Preview: Due August 23 - U.S. July New Home Sales - Extending recent slippage

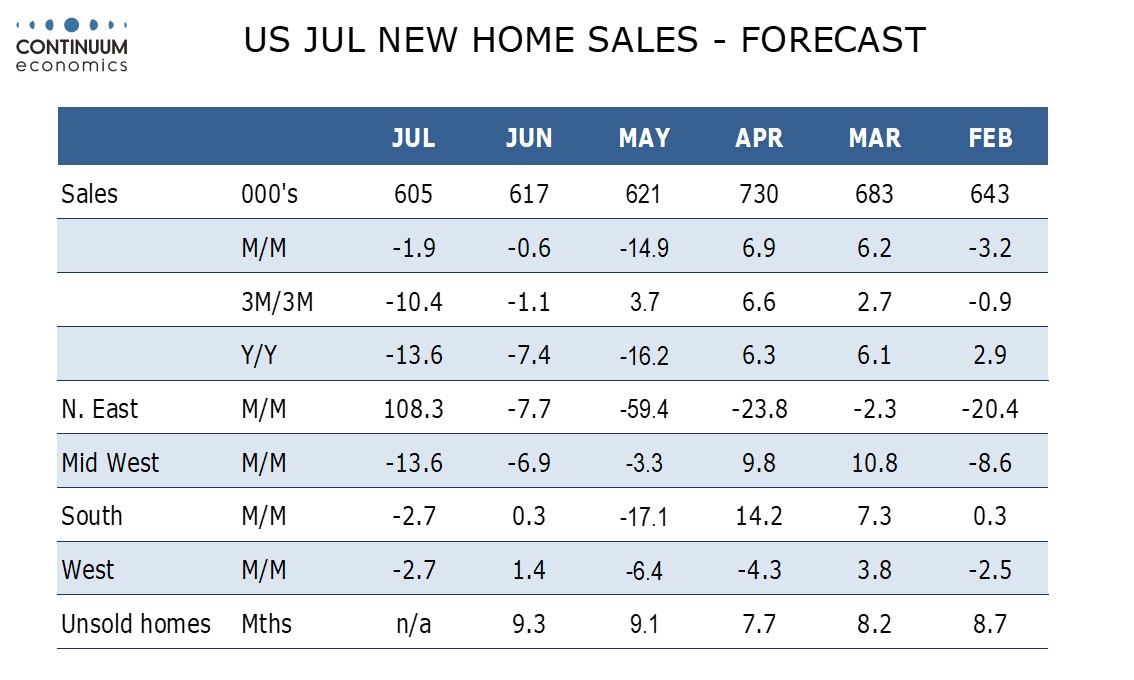

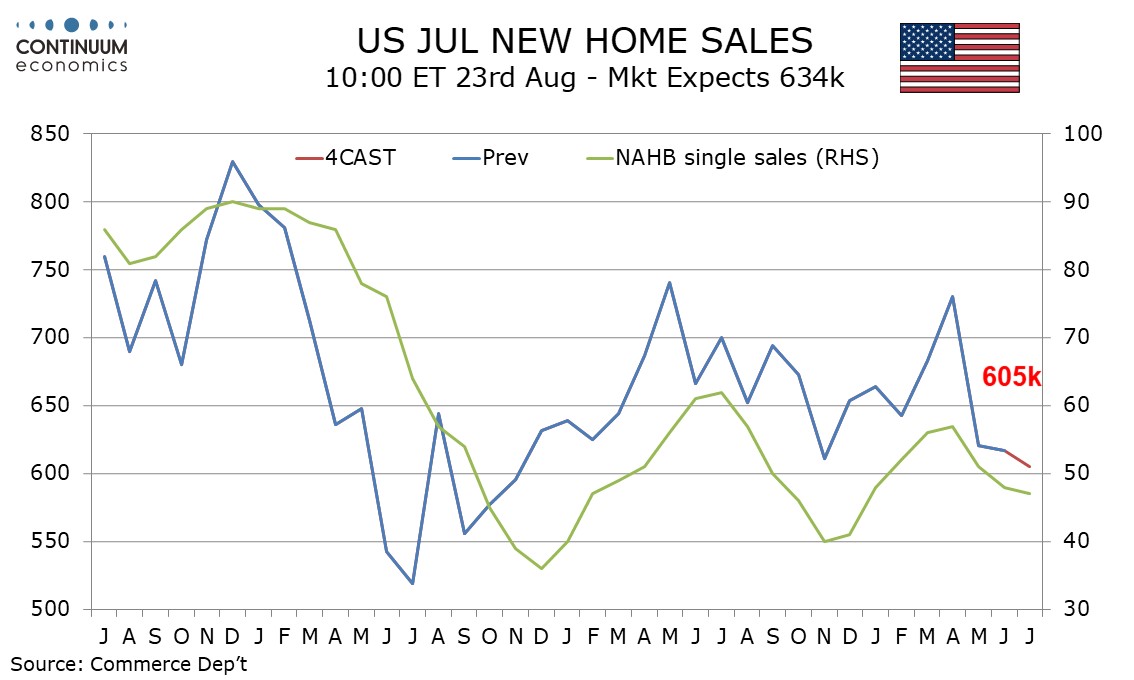

We expect a modest 1.9% decline in July new home sales to 605k, which would be the weakest level since October 2022, assuming no revision to June’s 617k outcome. June also saw a modest decline of 0.6%, extending a sharp 14.9% fall in May that corrected two straight gains each exceeding 6.0%.

The NAHB homebuilders’ index on current sales also saw a near term peak in April before a significant slide in May and more modest dips in June and July, suggesting that July new home sales will see a second straight modest dip. Should Fed easing commence later in the year, the latest slippage is likely to stabilize. Sales in the Northeast are due for a sharp bounce after very weak May and June readings but make up only a small proportion of the total. The Midwest however is due for a fall with recent data significantly outperforming other regions on a yr/yr basis. For the South and West, we expect moderate declines.

We expect the median price to rise by 1.0% on the month after a 2.5% June decline, seeing yr/yr data fall to -5.2% from -0.1%. For the average price however we expect a 1.0% monthly increase after a 3.4% June decline, seeing yr/yr data marginally less weak at -3.1% from -4.1%. The price data is volatile, but trends are negative.