FX Daily Strategy: Europe, May 8th

BoE and Riksbank the main focuses

BoE cut seen, but GBP performance may hinge on growth forecasts

Riksbank unlikely to cut but market will watch Riksbank rate path forecast

JPY still looks to have the most potential for gains

BoE and Riksbank the main focuses

BoE cut seen, but GBP performance may hinge on growth forecasts

Riksbank unlikely to cut but market will watch Riksbank rate path forecast

JPY still looks to have the most potential for gains

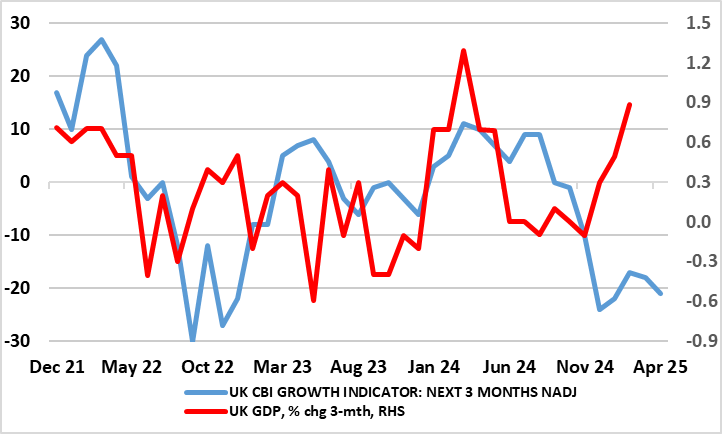

Bank of England and Riksbank monetary policy decisions are the main focus for Thursday. Recent MPC comments have pointed to the MPC majority envisaging rate cuts no faster than every quarter this year and a little further into 2026 but with no pre-set path being considered – at least openly. This would be consistent with a 25 bp cut (to a 2-year low of 4.25%) at Thursday’s meeting, which is even more likely given the added downside risks that the UK is increasingly facing over and beyond that from a global trade flare-up. What will be (more) important is how the updated Monetary Policy Report (MPR) pares back its inflation surge for this year both due to lower energy prices and these added downside risks paring back growth ahead.

Surveys Pointing South!

Source, ONS, CBI

As it stands, the market is more than fully pricing a 25bp cut this month, although a larger cut is priced as a very low (<10%) chance. For the year, there are 95bps of cuts priced, so 20bps more than the one every quarter suggested by recent MPC commentary, due to the market concerns about the impact of tariffs on the UK and global economy. It seems unlikely that the BoE will want to commit to any new stance at this stage, given the uncertainty of US policy, so we would not anticipate any significant new guidance in the press conference, and the market pricing of cuts seems unlikely to change a great deal. However, GBP may be more influenced by growth forecasts going forward, with confidence increasingly a factor for currencies, especially those that have a tendency to suffer in periods of risk aversion. So GBP risks may well be on the downside, especially against the safer havens, meaning primarily the JPY and the EUR, with the CHF less attractive with the SNB appearing keen to halt any further appreciation.

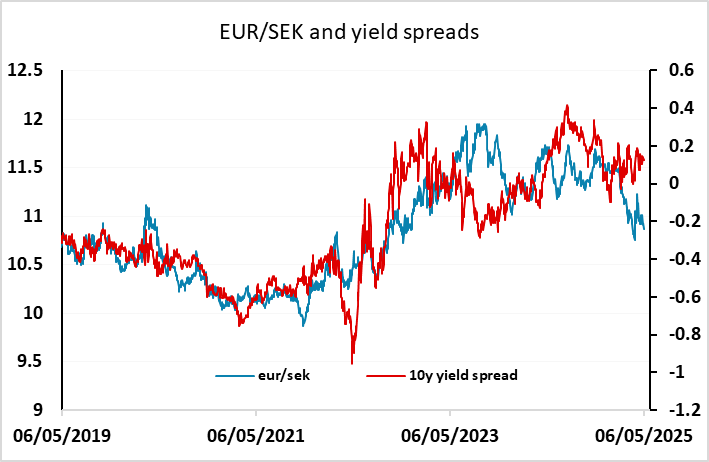

The market has increased the implied probability of a rate cut from the Riksbank in the wake of the softer than expected CPI data on Wednesday, with a cut now seen as close to a 30% chance from less than 10% on Wednesday morning. We still doubt that the Riksbank will want to act at this stage given the degree of uncertainty around the global economy, but the chance of a rate cut by June have certainly increased, with the market now pricing this as around a 70% chance. The SEK may bounce slightly on no change in policy, but the market will be focused on the policy rate forecast that accompanies the decision. If a cut is seen by June, there is scope for EUR/SEK to correct higher towards 11, with the SEK having outperformed yield spreads so fat this year.

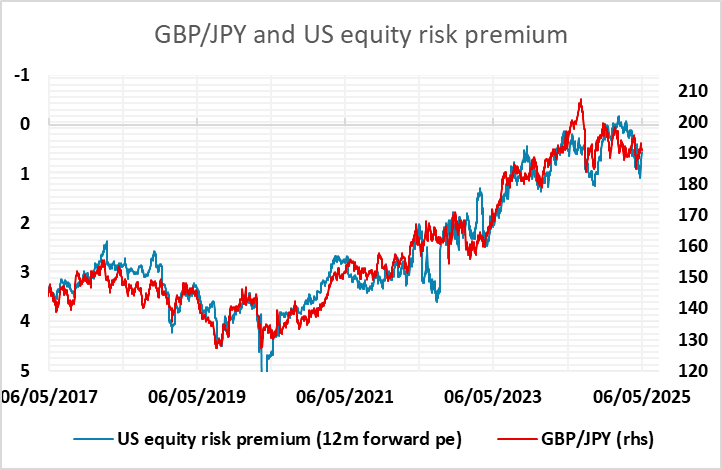

The general market tone has become quite neutral as we await the first data that will be directly affected by US tariffs. We continue to see risks to be mainly on the downside for US equities, with the S&P 500 still trading very close to the level seen before the tariff announcement, and this makes us continue to see the JPY as the most favoured currency. The JPY crosses may now have the most scope for gains, as EUR/USD looks likely to struggle to make further advances without some positive European economic news, and EUR/JPY remains well correlated with movements in equity risk premia.