EUR, JPY: Steady trading in quiet markets

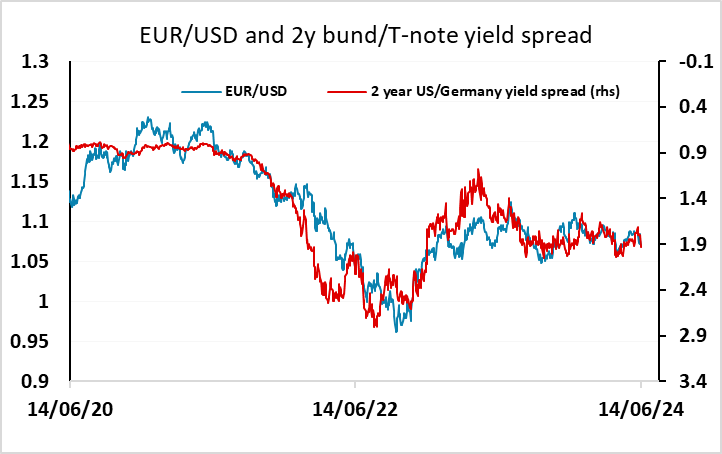

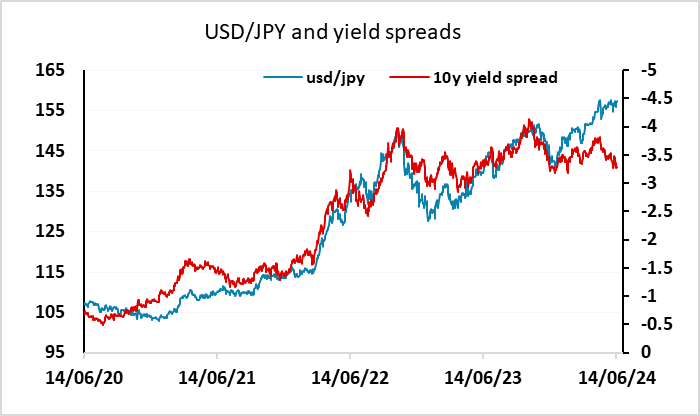

EUR awaiting more news on French elecitons, but holding steady for now. JPY awaiting trigger for singificant gains

Monday’s calendar is quiet as usual, and FX markets have been similarly quiet overnight. The Chinese data overnight was mixed, with retail sales stronger than expected but industrial production weaker, but the continuing decline in house prices maintains a negative perception of the property market.

In Europe, the focus remains on the French elections, and the latest poll at the weekend shows continued strong support for the right wing populist RN party. The Ifop poll shows them with 35% of the vote, which is the highest we have seen but is the same as the previous Ifop poll on June 10/11, so doesn’t change the underlying story. The market will stay on watch for any developments, but it seems unlikely there will be much clarity before we get the second round of votes on July 7.

USD/JPY continues to hover just below intervention territory in defiance of yield spread moves suggesting JPY gains and a more negative risk tone due to the French election uncertainty and some softer US data. Longer term it’s hard to see anything other than significant JPY gains, but while volatility is low we may see USD/JPY stay fairly steady.