FX Daily Strategy: Asia August 22nd

PMI data to dominate sentiment on Thursday

European data needs to show some improvement to justify recent EUR strength

US claims data also of interest

NOK unlikely to benefit from GDP data despite undervaluation

PMI data to dominate sentiment on Thursday

European data needs to show some improvement to justify recent EUR strength

US claims data also of interest

NOK unlikely to benefit from GDP data despite undervaluation

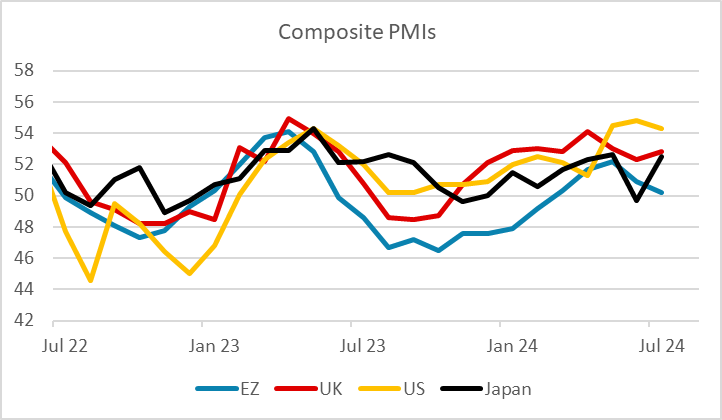

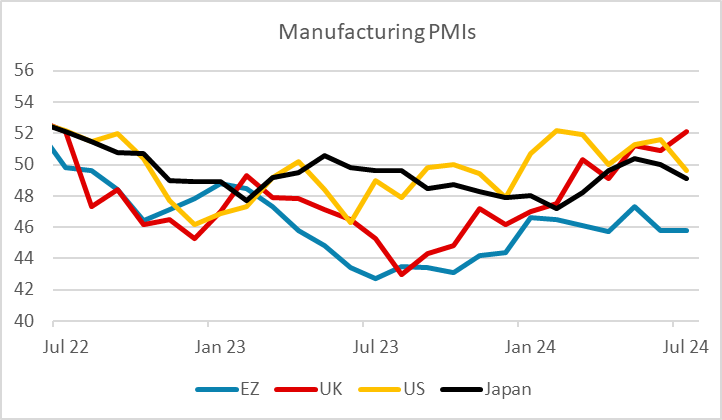

Thursday sees preliminary PMI data for August, and this could be a test of the recent strength in the EUR and GBP, as the latest PMIs have not been particularly inspiring, particularly in the Eurozone, even though there was some recovery earlier in the year. We see a small further drop back in the Eurozone composite index. While it remained in expansion territory in July, it saw a second successive monthly decline from June’s 50.9 to 50.2 and its weakest since activity levels began rising again in March. The UK numbers have been stronger, particularly manufacturing which has shown surprising strength this year, but the services index has edged lower in the last couple of months.

While the strength of the EUR and GBP against the USD in the last week has more to do with concerns around the US and the recovery in equity markets than any major confidence in the European economies, some sort of confidence in European recovery is required if the gains are to be sustained. EUR/USD upside looks quite limited based on the current level of yield spreads, and if there were any increase in market expectations of ECB easing due to weaker Eurozone data, the recent gains above 1.11 may prove hard to sustain. The better performance of the UK PMIs, notably manufacturing, and the strength of UK growth in H1 have helped support GBP so far this year, and have contributed to the slower expected rate of UK rate cuts compared to the Fed and ECB. But GBP is now quite expensive against the EUR, with current levels incorporating these positives. There is therefore some risk of a weaker pound if we see any signs that H1 strength is fading.

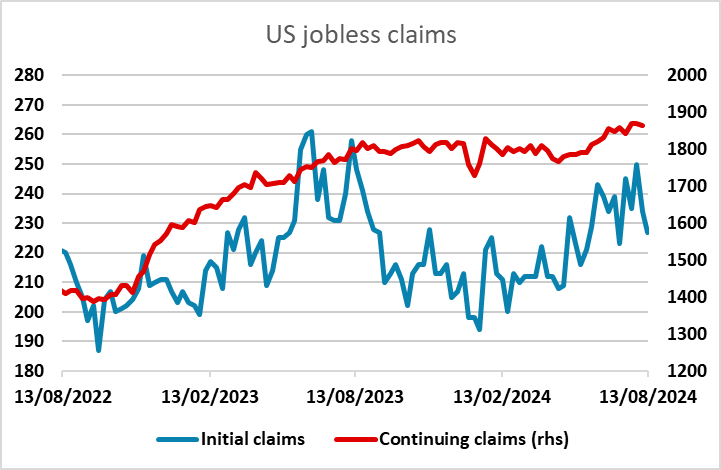

Otherwise, Thursday sees the usual US jobless claims data, which continue to be seen as an important guide to the labor market. The improvement in the data last week along with the stronger retail sales data helped to boost the USD and risk sentiment. Given the softer USD subsequently, it may be that stronger numbers are seen as more positive for the risky currencies against the USD, JPY and CHF rather than particularly USD positive.

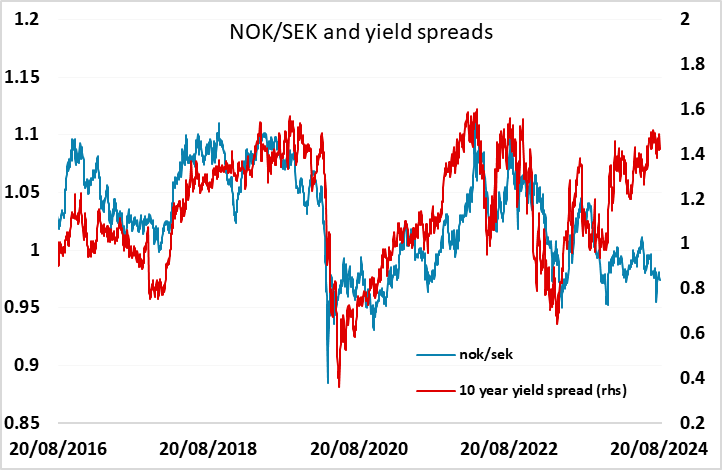

Ahead of the US data there is Norwegian Q2 GDP data, with the market looking for a 0.2% gain in mainland GDP. The NOK continues to underperform relative to yield spreads and has barely benefited from the improvement in risk appetite in the last couple of weeks, so it is hard to see much positive impact form the GDP data, especially as we see the risks as being on the downside. But the break below 11.70 this week does carry some technical significance, so we still see a case for EUR/NOK to extend the decline towards 11.50 near term.