FX Daily Strategy: N America, August 21st

Focus on benchmark revisions to US payroll data – risks on the downside

FOMC minutes will also be watched ahead of Powell speech this week

AUD and JPY still have scope for further gains against generally weak USD

NOK should start to play catch-up

Focus on benchmark revisions to US payroll data – risks on the downside

FOMC minutes will also be watched ahead of Powell speech this week

AUD and JPY still have scope for further gains against generally weak USD

NOK should start to play catch-up

Wednesday sees benchmark revisions to non-farm payrolls and the FOMC minutes. The Bureau of Labor Statistics (BLS) is expected to announce a significant downward revision to payrolls, potentially lowering payroll growth by up to 1 million jobs for the year ending in March 2024. Once a year, the BLS benchmarks the March payrolls level to a more accurate but less timely data source called the Quarterly Census of Employment and Wages, which is based on state unemployment insurance tax records and covers nearly all US jobs. The release of the latest QCEW report in June already hinted at weaker payroll gains last year. While most analysts expect a reduction in job growth, there are differing views on the likely size of the adjustment, and on how significant it is, as some of it may reflect the failure to include unauthorised immigrants, while the revisions are themselves subject to revision.

But there was a sharp reaction to the modest softness in the last employment report, and in a market that is sensitive to any evidence of employment weakness, these revisions could have a market impact. Any reduction of more than 500k might be seen as USD negative. Fed chair Powell has recently said they’re focusing more on the labor side of their dual mandate, and he’ll take the benchmark revisions into account in his Friday speech at the Fed’s annual symposium, so weak data could certainly increase easing expectations. Even so, we don’t see the Fed as being keen on a 50bp rate cut, and with the market already priced for 32bps of easing in September, it’s hard to see much more being priced in unless we see data or market action that indicates a need for aggressive action. The revisions are not enough for that, even if they are on the high side of estimates, and with the USD already having been weak this week, we wouldn’t see huge USD downside. Nevertheless, a big revision is liekly to keep the USD on the back foot.

The FOMC minutes will also be a factor. We expect the minutes will show a cautious tone on inflation, needing to see more data before easing, but increasing signs of concern over rising unemployment, which July non-farm payroll data will have increased. Still, the tone on inflation is likely to be cautious enough to suggest that a 50bps move in September remains unlikely, but may be dovish enough to maintain the USD negative tone ahead of Powell’s Jackson Hole speech.

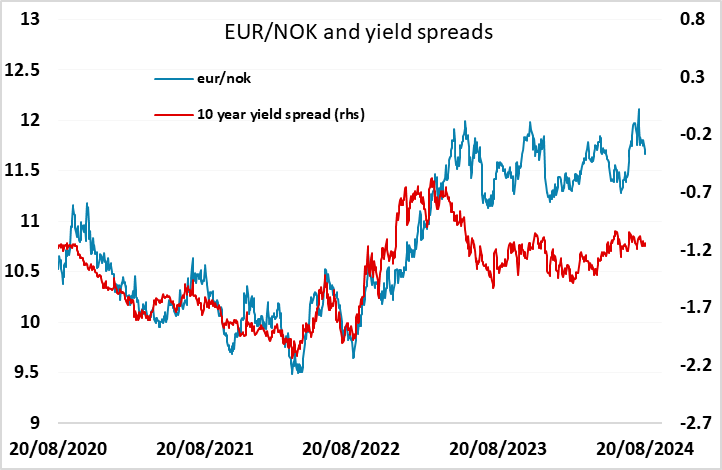

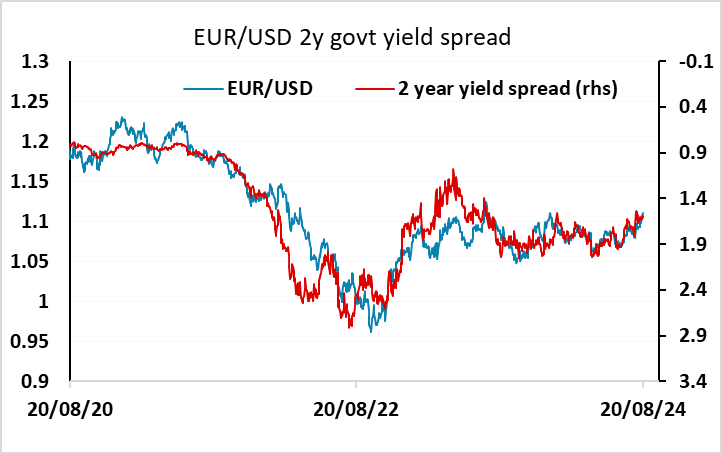

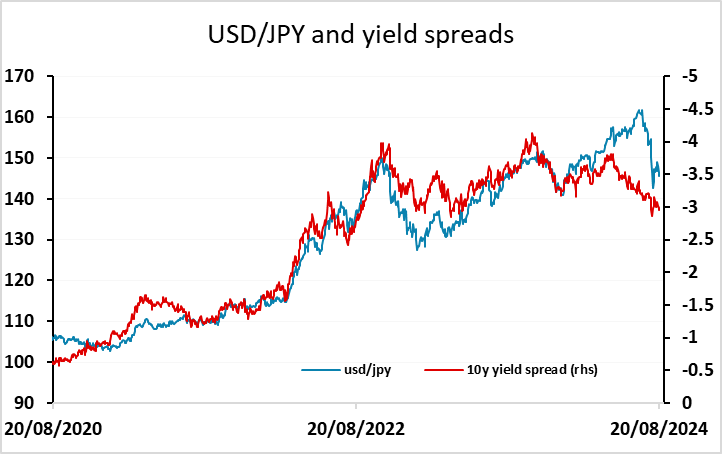

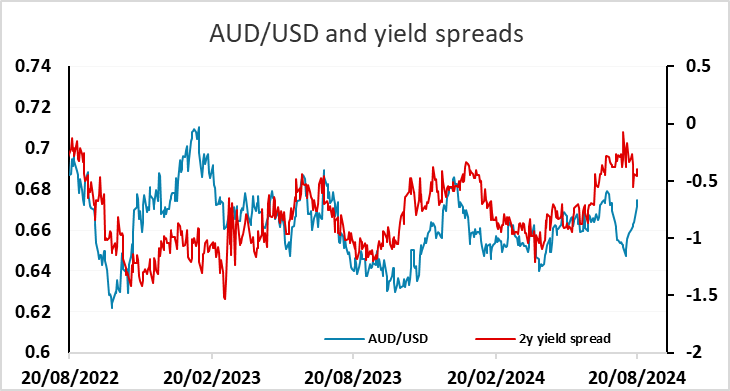

There isn’t much else of significance on the calendar, but the USD has shown notable weakness in the last few sessions, hitting new lows for the year against the EUR, and approaching the lows of the year against a range of other currencies. Some of this reflects nerves about the Powell speech on Friday, but a lot of it is a delayed reaction to yield spread moves that have already been seen. This is clearest against the JPY and AUD, where spreads suggest scope for further USD weakness, but looks less clear against the EUR, where recent EUR/USD gains have taken it above the level suggested by current spreads. Some of the USD weakness may also reflect the better equity tone in the last couple of weeks. The NOK continues to look like the major laggard but with EUR/NOK having broken below the 11.73 support there should now be scope for a bigger move below 11.50.