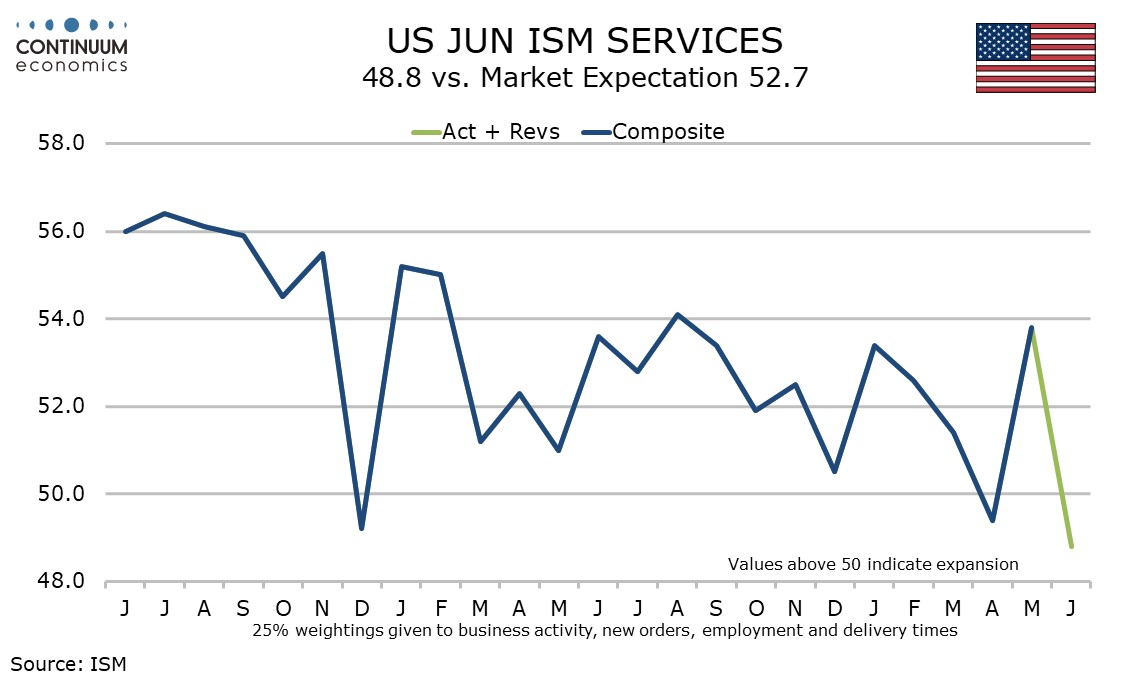

U.S. June ISM Services - Negative reading contrasts strong S&P Services PMI

In a stark contrast to June’s S and P services index which at 55.3 improved on an unexpectedly strong May, June’s ISM services index has not only more than fully reversed an unexpected May improvement, in falling to 48.8 from 53.8, it is now back below neutral for the second time in three months.

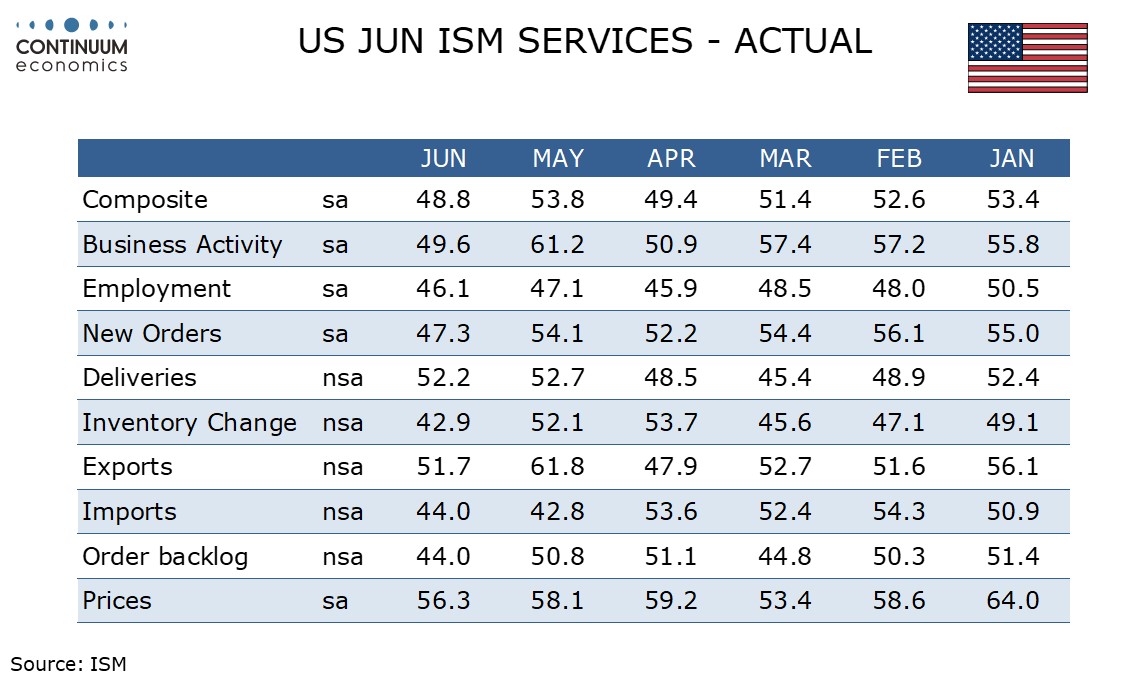

All four components of the composite fell, business activity sharply to 49.6 from May’s strong 61.2, while new orders fell to 47.3 from 54.1. Dips in employment to 46.1 from 47.1 and deliveries to 52.2 from 52.7 were more modest with employment while negative not far off recent trend.

Prices paid do not contribute to the composite about saw a modest slowing, to 56.3 from 58.1.

We are more inclined to believe the weak ISM data than the strong S and P PMI, given that services consumer spending has lost momentum in April and May. The strength in the S and P index may reflect optimism about Fed policy given recent inflation data rather than the state of the economy.