FX Daily Strategy: North America, June 6th

ECB rate cut essentially fully priced in

EUR/USD focus on the prospects for further cuts, but some upside bias

Claims trend will garner some attention

JPY weakness looking ever more out of line with spreads

ECB rate cut essentially fully priced in

EUR/USD focus on the prospects for further cuts, but some upside bias

Claims trend will garner some attention

JPY weakness looking ever more out of line with spreads

Thursday is dominated by the ECB monetary policy meeting. While the Bank of Canada have beaten the ECB to the punch as the first G7 central bank to cut rates, there is little doubt that he ECB will follow suit. This is 96% priced in coming into the meeting, so the EUR cane be expected to move significantly on the basis of a 25bp rate cut. The question markets are considering is what subsequent moves will follow this widely expected 25 bp cut. Given splits within the ECB Council no formal guidance is likely at the press conference, save to underline that policy will be data dependent and independent of the likes of the Fed. But updated ECB forecasts are likely to corroborate market thinking of an ECB depo rate falling well below 3%, if not lower if an earlier and more sizeable undershoot of the inflation target is flagged. This would chime with ECB Chief Economist Lane’s thinking that inflation moving durably to target as expected in 2025 would allow policy to veer away from restrictiveness and thus toward a neutral setting of circa-2%!

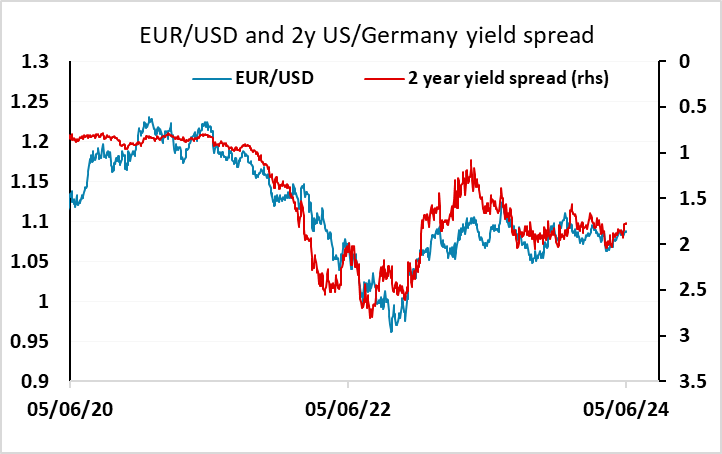

Currently, the market is pricing a policy rate of 2.63% at the end of 2025, and after the slightly stronger than expected provisional May CPI data and the new low in the unemployment rate announced last week, we doubt the market will push towards lower yields without some explicit guidance. Even so, the risks for this year look to be on the low side of the current pricing of between one and two further rate cuts, so we don’t see a case for EUR strength based on ECB policy. But yields spreads are already at levels that look supportive for EUR/USD, so we see pressure likely to be on the top rather than the bottom of the 1.08-1.09 range ahead of the US employment report.

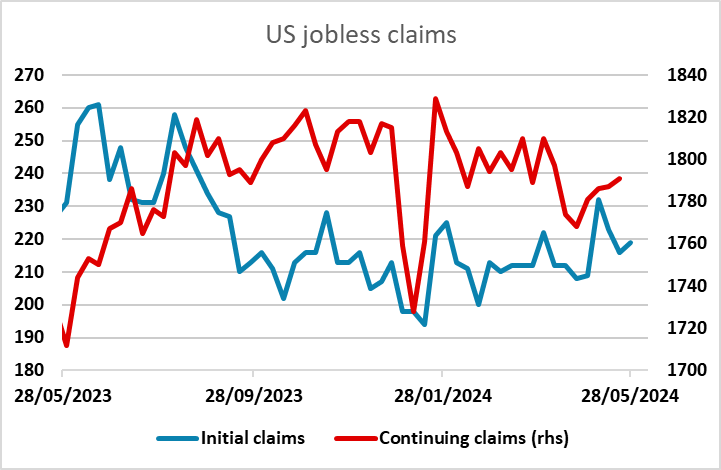

Otherwise, there will be the usual interest in the US jobless claims data, perhaps more than usual given that the employment report is on Friday, but the claims data don’t relate to the employment report survey week. Even so, there has been a slightly pick-up in the underlying trend in recent weeks, and the market may be sensitive to any further evidence of rising claims.

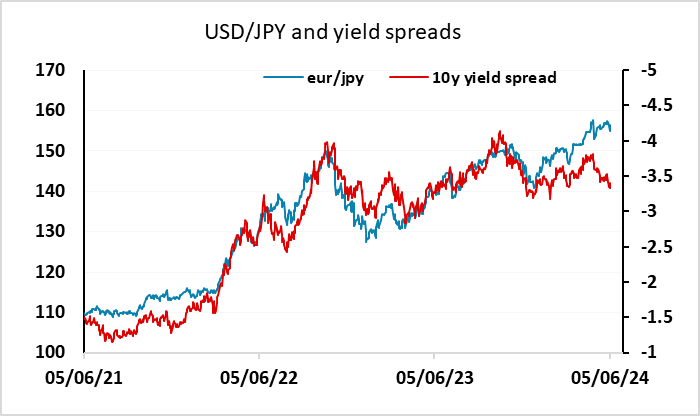

Wednesday saw general weakness in the JPY reversing the majority of the sharp gains on Tuesday, while other pairs were not much changed except for some further gains in the SEK, particularly against the NOK. The JPY’s weakness made some sense as a reaction to the ISM services data, but with US yields not moving significantly in response to the data, yield spreads now look even more out of line with the current level of USD/JPY, and the risks to the downside still dominate.