FX Daily Strategy: N America, June 5th

ISM services the focus after recovery in S&P services PMI

USD may manage a small bounce but upside limited, especially against the JPY

Modest downside risks for the CAD on BoC

NOK sell off likely to reverse

ISM services the focus after recovery in S&P services PMI

USD may manage a small bounce but upside limited, especially against the JPY

Modest downside risks for the CAD on BoC

NOK sell off likely to reverse

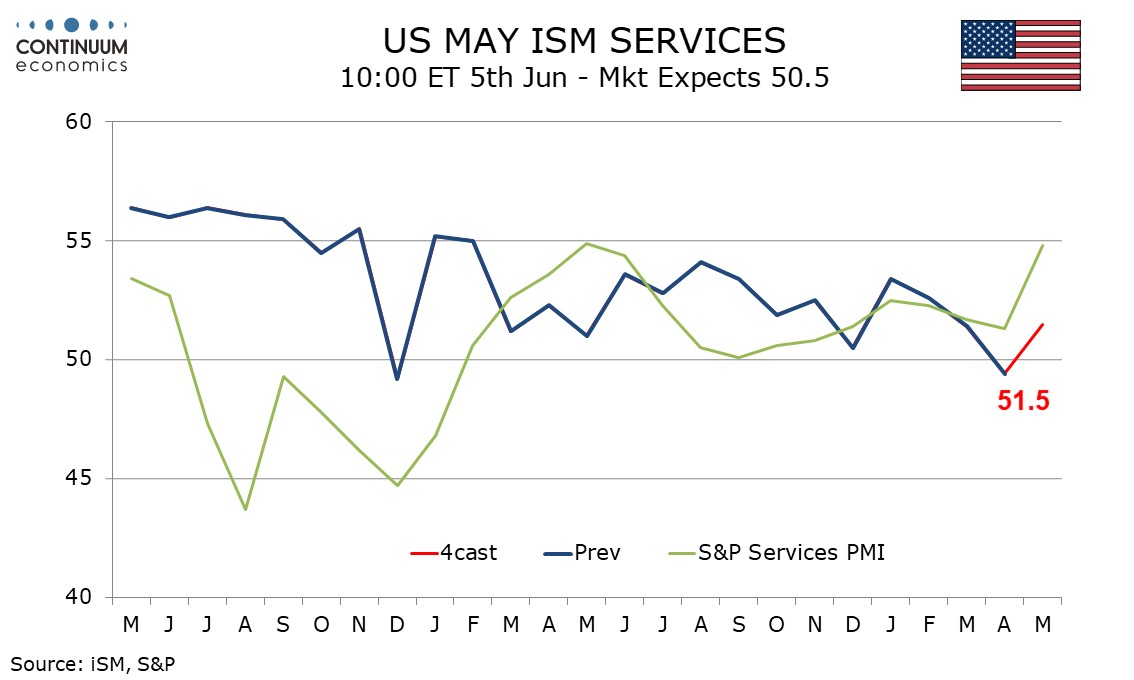

The ISM services index is the main data focus on Wednesday. The significance of the survey has increased after the weaker ISM manufacturing survey on Monday, the weak reading in April, and the stronger than expected preliminary S&P PMI services index released at the end of May. The final version of this is also released on Wednesday. We expect May’s ISM services index to recover to 51.5, after a fall below neutral to 49.4 in April saw the weakest reading since December 2022. May’s index would be back near March’s level of 51.4. The S&P services index saw a surprisingly sharp bounce in May after four straight declines to reach its highest level in twelve months at 54.8. But the S&P index is not a reliable guide to the ISM and most regional Fed service surveys, while on balance improved, are still quite subdued. Our forecasts is modestly above the market consensus of 51.0, but both our forecast and the market consensus would be consistent with the slow but steady downtrend seen in the last couple of years.

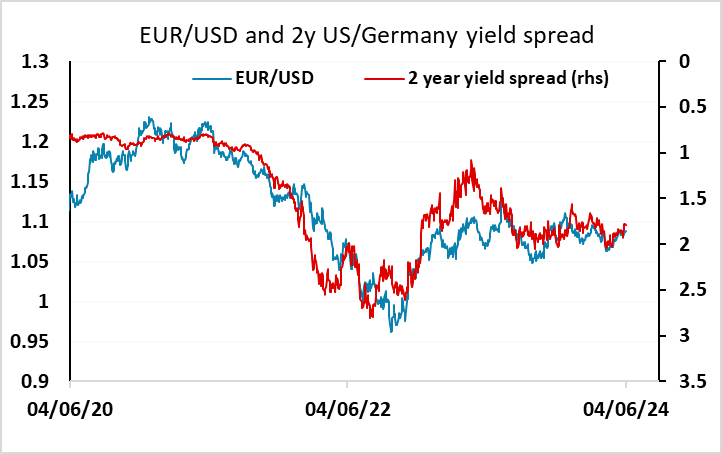

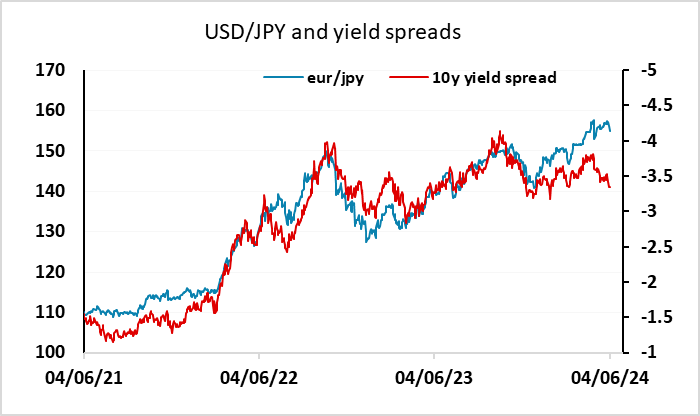

For the USD, our forecast would no doubt trigger a small rally as it is slightly above the consensus. But the underlying story is still one of a slowing US economy, so we wouldn’t expect any USD rally to be particularly strong. The rise in the USD on Tuesday against the riskier currencies was based on risk negative sentiment rather than any intrinsically USD positive story, and if we see a stabilisation in sentiment yield spreads suggest scope for the EUR to rally modestly, although the 1.08-1.09 range should hold into Thursday’s ECB meeting. For USD/JPY, yield spreads still suggest plenty of downside risk, with scope to 150 and below. Technically, a break below the 154 area could trigger a sharp move.

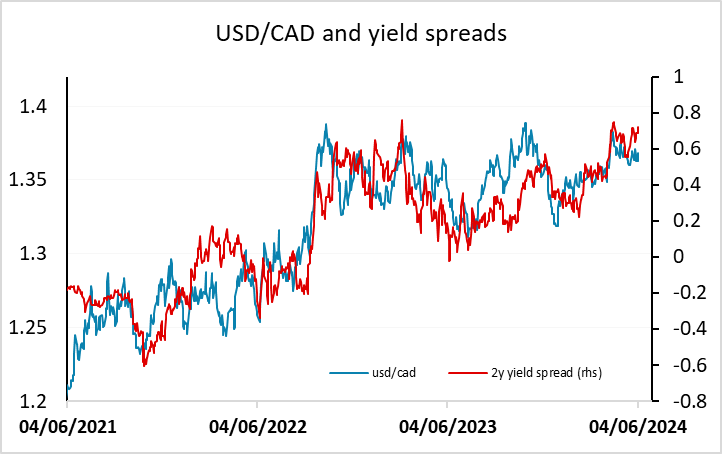

The other big focus in the BoC policy meeting. A BoC rate cut is not quite fully priced, with a cut seen as just an 80% probability, but the weaker than expected Q1 GDP data did shift market expectations in favour of a cut. While we have been calling for a cut for some time, we don’t see the GDP data as making a great deal of difference, as the details were stronger than the headline, with domestic demand picking up markedly and the weakness due to a lower inventory build. The delivery of a rate cut has only modest scope to boost USD/CAD, and a sustained break above 1.37 still looks likely to be out of reach unless the US employment numbers prove a lot stronger than expected.

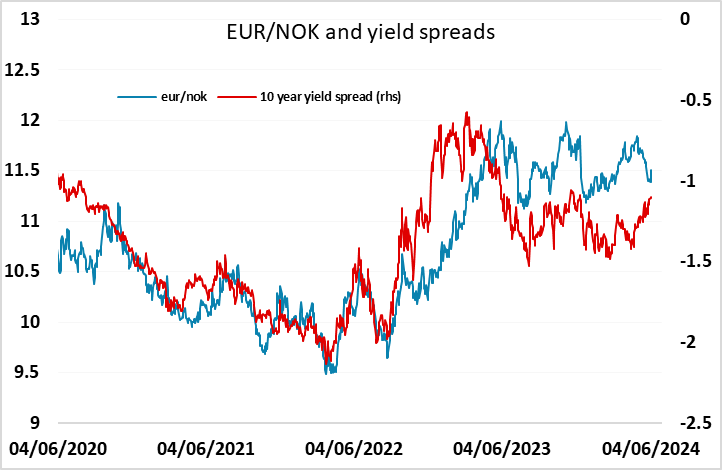

The CHF and the JPY were the best performers on Tuesday, reflecting the risk negative market tone, while the riskier currencies all fell back. The NOK was the worst performer, with EUR/NOK rising 1% and CHF/NOK up nearly 2%. This all looks like an unwinding of carry trades. From a fundamental value perspective, there is much less case for CHF strength and NOK weakness than there is for JPY strength and USD weakness, and we wouldn’t expect NOK weakness to extend. At these levels, EUR/NOK looks too high and NOK/SEK too low.