FX Daily Strategy: N America, January 6th

EUR slips slightly on softer preliminary CPI data

JPY still range bound but upside risks dominate

GBP strength is hard to trust

AUD gains well founded but may require more equity strength to extend

EUR slips slightly on softer preliminary CPI data

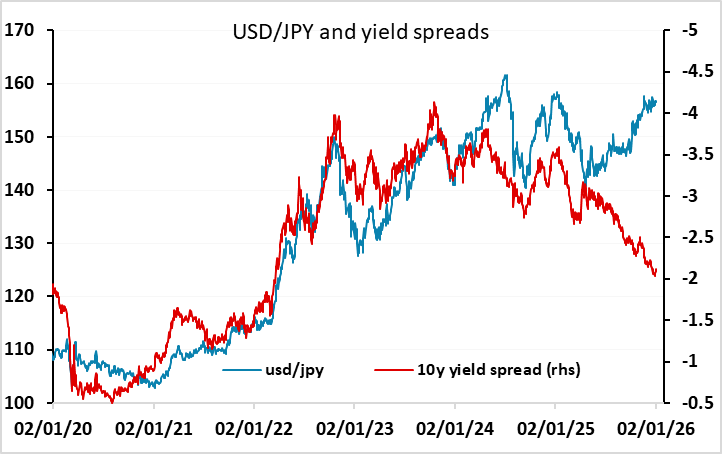

JPY still range bound but upside risks dominate

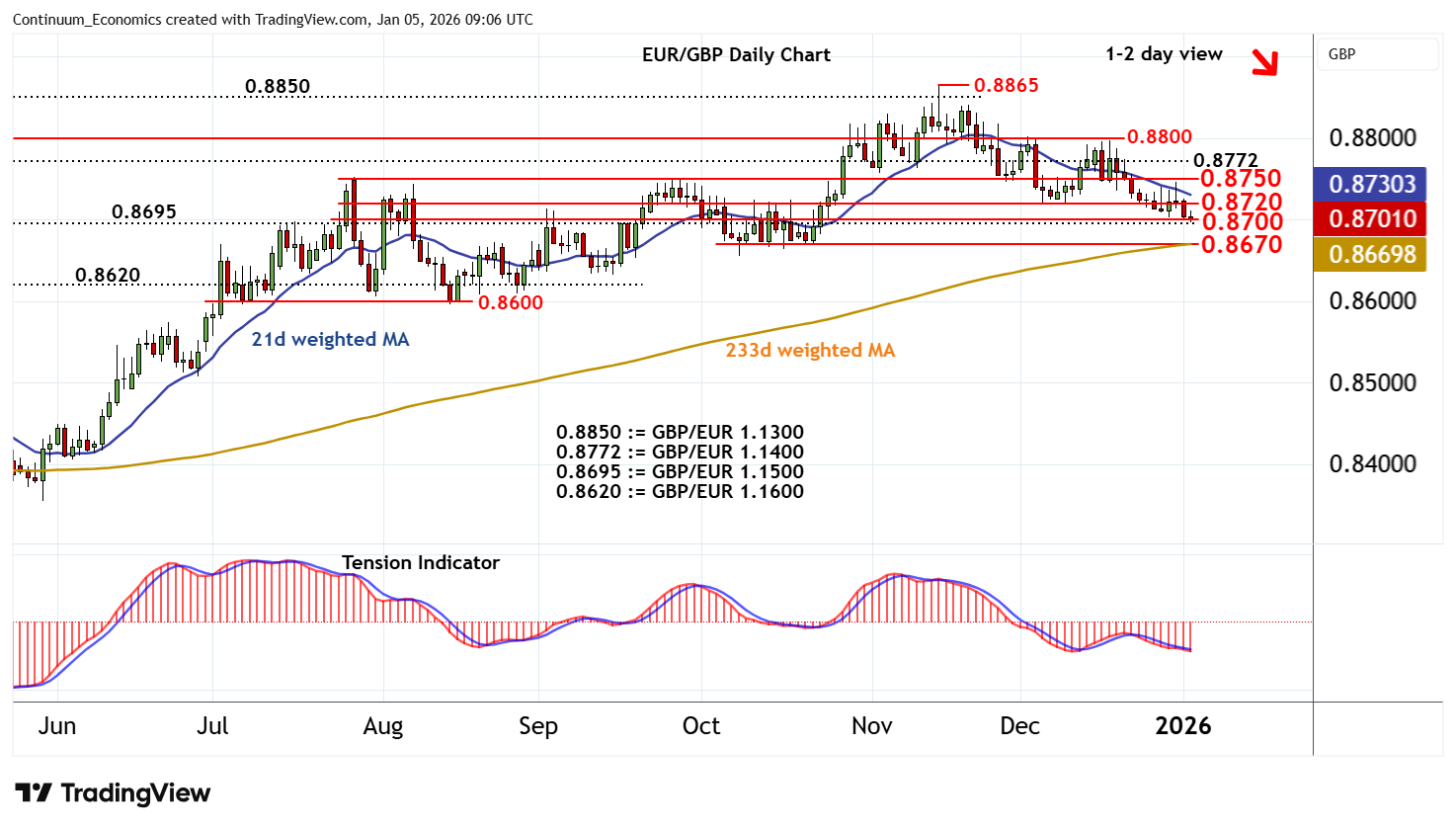

GBP strength is hard to trust

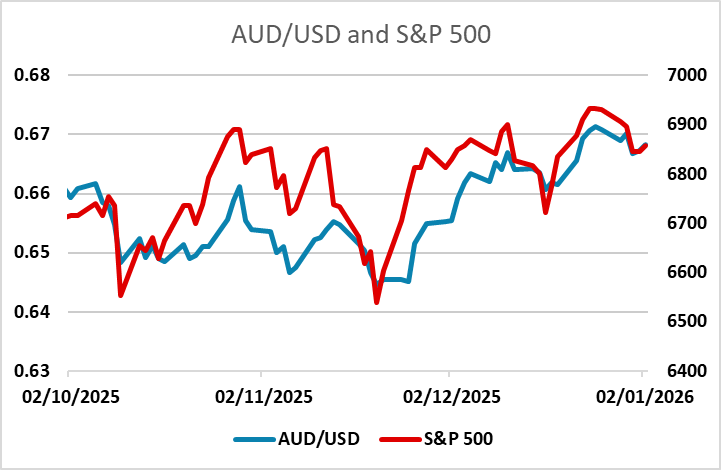

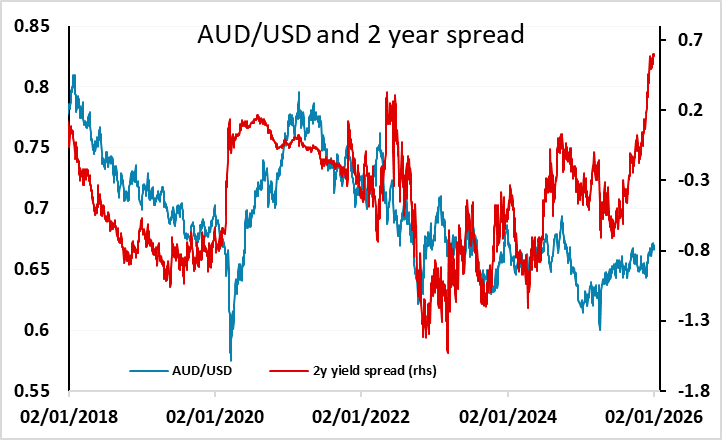

AUD gains well founded but may require more equity strength to extend

EUR data came in on the soft side, with German state CPIs showing a marginally larger decline in the y/y rate in December than expected, while a big downward revision in Italian services PMI led to a modest downward revision in Eurozone PMI. EUR/USD is a little weaker in response, with EUR yields also a tough softer, although there is still no significant expectation of any ECB easing being priced into the curve, with a cut by the end of the year seen as around a 15% chance..

The JPY managed a slightly firmer tone through Monday, helped by some hawkish comments from BoJ governor Ueda and higher Japanese yields while US and European yields sedged lower. Of course, yield spreads have been moving in the JPY’s favour for some time without any positive impact on the JPY, and at this point USD/JPY has still not broken out from the range of 155.50-1.5790 seen on the day of the last BoJ rate hike. It is hard for the JPY to gain ground in a risk positive environment in the absence of BoJ intervention, but we would still favour a JPY break to the upside. There remains huge potential for a JPY revaluation given the low starting point, and if we see momentum in JPY gains things can move very fast, as we have seen in previous JPY recoveries. A New Year could be a trigger, so we would be wary of holding JPY short positions here.

GBP was one of the best performers on Monday, seemingly helped by slightly stronger than expected money supply data, although there is little evidence that these numbers are supporting economic improvement or even rising inflation. The small dip below the 0.8670 level in EUR/GBP is potentially technically significant, but we don’t see sufficient rationale to favour any persistent GBP gains at this stage, so expect a bounce in EUR/GBP from these levels.

AUD also performed well in risk friendly conditions on Monday, and continues to look attractive on a yield spread basis, but has broadly been moving with the S&P in the last couple of months, so may struggle to make further gains unless the S&P can move to new highs. The strong equity performance on Monday was in part due to lower US yields, but there is limited scope for much decline from here, so AUD/USD may struggle to extend gains for now.