FX Daily Strategy: N America, August 22nd

PMI data to dominate sentiment on Thursday

European data needs to show some improvement to justify recent EUR strength

US claims data also of interest

NOK unlikely to benefit from GDP data despite undervaluation

PMI data to dominate sentiment on Thursday

European data needs to show some improvement to justify recent EUR strength

US claims data also of interest

NOK unlikely to benefit from GDP data despite undervaluation

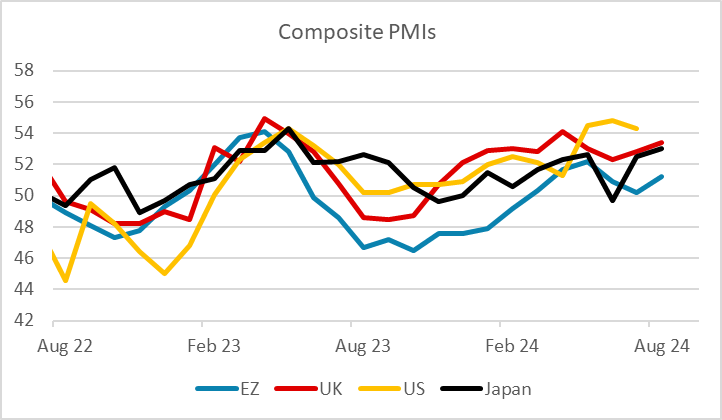

The Eurozone PMI has come in stronger than expected, with strength in the rest of the Eurozone offsetting the weakness in Germany. The EUR has edged higher as a result, recovering the ground lost after the German PMI. EUR/CHF and EUR/GBP are still lagging behind a little, but in a risk positive market we would expect EUR/CHF to find a bottom near here, while EUR/GBP’s performance has benefited from strong UK data.

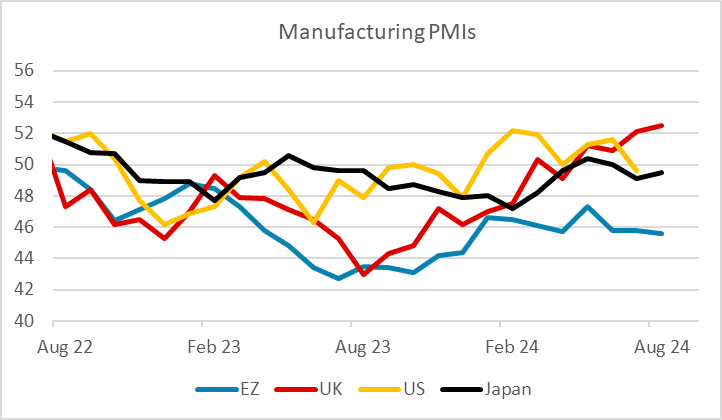

The UK data has consistently surprised on the upside this year, notably manufacturing. The rationale for that remains somewhat elusive, given the weakness of the manufacturing index in the Eurozone, and at this stage there is very little correlation between UK manufacturing output data and the manufacturing PMI. Nevertheless, with the UK services index also solid, and GDP growth strong in H1, this is all supportive of GBP strength. We have seen a dip sub-0.85 in EUR/GBP, but further GBP gains are likely to be more difficult as these are already quite extended valuation levels for GBP.

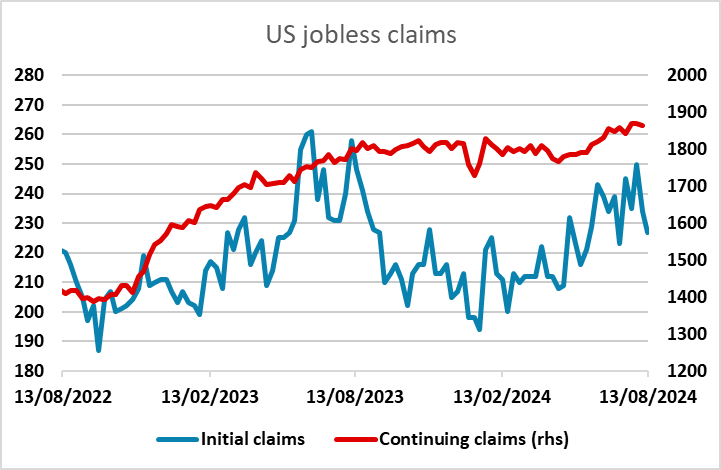

Otherwise, Thursday sees the usual US jobless claims data, which continue to be seen as an important guide to the labor market. The improvement in the data last week along with the stronger retail sales data helped to boost the USD and risk sentiment. Given the softer USD subsequently, it may be that stronger numbers are seen as more positive for the risky currencies against the USD, JPY and CHF rather than particularly USD positive.

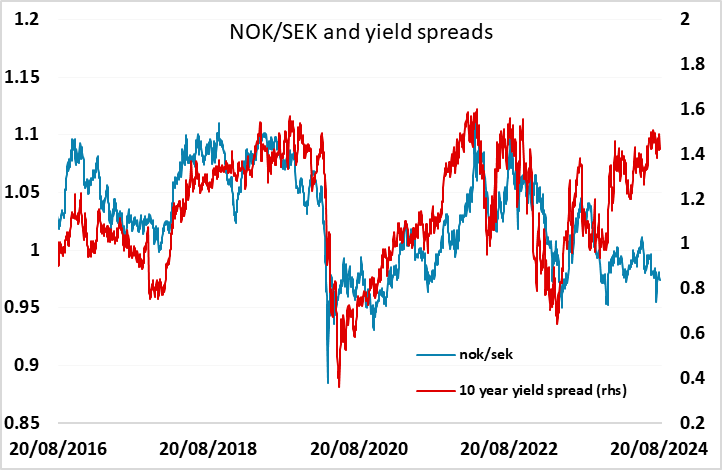

Ahead of the US data there is Norwegian Q2 GDP data, with the market looking for a 0.2% gain in mainland GDP. The NOK continues to underperform relative to yield spreads and has barely benefited from the improvement in risk appetite in the last couple of weeks, so it is hard to see much positive impact form the GDP data, especially as we see the risks as being on the downside. But the break below 11.70 this week does carry some technical significance, so we still see a case for EUR/NOK to extend the decline towards 11.50 near term.