FX Weekly Strategy: August 19th - 23rd

EUR may come under pressure if PMIs remain relatively weak

GBP strength a little extended but should continue if PMIs remain strong

SEK may be vulnerable even though Riksbank rate cut is largely priced in

CAD would benefit if inflation data surprises on the upside

JPY still has the most potential for volatility – value clearest versus CHF

Strategy for the week ahead

EUR may come under pressure if PMIs remain relatively weak

GBP strength a little extended but should continue if PMIs remain strong

SEK may be vulnerable even though Riksbank rate cut is largely priced in

CAD would benefit if inflation data surprises on the upside

JPY still has the most potential for volatility – value clearest versus CHF

The coming week looks set to be relatively quiet, with only PMI and Canadian CPI in the way of major data and only the Riksbank meeting providing some central bank action, although there is the Jackson Hole symposium starting on Thursday that could produce some market moving comments.

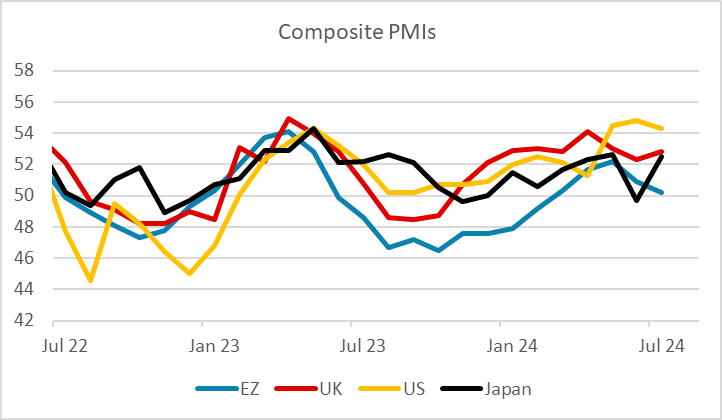

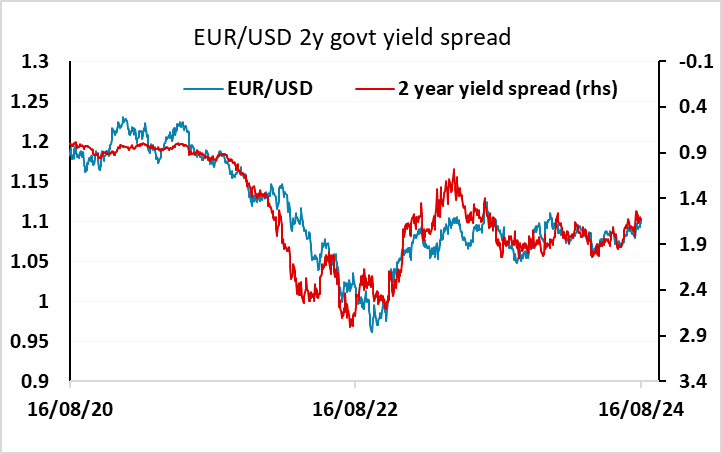

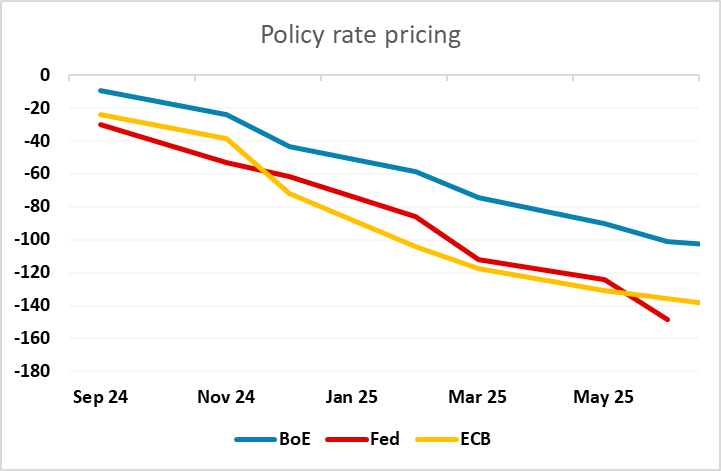

August PMIs provide the main data of the week, and the Eurozone numbers will probably be the most important given that they have underperformed in recent months. While Eurozone GDP has improved in H1 from the flat performance seen in H2 2023, it has nevertheless lagged behind the US and UK, and the latest dip in the composite PMI in July suggests that even the modest growth of the first half of the year may be stalling. The weakness doesn’t at the moment look like being pronounced enough to suggest recession, but may be weak enough to increase the pressure on the ECB for further rate cuts. The recovery in US yields in the last week means that the market is currently pricing the path of Fed and ECB rate cuts at a similar pace, but another month of relatively weak Eurozone PMIs could widen spreads in favour of the USD. EUR/USD continues to stick close to the levels implied by short term yield spreads, but even if we do see some decline in Eurozone yields, we are unlikely to see a dip below 1.09, unless there is a very clear disconnect between the Eurozone and the US.

UK PMIs have also been relatively strong of late, and UK GDP has certainly been stronger than expected in H1, and this accounts for the strong performance of GBP this year. There was some reversal of GBP strength when we saw the general risk decline a couple of weeks ago, but as equity markets have stabilized and edged higher, so EUR/GBP has resumed downward pressure on 0.85. This could continue if UK PMIs continue to outperform this week. But the strength of GBP looks somewhat out of line with moves in shot term spreads, and the market continues to price a much slower pace of BoE easing relative to the US and Eurozone. So if we do see any weakness in UK PMIs, there may be scope for GBP to correct more sharply from these somewhat extended levels.

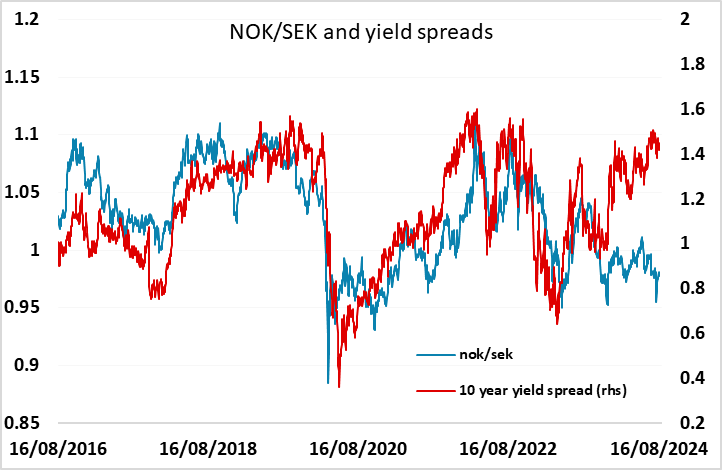

A 25bp rate cut is 85% priced for the Riksbank meeting, and we would not expect the Riksbank to surprise the market, so while there may be a small SEK decline on the news it is unlikely o be particularly sharp. Having said this, we still see the SEK as overvalued against the NOK, and another rate cut following the Norges Bank decision to leave rates unchanged last week would only emphasise the case for a NOK/SEK recovery. This still looks like it needs to come more from the EUR/NOK side than the EUR/SEK side, but there may be potential for EUR/SEK gains to trigger EUR/NOK losses if NOK/SEK breaks higher.

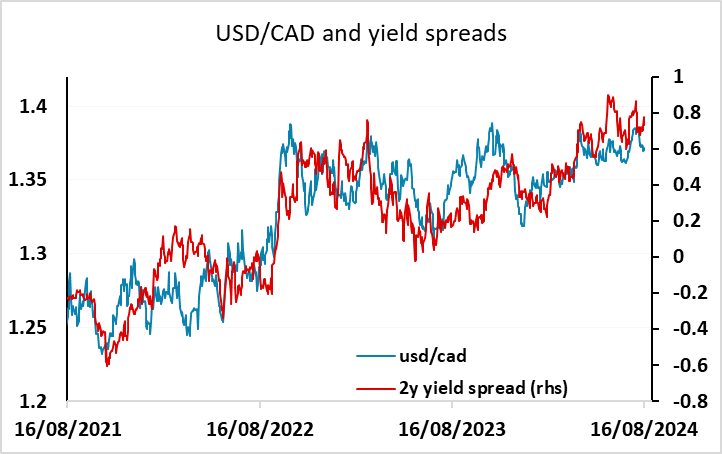

The other main data this week is Canadian CPI, which could be crucial in determining the BoC decision on September 4. However, all the risks look to be on the CAD upside, as a 25bp rate cut is already fully priced. Even so, the USD/CAD decline of the last week has taken it somewhat below the level that looks consistent with short term yield spreads. In practice we doubt there will be a big impact, but there does look to be more short term danger of CAD gains on strong data than CAD weakness on weak data.

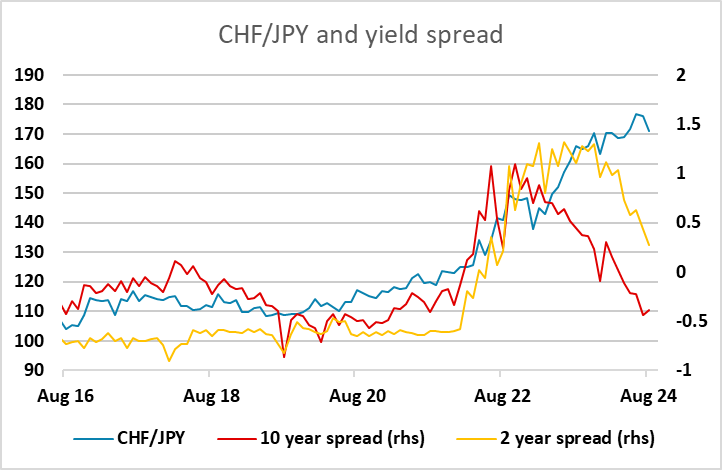

The JPY continues to be the currency with the most potential for volatility, and we still see substantial scope for JPY gains in the longer run. However, if the better tone to risk sentiment continues this week, there is unlikely to be any significant JPY strength. There is still potential for a USD/JPY test up to 150 if equities continue to recover. Nevertheless, the JPY remains hugely undervalued from a longer term perspective, and the undervaluation is perhaps clearest against the CHF, which is likely to be similarly vulnerable to any recovery in risk appetite.

Data and events for the week ahead

USA

It is a quiet week for US data. Monday sees July’s leading indicator and also the start of the Democratic National Convention which will conclude with a speech from Kamala Harris on Thursday. We doubt this will have a major impact in the polls, which currently show Harris in a marginal lead.

Fed’s Bostic is due to speak on Tuesday, and Wednesday sees the release of FOMC minutes from July 31. These are likely to show a fairly cautious tone, wanting to see more data before easing. Key data for July released since the meeting has strengthened the case for easing, which will make the minutes somewhat dated. The Fed will also have seen key data for August before its September 16 meeting. The Fed’s annual symposium at Jackson Hole starts on Thursday, and continues through Saturday.

Weekly jobless claims are due on Thursday. We expect modest slippage in August’s S and P PMIs, manufacturing to 48.5 from 49.5 and services to 54.0 from 55.0. We expect July existing home sales to be unchanged at 3.89m after a steep 5.9% decline in June. On Friday we expect July new home sales to fall by 1.9% to 605k.

Canada

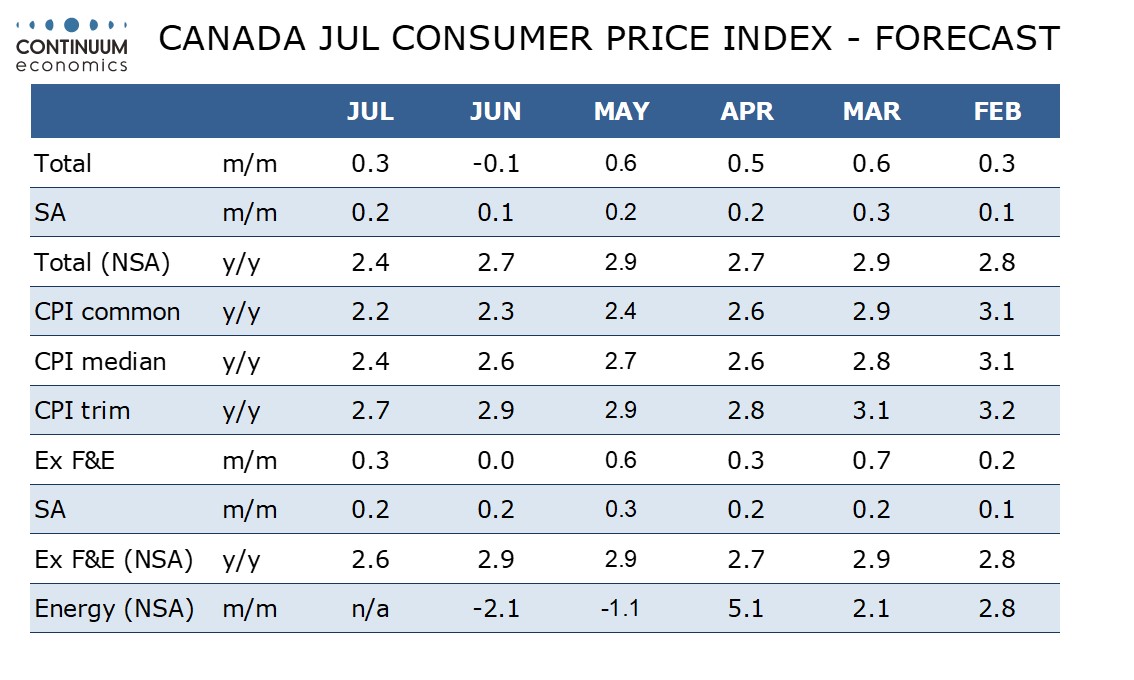

Canada’s clear calendar highlight is July CPI on Tuesday, where soft data would probably allow the Bank of Canada to deliver a third straight easing on September 4. We expect slippage in yr/yr growth to 2.4% from 2.7% overall, with softer data also for the BoC’s core rates. July IPPI/RMPI data is due on Wednesday. Friday sees June retail sales. A preliminary estimate for a 0.3% decline was made with May’s report.

UK

Flash PMI data (Thu) for August are seen correcting back slightly in the July, although there is still some upside risks from the election result. The composite Index picked up slightly last time, rising from 52.3 in June to 52.8 in July. It said that the rate of job creation quickened to a 13-month high, something not at all backed up by payroll data computed by the HMRC. Otherwise, Thursday also sees CBI survey numbers and the day before sees public borrowing. As for the latter, borrowing in the first three months of FY 2024-25 was £1.1 billion below the same period last year but £3.2 billion above the OBR’s forecast profile. The week end with a speech by BoE Governor Bailey at Jackson Hole. There is not yet and formal tone to what it may contain, but it may have at least implicit policy implications as Symposium this year is based around the topic "Reassessing the Effectiveness and Transmission of Monetary Policy,

Eurozone

Datawise, the main interest will be the PMI flashes on Thursday, where we see a small further drop back in the composite index. While it remained in expansion territory in July, it saw a second successive monthly decline from June’s 50.9 to 50.2 and its weakest since activity levels began rising again in March. Other business surveys are due, including the French INSEE figure (Fri) where some declines may be in the offing. There is also EZ construction numbers (Tue) too and ECB attention with its consumer expectations survey (Fri) and some Council speakers due, but with most attention being the account of the July Council meeting decision (Thu). The ECB will also release increasingly-watched negotiated wage data for Q3 (Thu)

Rest of Western Europe

In Sweden, there is the Riksbank decision (Tue). Recent data have justified the Riksbank’s increased confidence in the current disinflation process and is highly likely to exercise its easing bias with a second (in three months) 25 bp rate cut (to 3.5%) at the Sep 20 policy verdict. As for future policy, in a Board meeting with no fresh projections, it is likely to repeat existing guidance which implies at least one more such cut this year. Norway sees Q2 GDP numbers where we see a flat q/q outcome

Japan

Light calendar for Japan next week with only trade balance and preliminary PMIs. The trade balance on Wednesday would carry more weight as we begin to see private consumption picking up on growing real wage. For the BoJ to continue its hawkish tilt, it would require a solid and continuous pick up in consumption. A strong import could reinforce that though it is unlikely.

Australia

The RBA minutes will be out on Tuesday and there should come with no surprises as the current inflationary dynamics has not changed, thus not allowing them to ease early. Else, we have PMIs on Thursday.

NZ

Trade Balance on Tuesday and Retail sales on Friday are both technically important. But with the RBNZ announcing the beginning of easing cycle, these data will be less market moving.