Published: 2024-08-21T13:20:02.000Z

Preview: Due August 22 - U.S. August S&P PMIs - Modest declines, Manufacturing weaker than Services

Senior Economist , North America

4

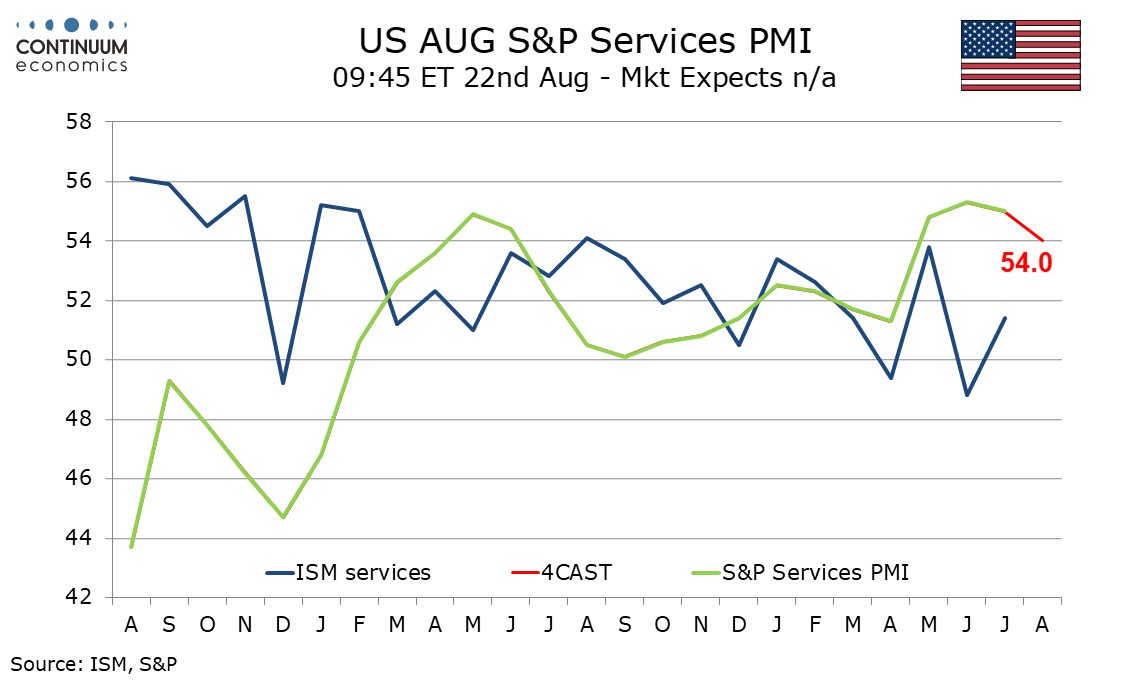

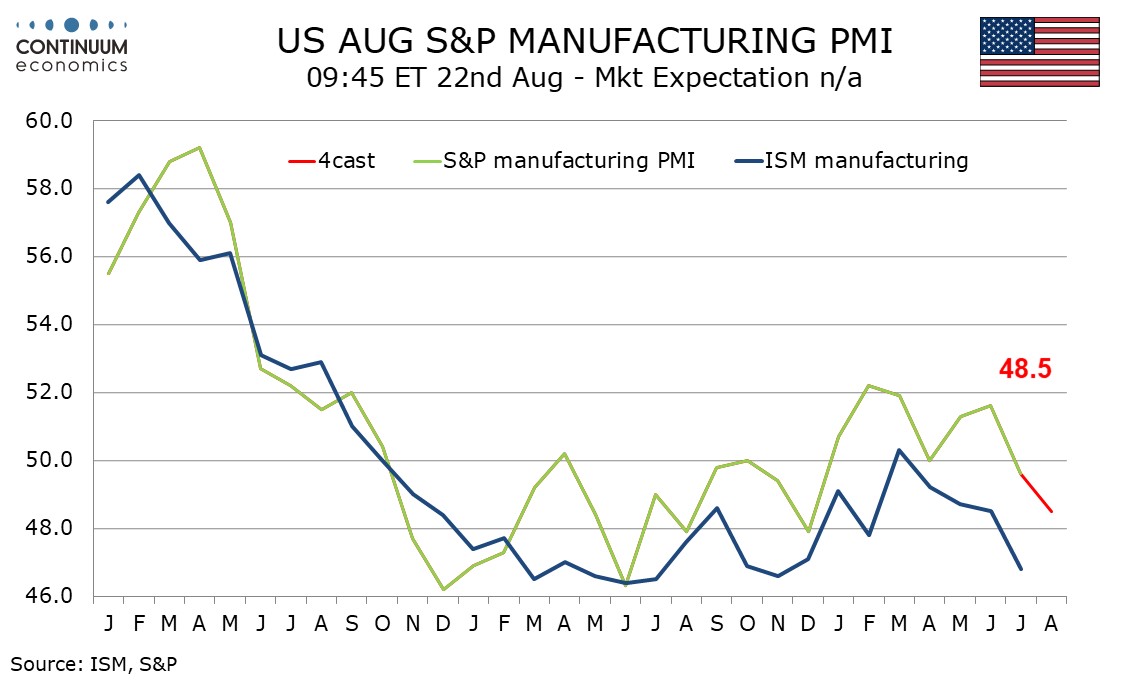

We expect August’s S and P PMIs to show modest weakenings, manufacturing to an eight-month low of 48.5 from 49.6, and services to a still quite strong 54.0 from 55.0.

The S and P manufacturing index is reasonably well correlated with its ISM counterpart, picking up early this year but now showing signs of fading, albeit a bit more convincingly in ISM data, with the S and P index having outperformed in May and June. Both indices however slipped significantly in July, and the S and P index has scope to extend that slippage.

The S and P and ISM service indices are less well correlated, with the former having been trending higher while the latter has had a marginal downward trend over the last two years. The S and P index seems more sensitive to interest rate expectations than the ISM’s which does provide some upside risk to August’s data, but if the economy is slowing the recent strength will be difficult to sustain. June’s 55.3 reading was the highest since April 2022. July’s dip to 55.0 probably signals a peaking which will be extended, if not sharply, in August.