FX Daily Strategy: N America, June 25th

Canadian CPI the only data of note

Mild CAD downside risk

JPY approaching big levels, but period of consolidation seems likely

Canadian CPI the only data of note

Mild CAD downside risk

JPY approaching big levels, but period of consolidation seems likely

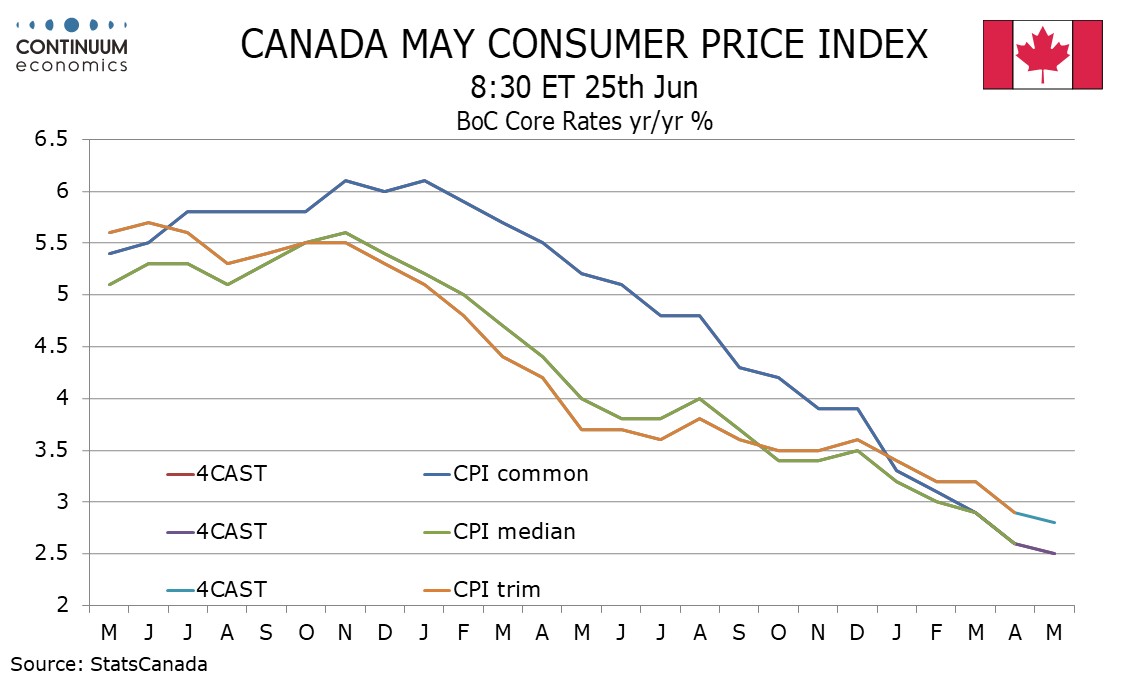

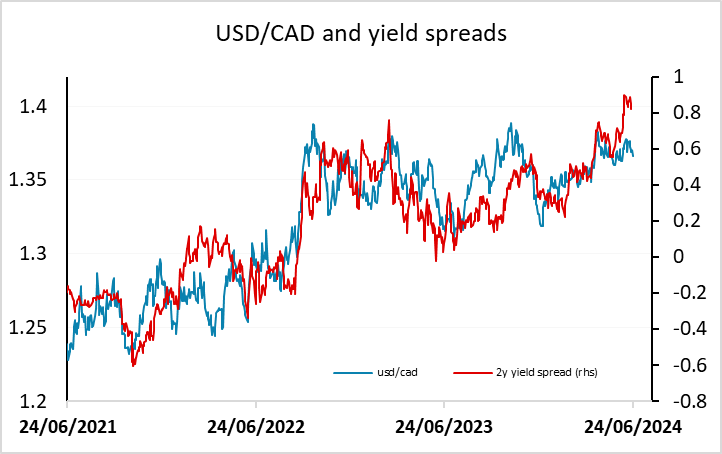

There is very little of note on Tuesday’s calendar, with Canadian CPI the most significant data. We expect May CPI to maintain downward progress, overall and in the BoC’s core rates, though less sharply than was the case in April. We expect overall CPI, and the average of the BoC’s three core rates, to slip to 2.6% yr/yr from 2.7%, which would be the lowest overall CPI since March 2021. We expect the core rates to also fall by 0.1% from their April paces. Our forecasts are broadly in line with consensus so we wouldn’t expect much market reaction. However, the risks look to be to the CAD’s downside, with USD/CAD having outperformed yield spreads in the last couple of weeks.

Otherwise there is very little to focus on, with the JPY as usual offering the most scope for volatility. There were renewed warnings from Japanese officials on Monday about the possibility of intervention, and there was a brief sharp decline in USD/JPY in the late European morning, although this doesn’t look to have been due to any official action, but rather due to squaring of some nervous short JPY positions. Nevertheless, there are still some important targets on the JPY downside, with 160 and the 38 year high at 160.03 in USD/JPY and the 32 year high of 171.42 in EUR/JPY, both of which were hit before the intervention on April 29. There is no obvious trigger for these to be broken on Tuesday, and if they were, with little fundamental support, there is a big risk of BoJ reaction. We would therefore expect some neutral consolidation in the JPY as well as elsewhere.