Japan and BoJ governor Ueda is set to speak to parliament. He is likely to maintain the modestly hawkish stance indicated after the latest rate hike, and this could given the JPY some relief after recent weakness. The CPI data is rarely a surprise with the Tokyo CPI data already released providing a reliable guide.