Preview: Due August 26 - U.S. July Durable Goods Orders - Aircraft to rebound, modest slippage seen elsewhere

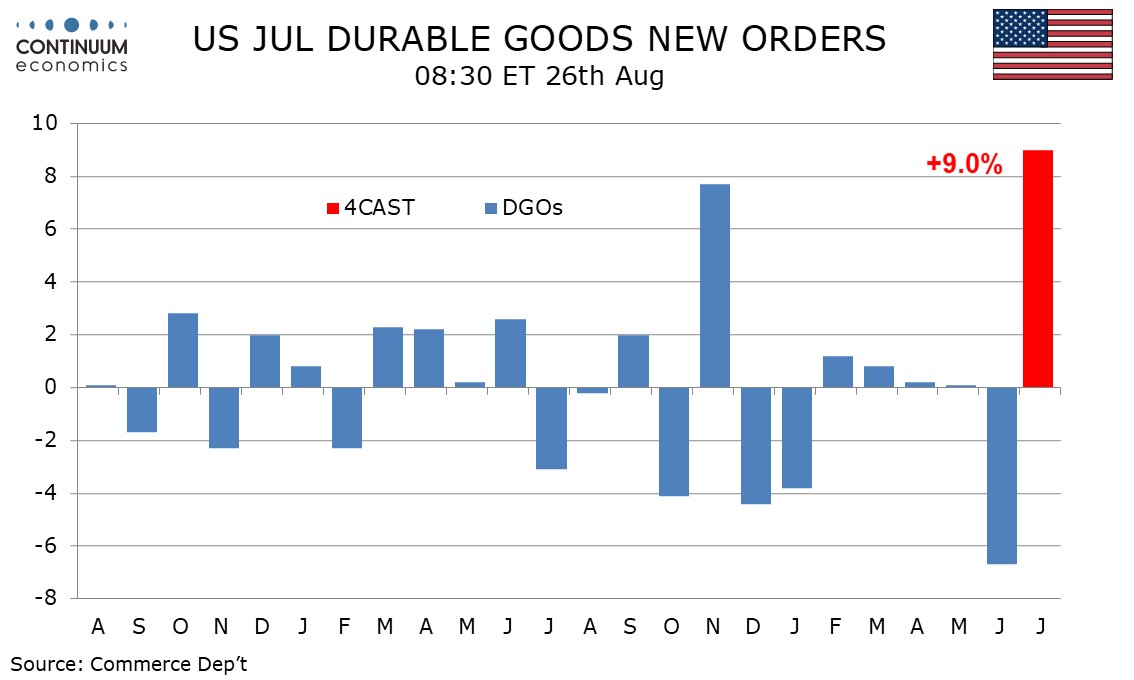

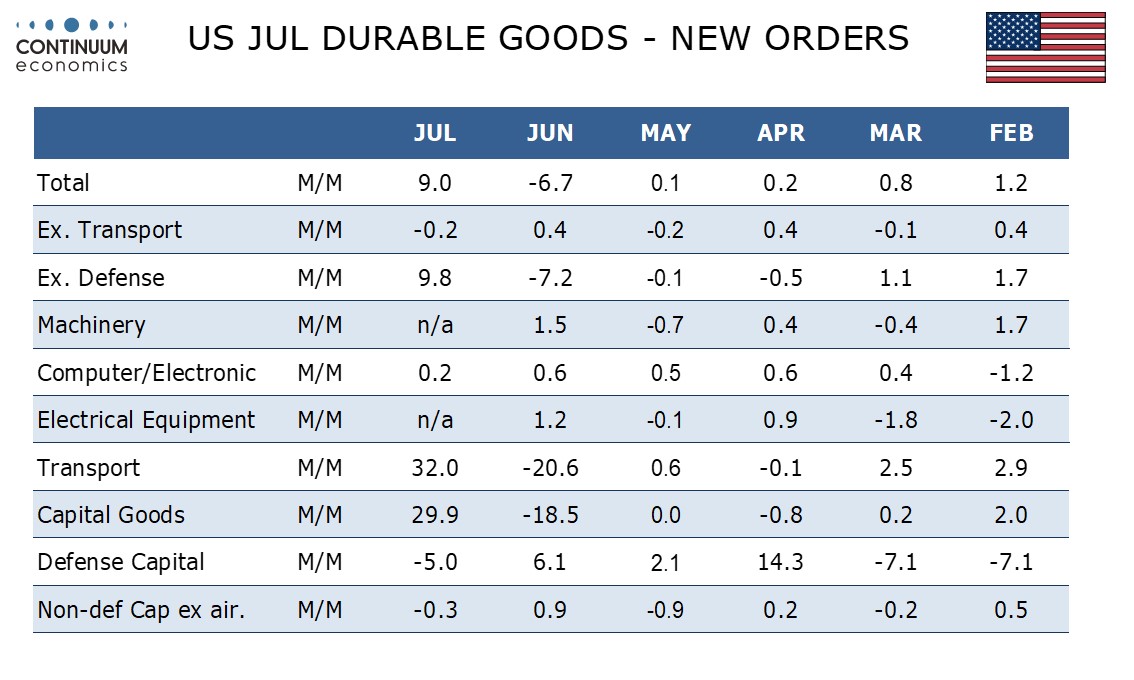

We expect July durable orders to increase by a sharp 9.0% to more than fully erase a 6.7% fall in June with the swings largely coming from aircraft. Ex transport we expect a 0.2% decline to follow a 0.4% June increase.

Boeing data suggests an above trend month from aircraft in July. However the main reason to expect a sharp rise in aircraft is that June saw a sharp decline that was exaggerated by seasonal adjustments. Before seasonal adjustment aircraft orders saw a marginal increase but after seasonal adjustment aircraft saw such a large decline that the level was recorded as negative. More normal seasonal adjustments combined with a relatively strong month should deliver a strong rebound in aircraft.

We expect a marginal decline in autos and a correction lower in defense, which has a large overlap with transport, from a strong June. Ex defense we expect a rise of 9.8% to follow a 7.2% June decline.

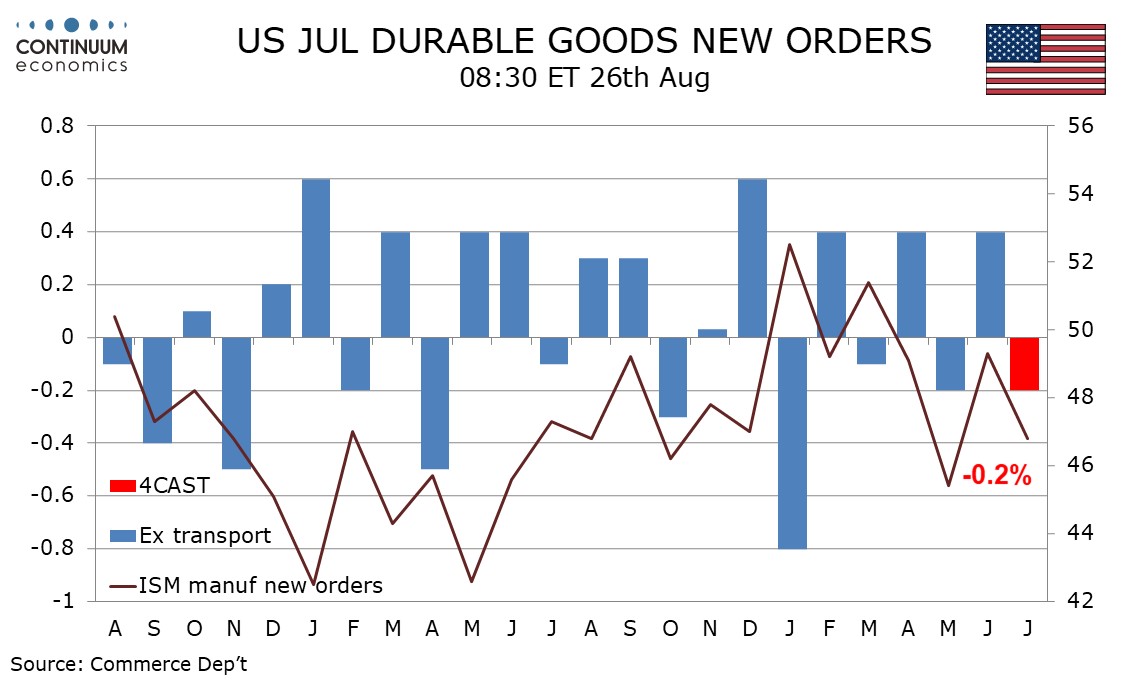

Ex transport we expect a 0.2% decline to correct a 0.4% increase in June. While not always a reliable guide this would be consistent with a weaker ISM manufacturing new orders index after a stronger June outcome. The ex-transport trend is neutral to positive and we have not seen a monthly move in either direction reach 1.0% for over two years.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to fall by 0.3% after a 0.9% June increase corrected a 0.9% decline in May. Trend in this series is also close to flat.