U.S. July ISM Manufacturing - Weaker, employment in particular

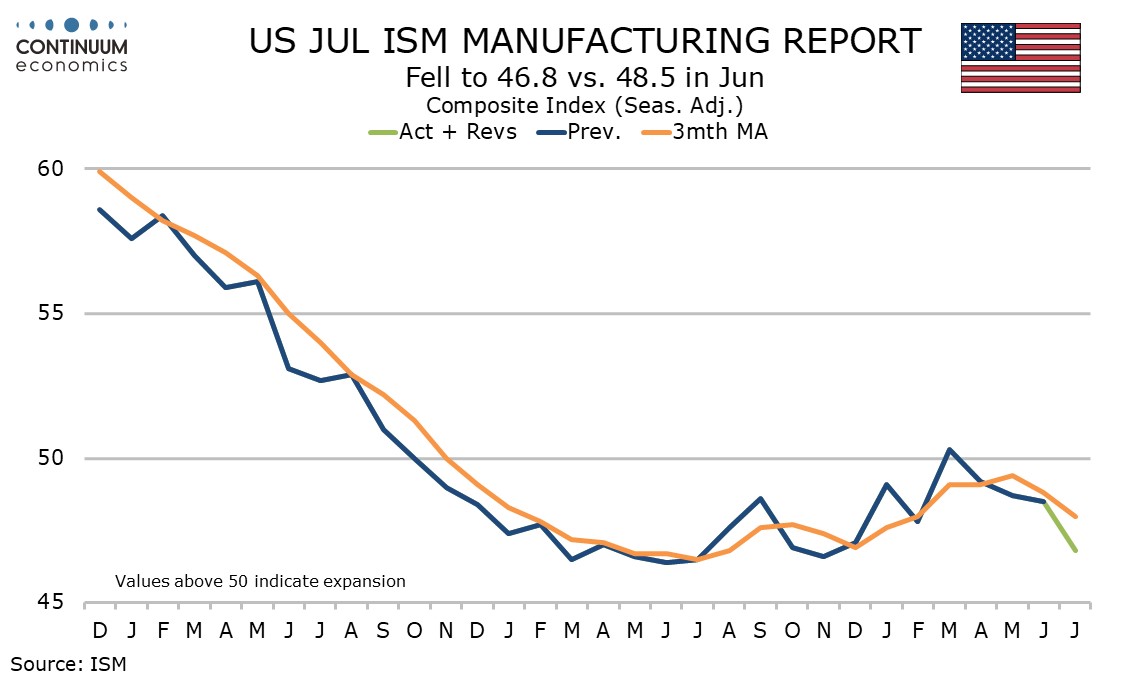

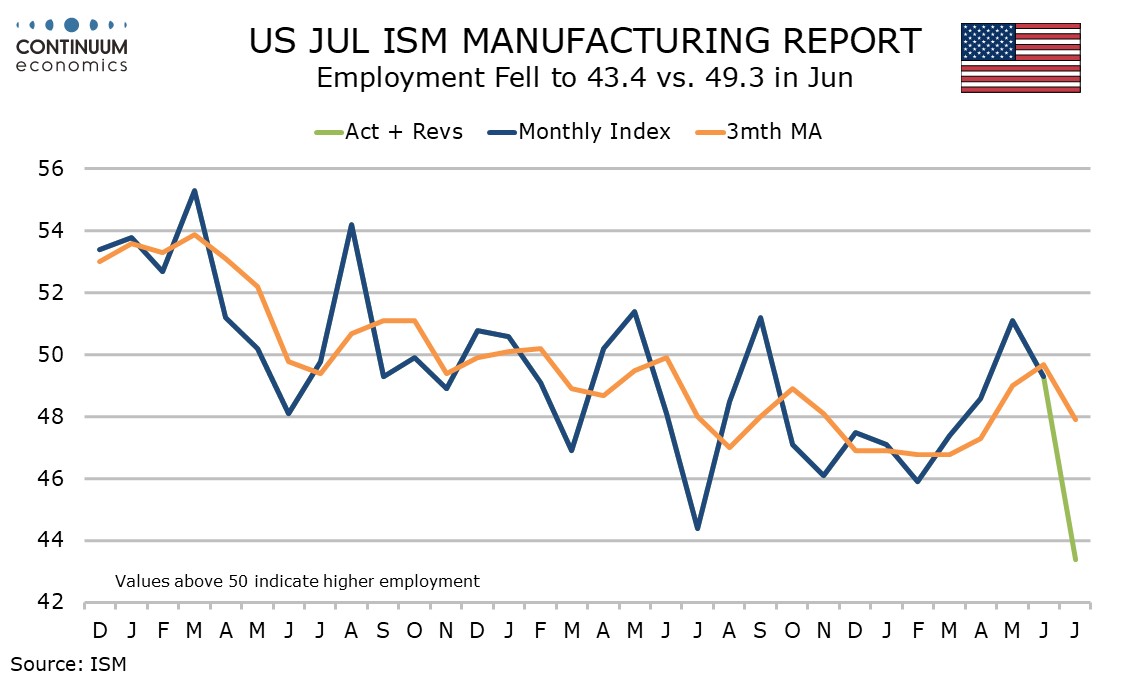

July’s ISM manufacturing index at 46.8 from 48.5 has seen an unexpected slowing with an employment index of 43.4 from 49.3 the most notable sign of weakness. Regional manufacturing surveys, with the exception of the Philly Fed’s, were generally a little softer in July.

The S and P manufacturing index of 49.6 was also down from 51.6 in June, and the dip in the ISM index means it continues to underperform.

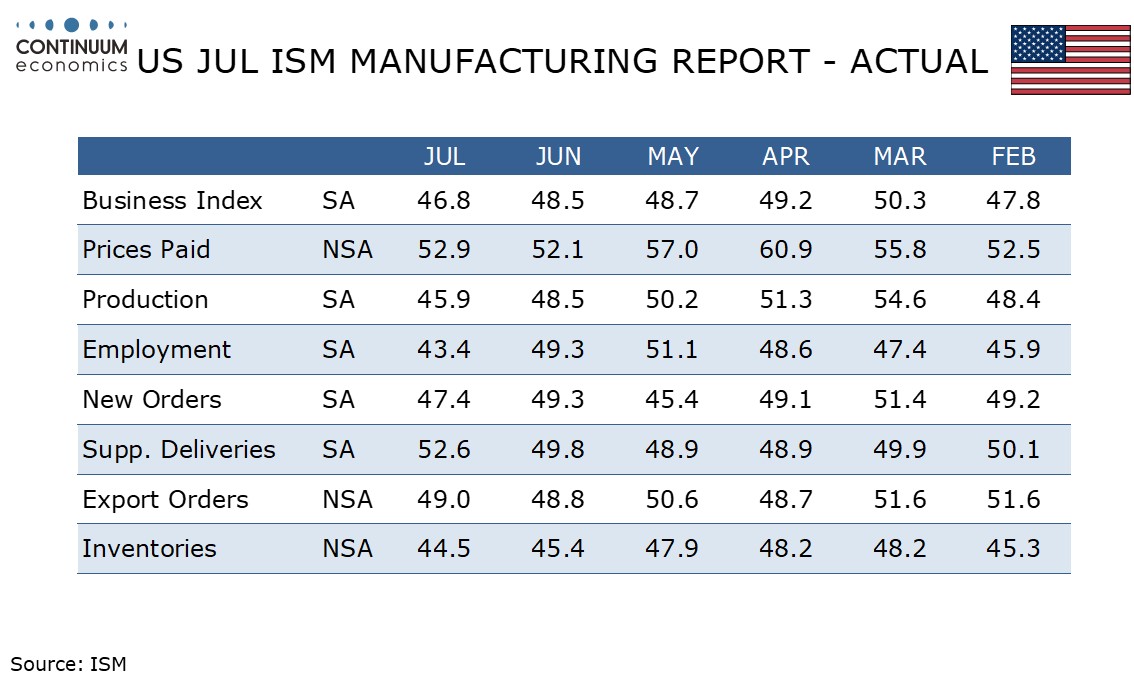

Four of the five contributors to the composite fell, and while employment slipped the most to its lowest since June 2020 production at 45.9 from 48.5 is the lowest since May 2020 at the height of the pandemic. New orders at 47.4 from 49.3 and inventories at 44.5 from 45.4 also fell.

The one component of the composite to increase was deliveries, at 52.6 from 49.8 the highest since August 2022 and hinting at supply problems. However there is little sign of inflation in prices paid, up only marginally to 52.9 from 52.1, with June’s index having been the lowest since December.

May construction spending also shows a subdued picture, down 0.3% on the month from a downwardly revised 0.4% dip (from -0.1%) in May, though Q2 revisions look stronger overall with April revised higher to a 1.3% gain from 0.3%. Junes’ detail shows broad based moderate slippage.