FX Weekly Strategy: Europe, May 27th-31st

CPI data at the end of the week limits early week volatility

Still scope for some action in USD/JPY in particular

CHF remains vulnerable, NOK may represent the best carry trade

GBP has potential to rise on declining risk premium

Strategy for the week ahead

CPI data at the end of the week limits early week volatility

Still scope for some action in USD/JPY in particular

CHF remains vulnerable, NOK may represent the best carry trade

GBP has potential to rise on declining risk premium

It looks like a relatively quiet week with the main data being the preliminary May Eurozone CPI data, the US April PCE data and the May Tokyo CPI data, all of which come out on Friday. There isn’t much on the calendar before then, and the US and UK are on holiday on Monday, so we wouldn’t expect a lot of volatility in the early part of the week.

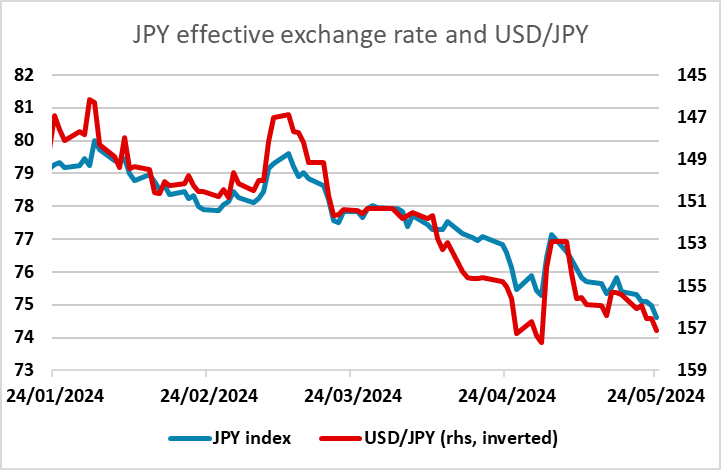

Nevertheless, there is still the possibility of action from the Japanese authorities on the weak JPY. The JPY has fallen further on a trade-weighted basis since they intervened in late April/early May, so even though the USD/JPY intervention level may have been nearer 158 than 157, action should not be ruled out. Indeed, there is no guarantee that the BoJ will act at the same levels as before. To do so would be too predictable and they will not want to be drawn in to defending a specific level. The US and UK holiday might even be seen as an opportunity to take advantage of thin markets.

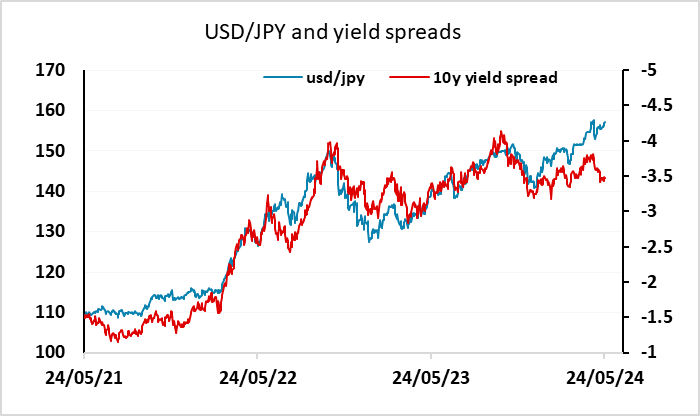

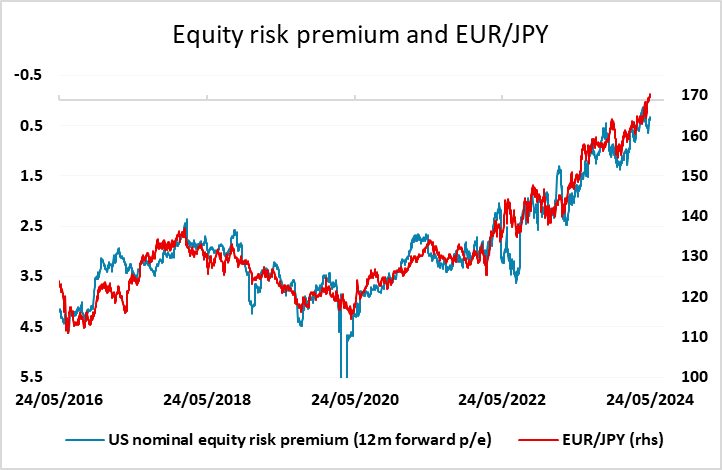

A sustained recovery in the JPY will still depend on underlying moves in yields and risk premia. However, yield spreads have already moved in the JPY’s favour, and support a significant decline in USD/JPY, while EUR/JPY has exceeded the levels suggested by the correlation with equity risk premia that has held in recent years. In a quiet week, there will be a temptation to load up on carry trades, but JPY shorts are becoming increasingly risky at these levels.

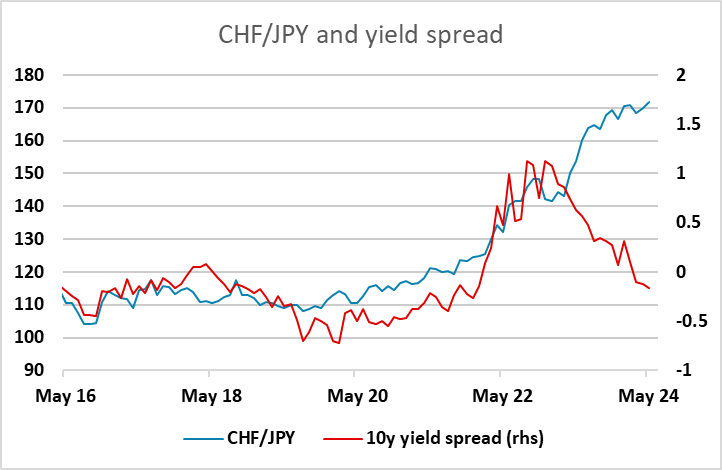

The CHF looks a more attractive funding currency for carry traders, having appreciated dramatically in recent years. In fact, the CHF has been fairly steady in real terms against the EUR due to the low Swiss inflation rate, so gains are most obvious against the JPY, given the similar inflation rates in Switzerland and Japan.

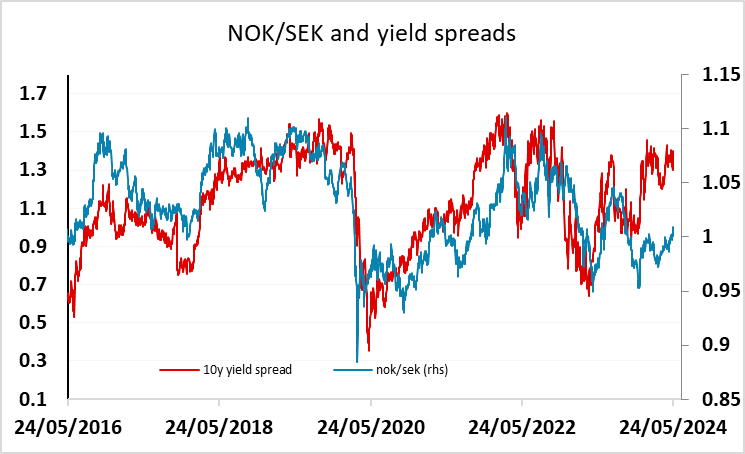

For those looking for carry, the NOK may represent the best value, having underperformed yield spreads against the EUR and SEK this year. However, there were some signs of recovery in the last week, with NOK/SEK now better established above parity and EUR/NOK hitting its lowest level since March.

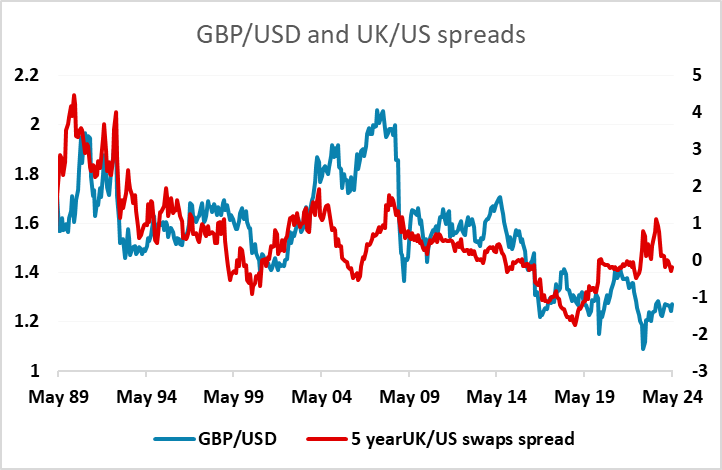

EUR/GBP tested the support area at 0.85 last week following the stronger than expected CPI data, with the chances of a June rate cut now seen as minimal. The UK election called for July 4 may also be seen as GBP positive, as a change of government could see an earlier UK rapprochement with the EU. GBP/USD still looks as if it includes a significant risk premium which has been in place since (at least) the short-lived Truss administration in late 2022, and this may be reduced if the markets see the UK election result as positive.

For EUR/USD, the picture looks relatively stable. The better than expected US PMI data last week undermined perceptions of a slowing US economy and halted the mild EUR uptrend seen over the last couple of weeks. But a more solid Eurozone economic picture still means that EUR/USD is unlikely to fall far from what are still quite depressed levels.

Data and events for the week ahead

USA

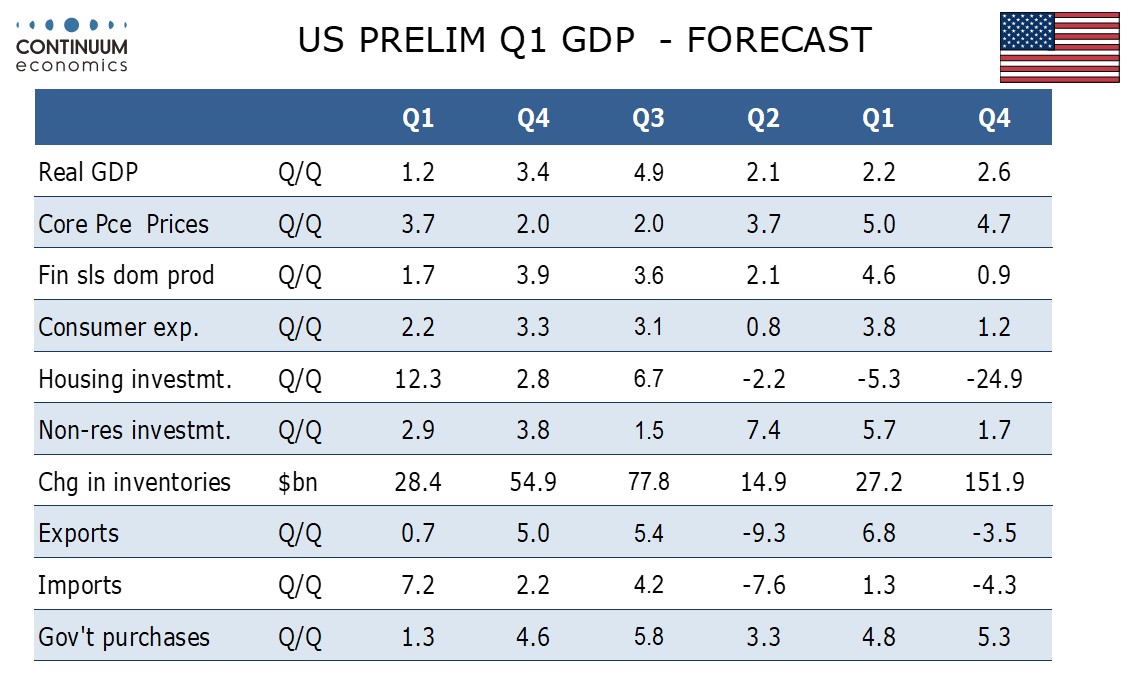

US markets are closed on Monday for Memorial Day. Tuesday sees March house price data from FHFA and S and P Case-Shiller, and May consumer confidence, for which Michigan CSI data hints at slippage. Fed’s Mester and Kashkari are due to speak on Tuesday. Wednesday sees no major data, but Fed’s Williams will speak and the Fed’s Beige Book is due. On Thursday we expect Q1 GDP to be revised down to 1.2% from 1.6%, and April’s advance goods deficit to increase to $93.0bn from $91.5bn. Weekly jobless claims are also due, with April pending home sales and Fed’s Logan following.

The most important release of the week will be Friday’s core PCE price index for April. It is a close call between 0.2% and 0.3% but we believe the change will be rounded down to 0.2% rather than, as was the case in the core CPI, rounded up to 0.3%. We also expect personal income to rise by a modest 0.2%, continuing to underperform spending where we expect an increase of 0.4%. Fed’s Bostic will speak on Friday.

Canada

Canada releases April IPPI and RMPI on Tuesday and more importantly Q1 GDP on Friday. We expect an improved 2.0% annualized increase given stronger data from January and February though March’s monthly data is likely to come in unchanged.

UK

A less busy week sees fresh BoE-compiled money and credit data (Fri) that may be of increasing importance. Firstly, they will show the extent to which cash-strapped households are still turning to borrowing to fund everyday spending. Secondly, they will highlight how BoE balance sheet reduction is having a wider impact, given the drop in bank deposits that has occurred of late, the question being to what extent is this adding to downward pressure on private sector credit.

Eurozone

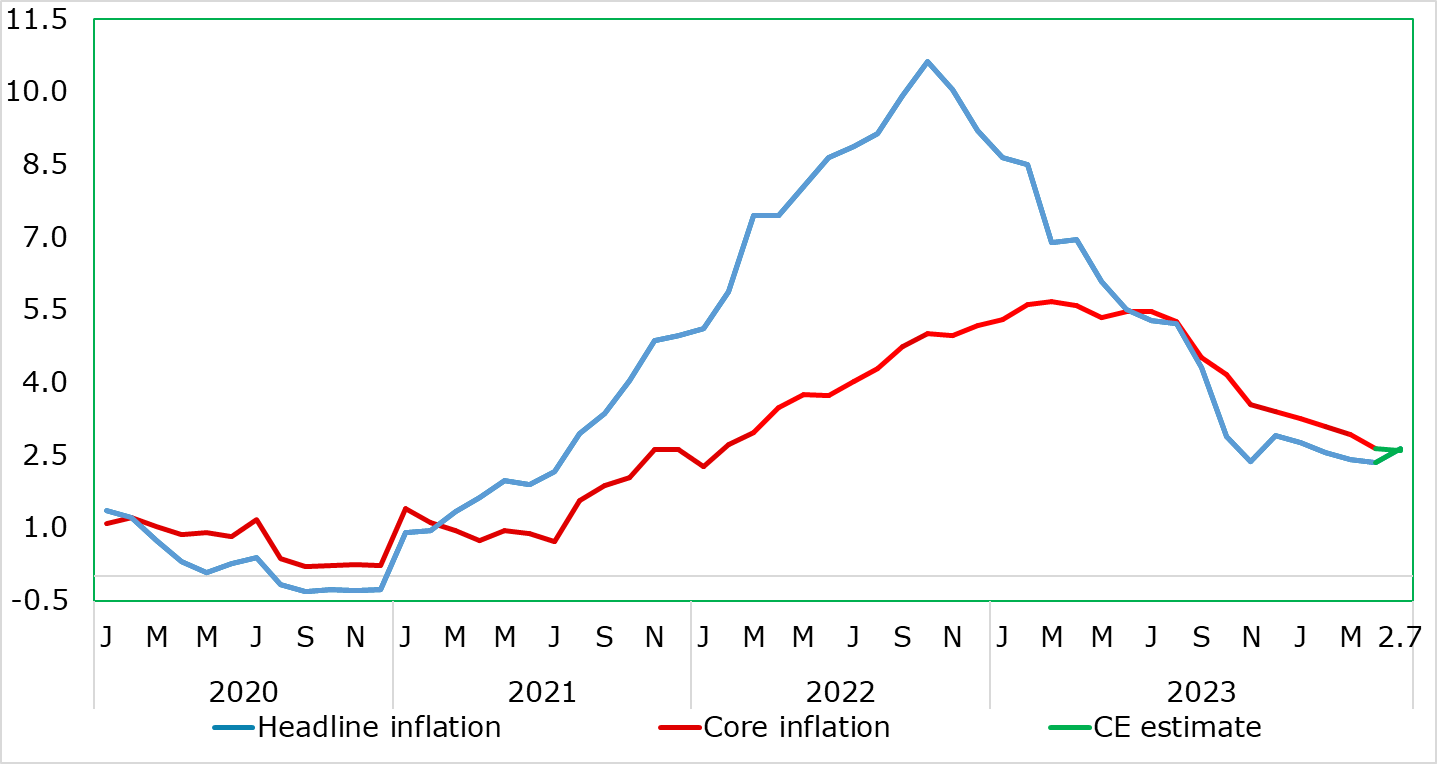

Datawise, it is a very busy week for high-profile survey numbers and inflation updates. Indeed, HICP data for the EZ arrives on Friday. But despite an energy-induced rise in the headline rate of 0.2 ppt to 2.6%, we expect to see for May data, the core rate may drop another notch as could services inflation, with m/m adjusted data also painting a softer picture. German HICP is due Wednesday. Amid more energy effects, albeit less acute than we thought a month ago as petrol prices have started to fall afresh point to headline inflation moving up to 2.6% but with a stable core reading. Updates regarding money and credit data may also be important (Wed), not least after more mixed data seen of late and the warnings of company loan demand slumping from the bank lending survey.

Higher Headline and Lower Core Inflation?

Source: Eurostat, CE, % chg y/y

There is also abundant survey data with the European Commission survey data (Thu) may tell a more downbeat story compared to the PMI composite. Other business surveys are due, including the German Ifo figure (Thu) where some small further improvement may be in the offing. That may also be the case for the ECB consumer expectations survey (Tue) adding to household sector insights

Rest of Western Europe

There are key events in Sweden, with Q1 actual GDP data (Thu) likely to confirm the message from the m/m GDP indicator, albeit the latter plagued with volatility and revisions. Otherwise, the Economic Tendency Survey (Thu) may improve slightly while amid still high mortgage rates the Riksbank Financial Stability Review will be interesting reading. Switzerland sees GDP data (Thu) with a rise of 0.2% anticipated and with KOF survey data due the same day.

Japan

Tokyo CPI heads the Japanese calendar on Friday, May 31. With wage growing, it is inevitable that a part of it translates into inflation. The May CPI report would be a good gauge to see how the Japanese react to higher wage and rates. We expect there will be a certain level of rebound for Tokyo CPI, potentially above 2%. We also have retail trade and industrial production on the same day, with the first carry more weight from our perspective.

Australia

Monthly CPI will come on Wednesday, May 29. There was a minor growth on m/m CPI for March but we don’t see a significant spike from here. Else, retail sales on Tuesday, May 28 would be more important their other tier two data.

NZ

Business outlook and Confidence on Wednesday, May 29 and budget on Thursday, May 30.