U.S. July PPI - Trade corrects June gain, elsewhere data slightly firmer

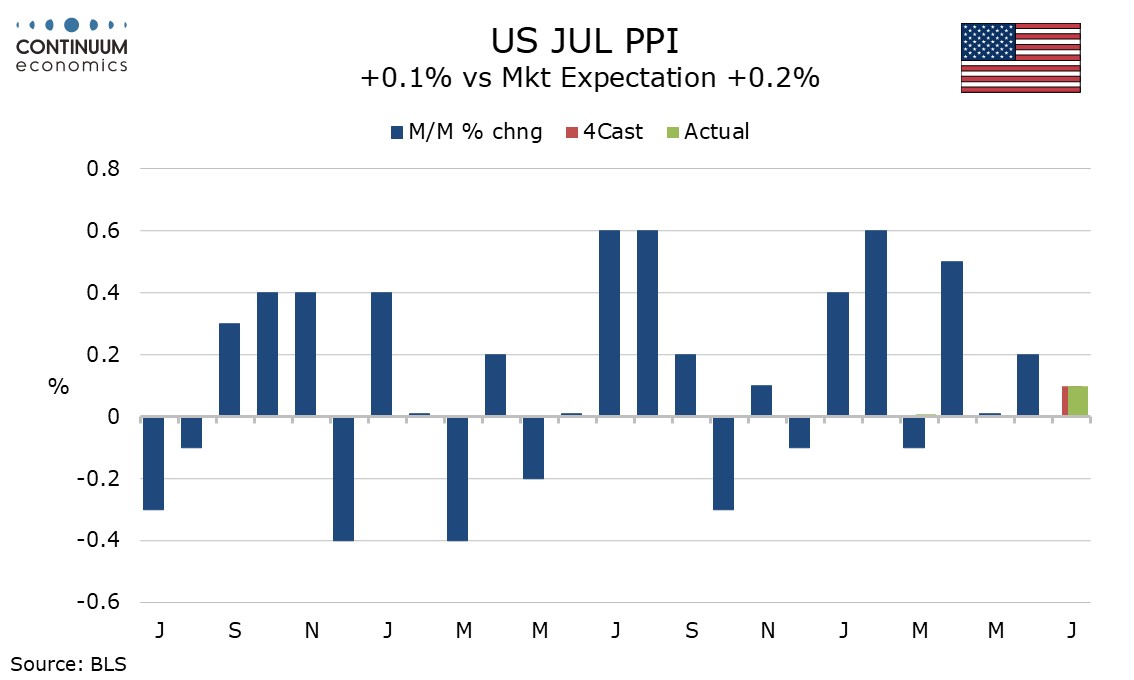

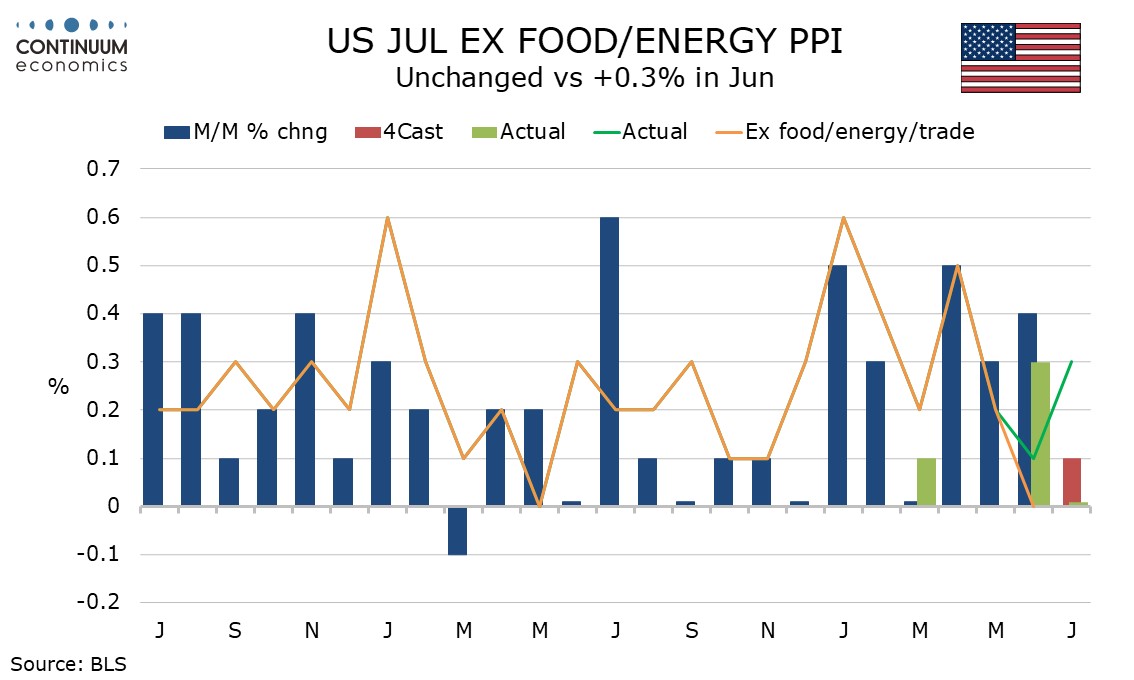

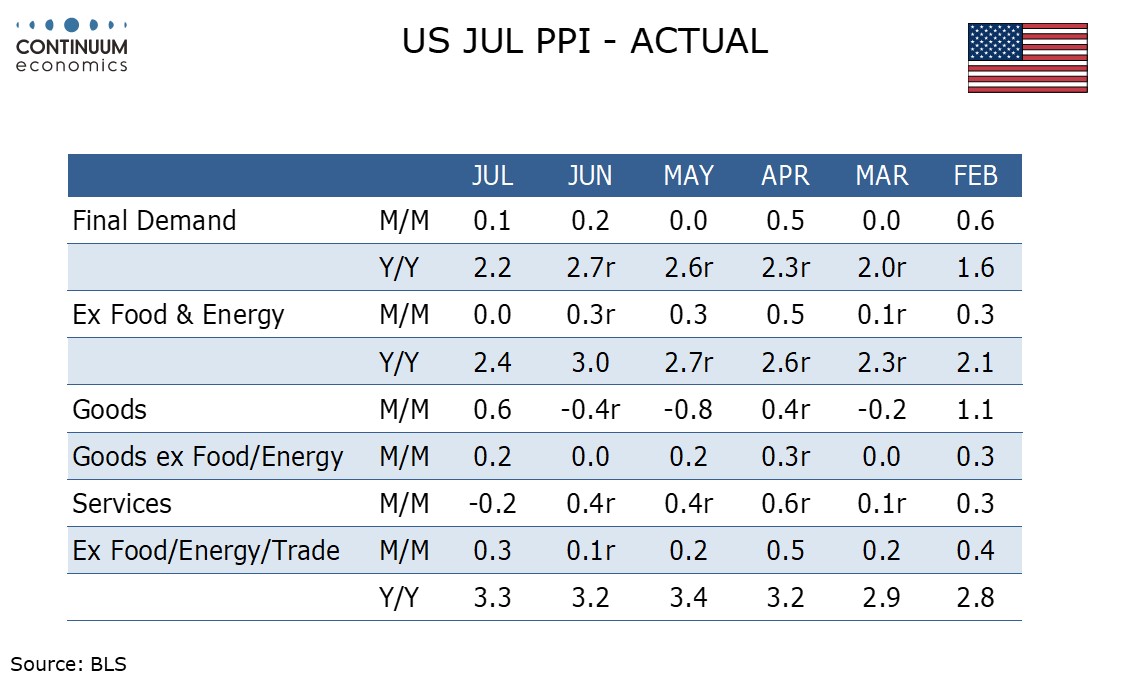

July PPI provided a subdued 0.1% increase overall, and an even softer unchanged outcome ex food and energy, but a firmer 0.3% increase ex food, energy and trade. Trade corrected from strength in June when overall PPI rose by a revised 0.2%, ex food and energy was quite firm at 0.3% but ex food, energy and trade subdued at 0.1%.

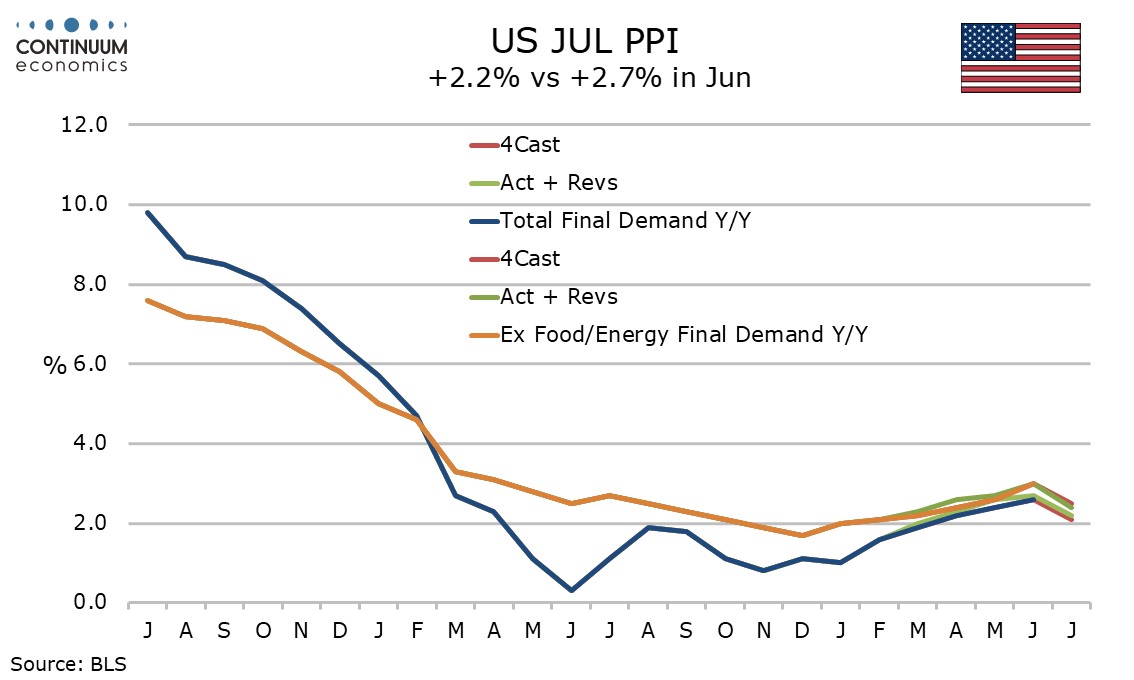

Averaging the June and July data suggest an underlying picture around or a little below 0.2% per month, which is consistent with the underlying pace being near 2.0% yr/yr.

However yr/yr rates rate a little firmer than that, particularly ex food energy and trade which actually increased to 3.3% from 3.2%. Ex food and energy however slowed to 2.4% from 3.0% while overall PPI slowed to 2.2% from 2.7%, the latter two correcting from acceleration in the first half of the year..

Trade prices fell by 1.3% after a 1.4% June increase causing services to fall by 0.2% after a 0.4% June increase. However elsewhere the service data was firmer, transportation and warehousing up by 0.4% after a 0.1% June decline and other services up by 0.3% versus 0.1%.

Goods ex food and energy with a 0.2% increase was up from a below trend flat outcome in June. Energy with a 1.9% increase corrected two straight declines while food was also above trend with a 0.3% gain. Excluding the correction lower in trade, this was not a weak month.

Intermediate data was also far from weak, services up by 0.3% from 0.2% in June, processed goods up 0.7% but with a soft 0.1% gain ex food and energy, and unprocessed goods firm at 3.6%, 0.7% ex food and energy.