FX Daily Strategy: N America, June 12th

USD focus on CPI and FOMC

Fed expected to be more hawkish, but USD reaction depends on how much

EUR/CHF may remain biased lower if France/Germany spreads continue to widen

GBP steady after April GDP

USD focus on CPI and FOMC

Fed expected to be more hawkish, but USD reaction depends on how much

EUR/CHF may remain biased lower if France/Germany spreads continue to widen

GBP steady after April GDP

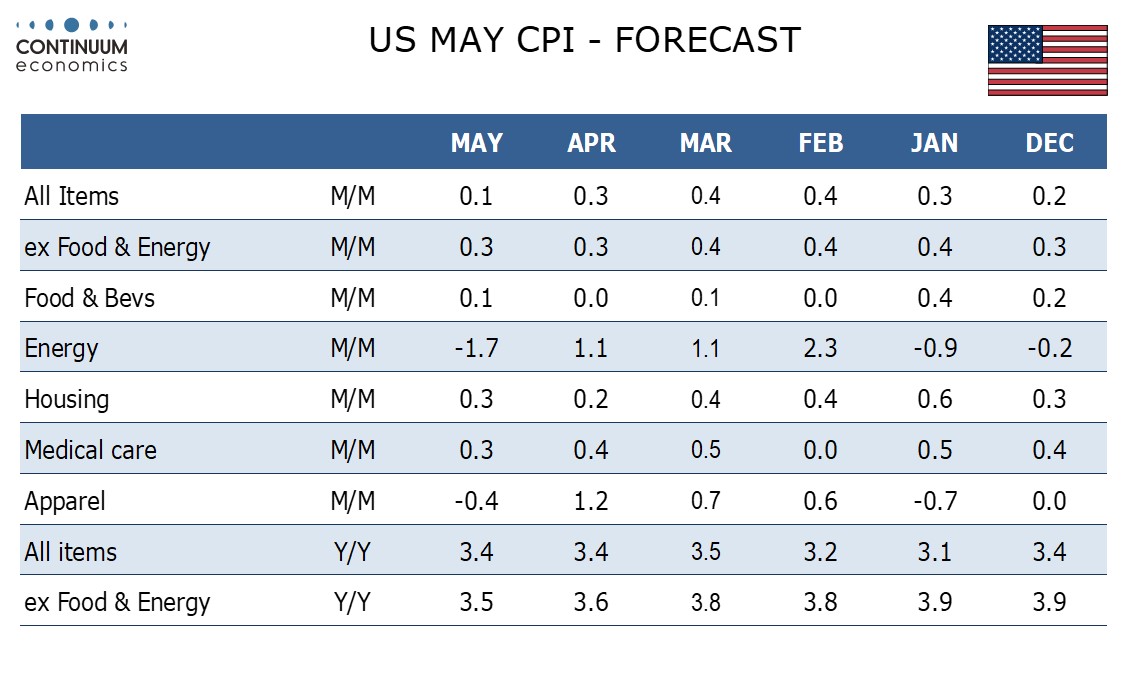

Wednesday sees both US May CPI data and the FOMC meeting, which both have potential to have a significant impact. We expect May CPI to rise by 0.1% overall, which would be the slowest since October 2023, but with a second straight 0.3% increase ex food and energy, to follow three straight gains of 0.4% during Q1. Before rounding we expect the core rate to be very close to 0.3% but the headline to be on the firm side of 0.1%. Our forecast is in line with consensus, so would be unlikely to have any major market impact, and while the data risks may be on the high side, the market risk may be towards a weaker USD as it will be hard to price in much less easing than the market currently has.

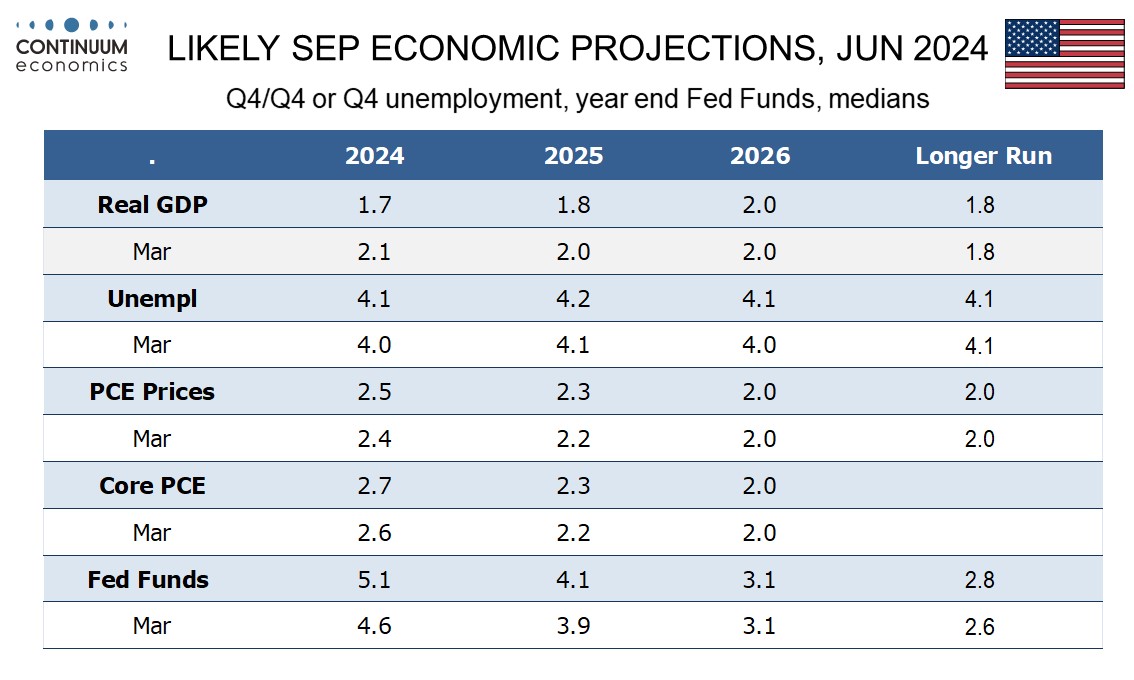

The FOMC looks sure to leave the target range unchanged at 5.25%-5.50%. The tone of the statement may be influenced by the May CPI, but even if CPI surprises on the downside is unlikely to give any hints easing is close. We suspect the dots will be more hawkish, which could be the focus of the initial reaction, but Chairman Jerome Powell at his press conference may downplay the significance of any hawkish dots. After the strong May non-farm payroll data, even after a downward revision to Q1 GDP the FOMC is unlikely to adjust its May 1 view that economic activity continues to expand at a solid pace, with job gains remaining strong and the unemployment rate low. Whether they fine tune the hawkish addition to May’s statement that saw a lack of further progress in recent months toward the Committee’s 2% inflation objective will depend on the CPI, but even with a downside surprise any fine tuning is likely to be cautious. The FOMC is likely to repeat that it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. The market is no doubt ready for a hawkish shift in the dots, as the median from March was for three cuts this year. The market I currently pricing one and a half, so the market reaction may well hinge on whether the median indicates one or two cuts. The USD would likely fall modestly if the median is for two cuts, but rise strongly if the median only shows one cut.

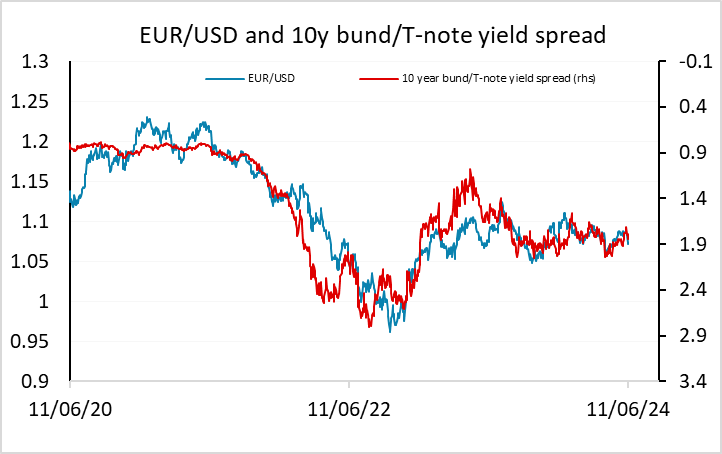

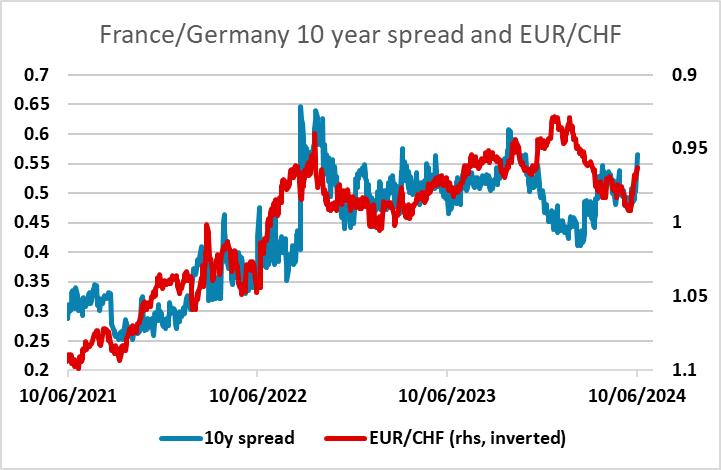

So far this week the USD has been firm against the EUR in particular as the market has become concerned about the European political picture following the right wing gains in the European elections and the surprise parliamentary election called by Macron in France. But yield spreads don’t currently support USD gains, and we are approaching a significant support area at 1.0675-1.0720. If the median of the dots indicates two cuts this year, this area is likely to hold and we would likely see a EUR/USD bounce to 1.0750 and above. However, as long as the yield spread widening between France and Germany remains, the EUR may remain under some pressure on the crosses. EUR/CHF historically responds to such spread movements, and a move up to 6bps could see EUR/CHF slip sub-0.95.

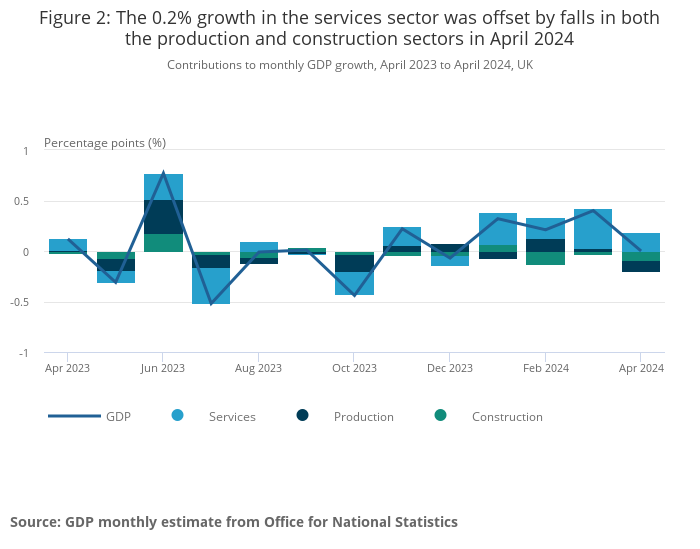

UK April GDP came in in line with expectations at flat on the month, with a 0.2% rise in services and strength in utilities and mining offsetting weakness in manufacturing (-1.4% m/m) and construction (also -1.4% m/m). On a 3m/3m basis growth still looks quite healthy at 0.7%, and the flat month after a 0.4% rise in March will not be a real concern, although the weakness in manufacturing and construction might be an issue if it were to be repeated in coming months.

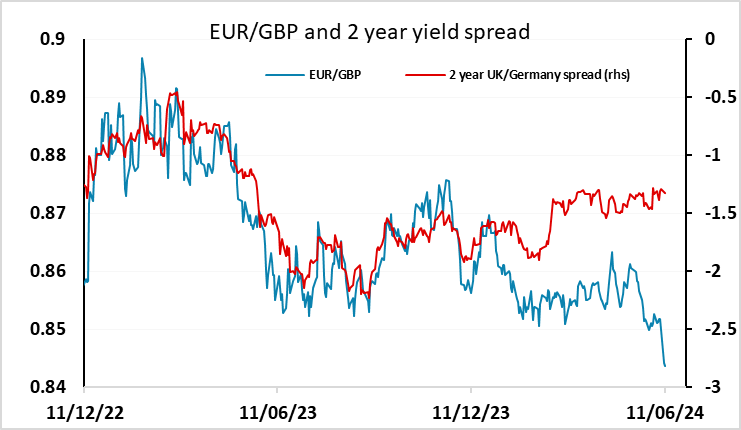

GBP is little changed after the data, with EUR/GBP still pressing recent lows on the back of general EUR weakness that has followed the announcement of the French election. We still doubt that this pressure will be sustained unless there is evidence of weakness in the Eurozone economy, but it might require weaker UK CPI data next week if EUR/GBP is to return towards 0.85.