FX Daily Strategy: Asia, June 11th

Market awaiting FOMC

GBP risks on the downside on UK labour market data

CHF strength may extend…

…but JPY remains much better value

Market awaiting FOMC

GBP risks on the downside on UK labour market data

CHF strength may extend…

…but JPY remains much better value

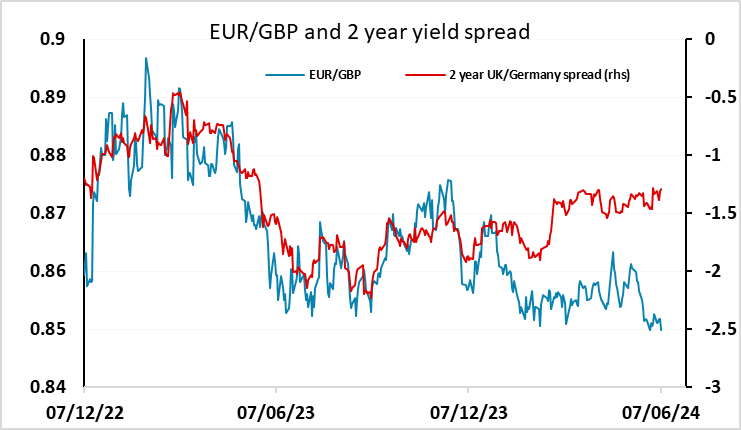

The FOMC meeting is the main event of the week, and the meeting starts on Tuesday, but the result won’t be announced until Wednesday so the market will need to find alternative stimuli before the Fed announcement. Tuesday sees UK labour market data, with the focus as usual more on the average earnings data than the employment data. But there has been broad evidence of softening in the labour market numbers in recent months, and more evidence in this direction would keep hopes of an August rate cut from the BoE alive. As it stands, an August cut is only priced as around a 35% chance, and GBP has moved higher against the EUR in the wake of the ECB cut as UK rate cut hopes have receded. EUR/GBP has also been pressured lower by the announcement of the French election, but this seems unlikely to have a sustained impact. The risks look to be towards a UK August rate cut getting more rather than less priced in on the back of the employment data, so EUR/GBP risks should be on the upside.

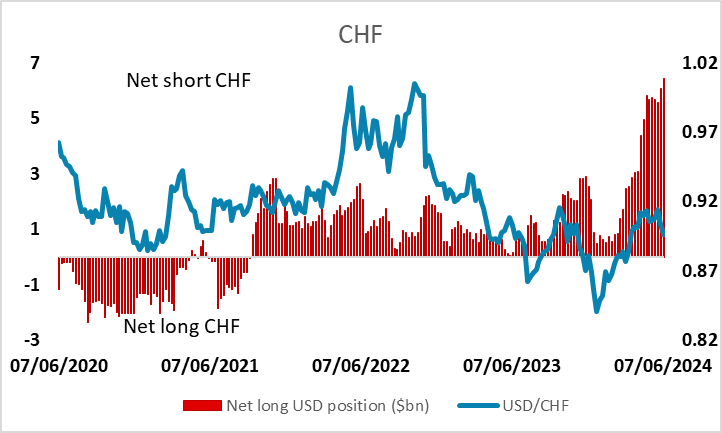

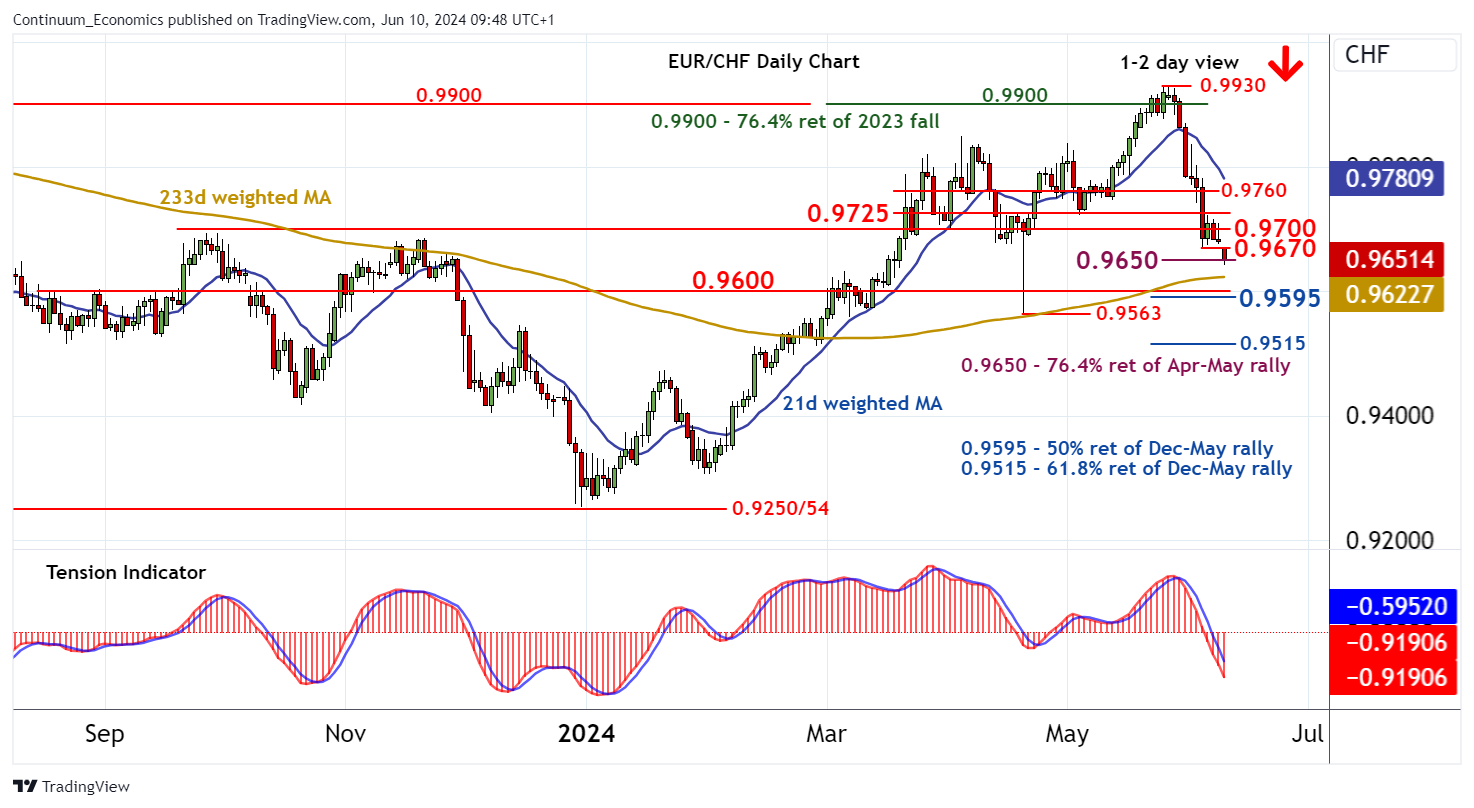

The EUR was generally soft in response to the French election news on Monday, falling back against the JPY and CHF as well as GBP. Declines against the safe havens may make more sense than declines against GBP, with yield spreads likely to move against the EUR against the safe havens in the coming months. The CHF also usually benefits from any widening in intra-Eurozone spreads, and we have seen some of that after the European elections and the French election announcement. It is also notable that speculative positioning is extremely short CHF according to the CFTC data, which suggests EUR/CHF is vulnerable to further declines if support at 0.9620 breaks.

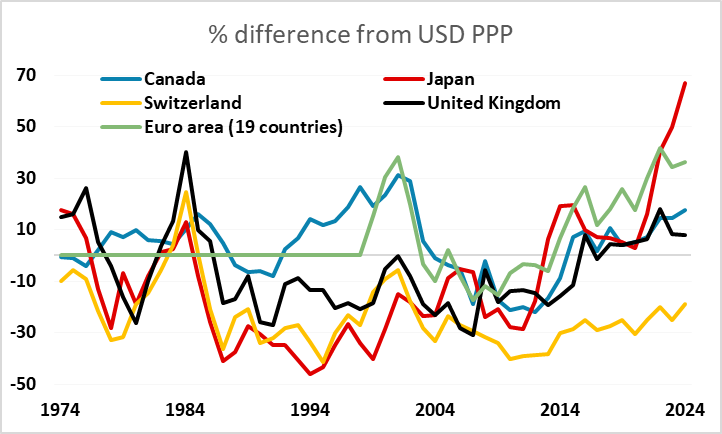

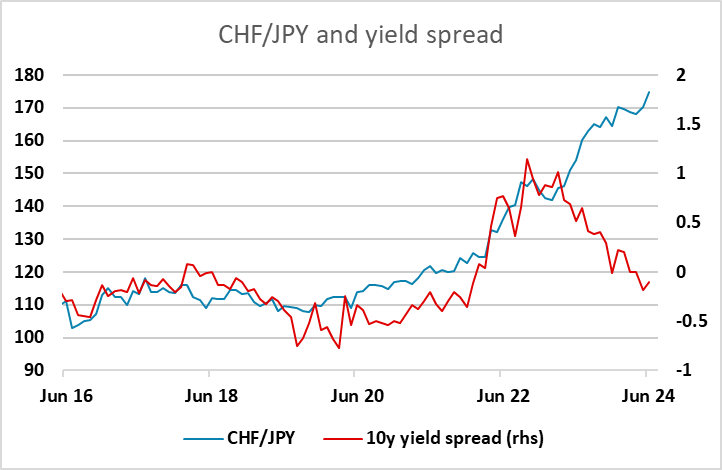

However, while the CHF may benefit from some European political uncertainty, it continues to look overextended relative to the JPY, with CHF/JPY hitting a new all time high on Monday. This is more about JPY weakness than CHF strength, with the JPY hugely undervalued against all the major currencies, but the valuation issue is more obvious against the CHF as similar Swiss and Japanese inflation rates mean the nominal exchange rate has moved closely with the real exchange rate. This week’s BoJ meeting on Friday is not generally expected to produce any change in policy, but there are some hawkish voices and we suspect the market is underestimating the risks of another surprise BoJ move. In any case, the JPY continues to represent obvious long term value at these levels.

The USD made general gains after the employment report on Friday, and looks set to hang on to most of them into the FOMC meeting. The AUD may have better prospects for recovery than European currencies, as sentiment towards China has improved on late. The NAB business survey on Tuesday could trigger a move back above 0.66 if it shows sentiment improving.