GBP flows: GBP slighty weaker after labour market data

GBP slips a little as claimant count rises and HMRC data shows weakening earnings growth

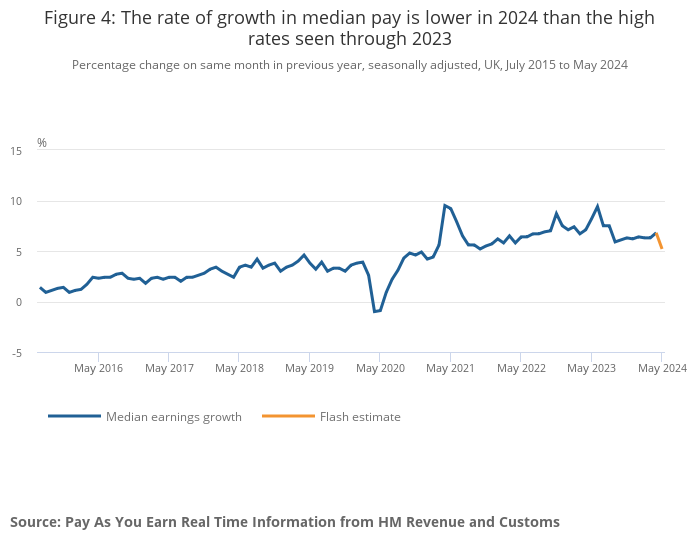

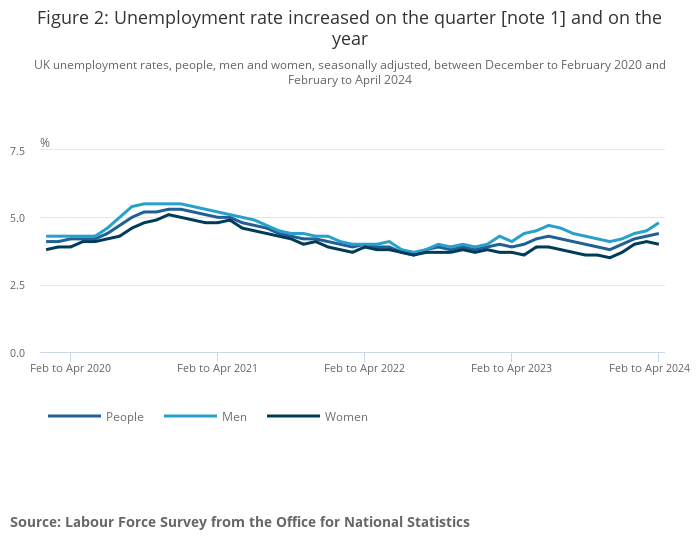

UK labour market data is generally on the weak side, and GBP is slipping a little lower in response. Although the official ONS average earnings data shows a higher than expected growth rate of 5.9% y/y in the 3 months to April, the more up to data HMRC payroll data shows a decline in the y/y rate of growth to 5.2% in May. The employment measures are on the weak side, with a sharp rise in the May claimant count of 50.4k, the largest since February 2021, and a drop in employment of 140k in the 3 months to April on the ONS measure and a small 3k drop in the HMRC measure in May.

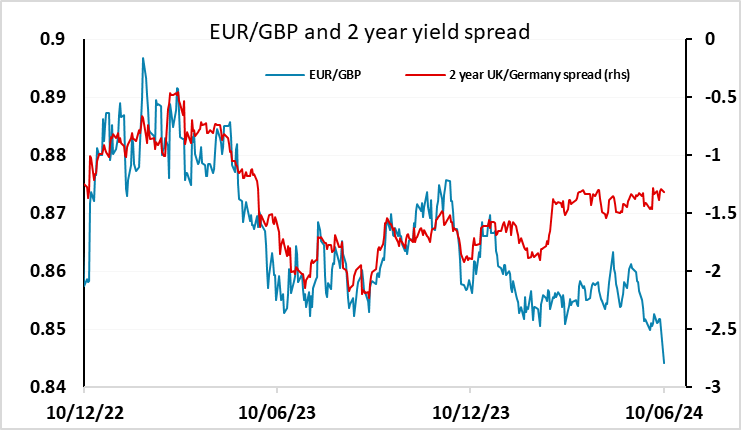

The data is nevertheless not weak enough to convince the BoE MPC to cut rates this month, after the slightly disappointing April CPI data. Although we have the May CPI data released next week just before the BoE meeting which could change sentiment, it is unlikely to be sufficiently weak to alter the June decision. However, today’s weak labour market data increases the chance of an August rate cut, which is currently priced as a less than 40% chance. EUR/GBP already looks a little low relative to yield spreads, and has dipped this week after the French election announcement as the EUR came under general pressure. But we doubt this will have a sustained impact, and see scope for a move up towards 0.85.