GBP flows: Stronger after labour market data

GBP rise after unemployment rate drops to 4.2%, but other data more mixed

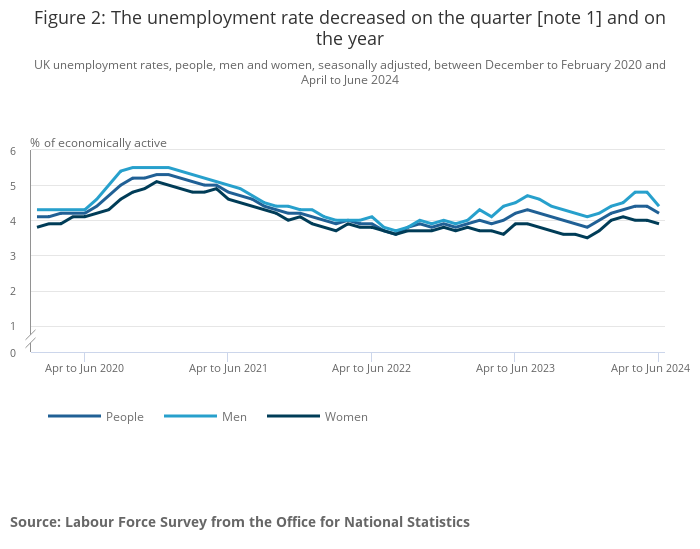

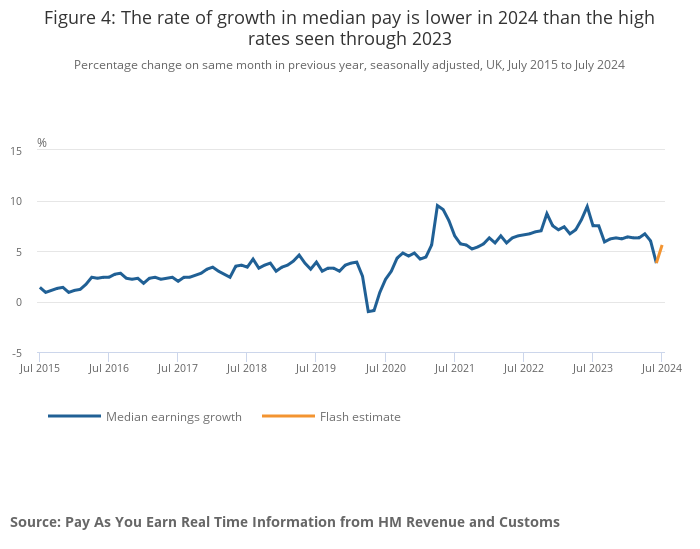

GBP is higher after mixed but generally slightly stronger UK labour market data. The official average earnings data for the April-June period showed the expected y/y fall to 4.5% y/y due to base effects, while the ex-bonuses number was also as expected, falling slightly to 5.4% y/y. But the HMRC numbers for payrolled employees for July showed a modest increase to 5.6% y/y, although the rise was again largely due to the base effect in June. But there was an unexpected sharp fall in the unemployment rate to 4.2% in the 3 months to June, from 4.4% in the 3 months to May. Against this, the claimant count for July rose sharply by 135k – the largest rise since the pandemic. The ONS employment data was also on the strong side, showing a 97k rise in the 3 months to June, but the HMRC version was more subdued, with a 24k rise in July.

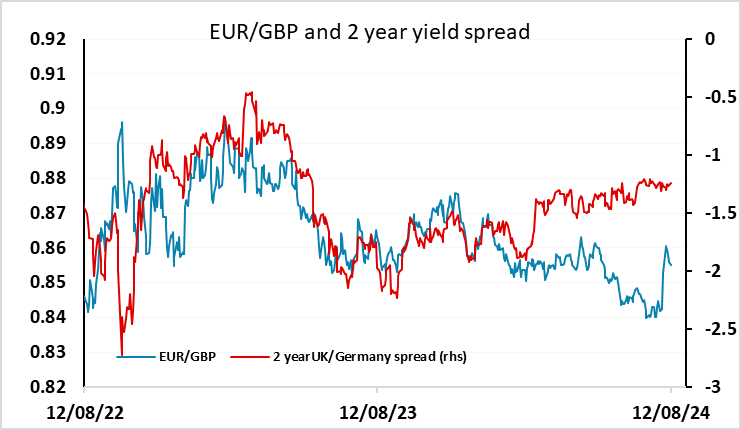

All in all, the decline in the unemployment rate may be seen as the most significant aspect of this data, but in practice it is unlikely to make a lot of difference to BoE MPC thinking at this point, with the labour market data seen as a little unreliable. EUR/GBP has dropped 20 pips to 0.8540, but the CPI data due tomorrow will likely be more relevant to near term policy thinking with the labour market data inconclusive at this stage. However, the big public sector wage increases planned by the new government could maintain strong wage growth and limit the scope for rate cuts. For today, GBP looks likely to hold onto these gains and EUR/GBP may push towards 0.85.