FX Daily Strategy: N America, June 14th

BoJ the focus on Friday and surprised market again

Already plenty of reasons for JPY recovery, but increasingly hard to find a trigger

SEK vulnerable vs NOK unless CPI comes in strong

USD generally looks vulnerable if US outperformance fades

BoJ the focus on Friday and surprised market again

Already plenty of reasons for JPY recovery, but increasingly hard to find a trigger

SEK vulnerable vs NOK unless CPI comes in strong

USD generally looks vulnerable if US outperformance fades

The lack of any action by the BoJ has been the main trigger for FX action overnight, with the JPY falling back across the board as the market expresses disappointment at the failure of the BoJ to reduce their bind buying. 10y JGB yields dropped around 4bps in response, and USD/JPY moved above 158 for the first time since the BoJ intervention at the end of April.

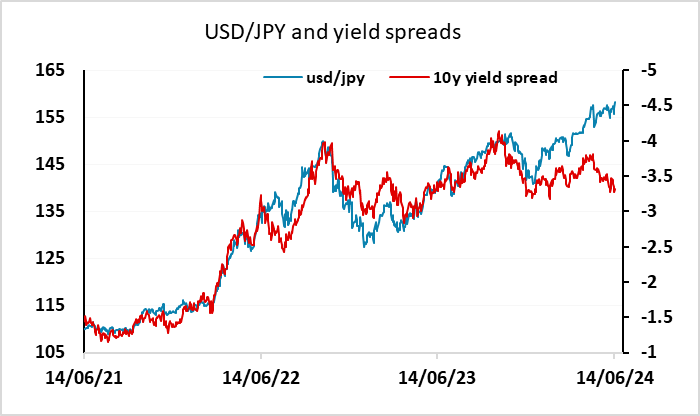

Even so, it’s hard to properly justify the JPY’s current weakness. While a knee-jerk negative response is to be expected after the lack of BoJ action, the decline in JGB yields only mirrors the decline in US yields seen in the last week or so, and the 10 year yield spread is close to the lows of the year. While rising US yields and rising yield spreads were closely correlated with USD/JPY gains from the end of the pandemic up to the beginning of this year, there has been little correlation this year, and since the beginning of May, USD/JPY has been rising while the yield spread has been falling. 158.28 is a key retracement level from the intervention inspired decline from above 160 to below 152, and we suspect that the BoJ may intervene again if we see any sustained move above this level.

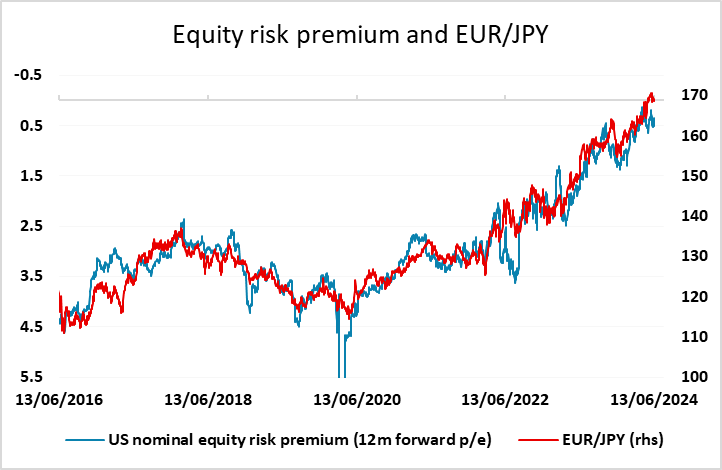

Nevertheless, given the lack of correlation between yield spreads and USD/JPY this year, it is getting harder to think of a trigger that will reverse the USD/JPY uptrend, given that the BoJ tightening in March failed to have a sustained impact. Historically, periods of JPY strength tend to be seen in periods of global economic weakness, and in particular periods of weakness in equity markets and rising equity risk premia. So we may have to wait for the US equity market to turn lower for a reversal in JPY strength, although the first Fed rate cut could also be a trigger. But the extreme weak level of the JPY and the likelihood of BoJ intervention if we see further USD/JPY gains still makes us see much more downside than upside risk.

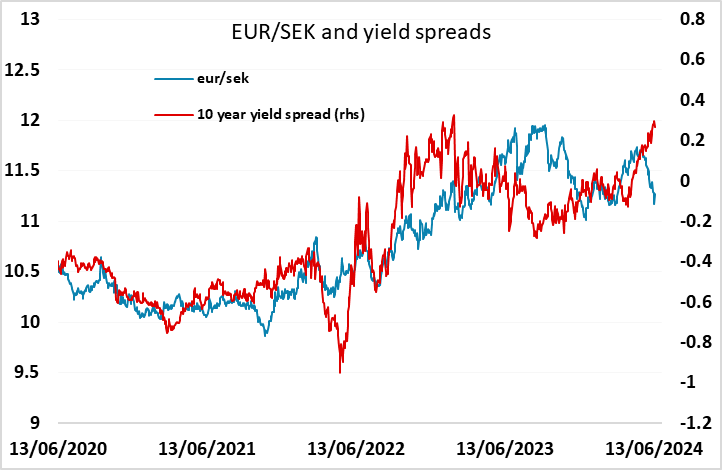

Swedish April CPI has come in somewhat above market consensus, at 3.7% y/y headline and 2.3% y/y core. While EUR/SEK initially fell back on the news, it has quickly reversed those declines and is now higher on the day. EUR/SEK has been soft through the last couple of weeks, significantly outperforming the yield spread correlation, helped by the negative EUR sentiment that emerged after the European elections and the announcement of the French parliamentary elections at the weekend. So some correction was due and the firmer CPI provides a profit-taking opportunity. SEK still looks to be on the strong side against the EUR and particularly the NOK. While EUR/SEK may well hold at lower levels given Eurozone political concerns, the case for NOK/SEK to hold below parity looks much weaker.

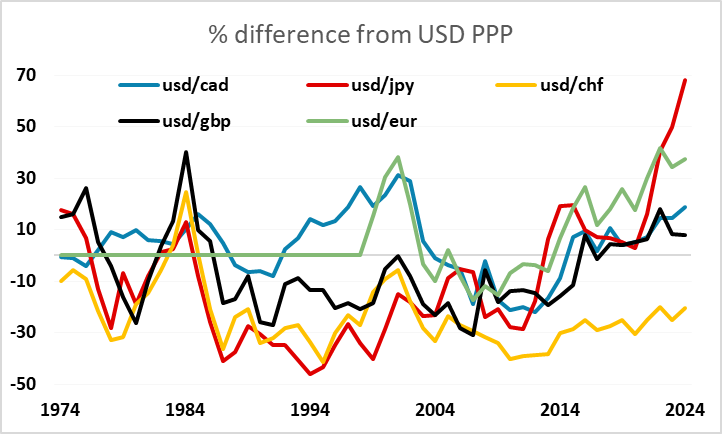

USD strength in general continues to look a little fragile after the softer than expected CPI and PPI data and the higher jobless claims data seen in the last few days. While there may be limited enthusiasm for the EUR due to the current political uncertainties, the USD remains at generally elevated levels that will be hard to justify if US growth numbers stop outperforming those elsewhere.