FX Daily Strategy: N America, June 13th

US PPI unlikely to have a big impact

Stronger employment data see muted impact on the Aussie

Scandi strength against the EUR reflects political uncertainty, NOK preferred

Market on watch for pre-BoJ leaks

US PPI unlikely to have a big impact

Stronger employment data see muted impact on the Aussie

Scandi strength against the EUR reflects political uncertainty, NOK preferred

Market on watch for pre-BoJ leaks

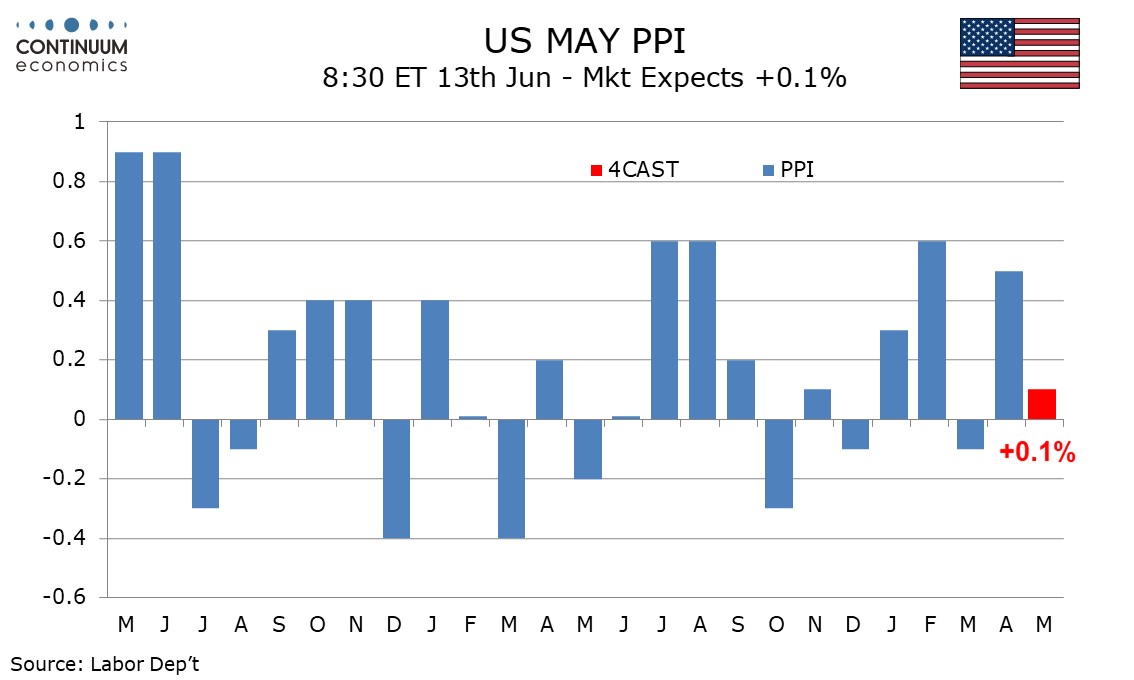

After the US CPI data and the FOMC meeting, it’s unlikely that the PPI data on Thursday will have any additional impact even though we have seen some unusually large reactions to PPI data in recent months. We expect a 0.1% increase in May’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. This would follow above trend April data, meaning that should May not produce the subdued data we expect, it would be cause for concern. But the market reaction should be muted given that we have already had the CPI and FOMC.

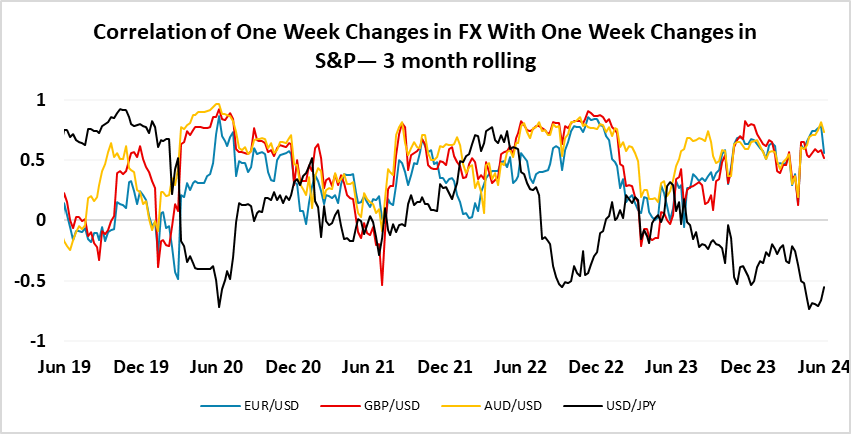

USD weakness post-CPI was most pronounced against the AUD and scandis, helped by the positive impact of lower yields on equities. AUD/USD correlation with equities remain very strong, and is likely to continue to be strong as long as equities are being driven primarily by fluctuations in US yields. However, there was Australian data in the shape of Australian employment this morning, which showed another performance in May. The unemployment rate dropped to 4% from 4.1% and headline employment change beats with strong gains in full time employment. Participation rate is also 0.1% higher than April. This continues to point out that while the peak has passed, the overall health of the labor market in Australia remain healthy, which maybe a problem for the RBA if they prefer early easing, though it is unlikely.

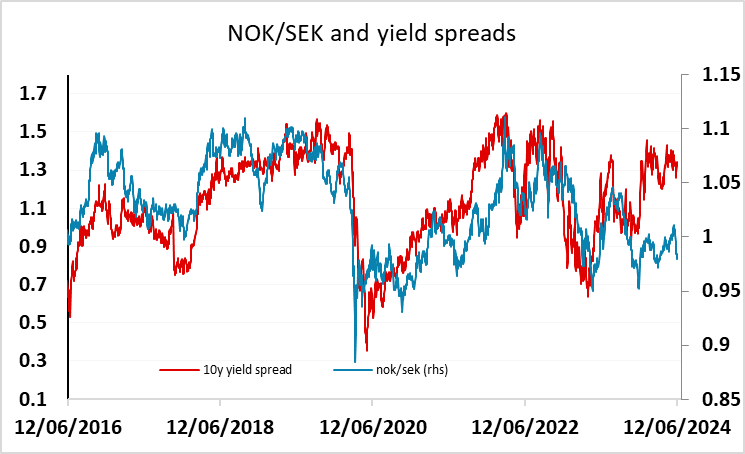

Scandi strength on Thursday reflects the combination of lower US yields, strong equities and a general reluctance to hold EUR in the wake of the European election and the French election announcement. However, SEK gains are now looking a little overdone, especially against the NOK, while EUR/NOK is closer to its historical correlation with yield spreads than it has been at any point this year. While political uncertainty continues to undermine the EUR the scandis may well be preferred, but the NOK looks the more attractive at these levels.

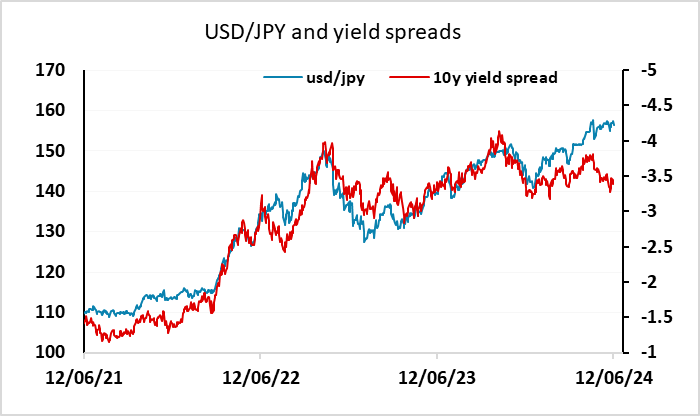

Other than the Australian data and the US PPI (and weekly US jobless claims data) there isn’t much on Thursday’s calendar to move markets. The market will however be on watch for any comments out of Japan ahead of Friday’s BoJ meeting. As it stands, the market is expecting an announcement of a reduction in bond buying of around JPY1trn, but no change in the policy rate. We see a larger risk of a policy rate hike than is priced in, with the market seeing only a 10% chance of a move this month and a 60% chance in July. The BoJ has surprised the market a couple of times in the recent past, and in the latest comment from Ueda, he mentioned that "If underlying inflation moves as we project, we will adjust the degree of monetary support" and "As we move towards exit from massive monetary stimulus, it would be appropriate to reduce bond purchases”. This suggests that rate hikes and bond purchase reduction are in BoJ's consideration, echoed by comments from Nakamura, a known dove, this week. However, if we don’t see any rumours of a rate hike on Thursday, the chances of a move are reduced.