FX Daily Strategy: Asia, May 24th

JPY to focus more on intervention threat than Japanese CPI

Levels suggests intervention likely but timing uncertain

GBP to maintain firm tone despite softer PMIs

CHF looks a more attractive funding currency than the JPY

JPY to focus more on intervention threat than Japanese CPI

Levels suggests intervention likely but timing uncertain

GBP to maintain firm tone despite softer PMIs

CHF looks a more attractive funding currency than the JPY

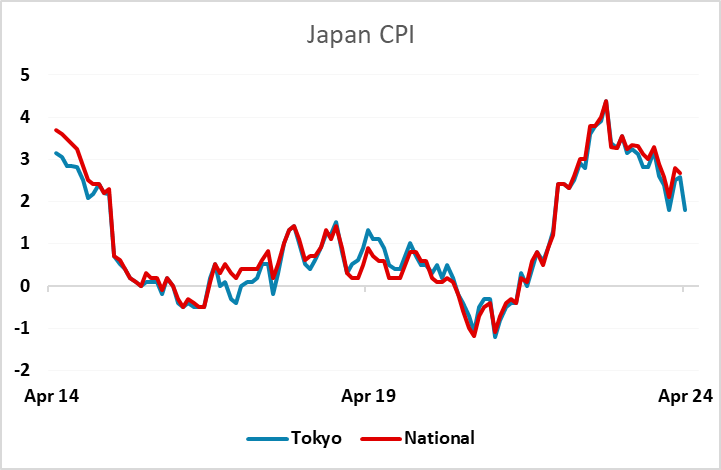

US durable goods orders, Japanese CPI and UK and Canadian retail sales provide a relatively uninspiring calendar for Friday. The Japanese national CPI data are of course important, but rarely deviate far from the Tokyo data already released. The Tokyo data showed a sharp drop in April to 1.8% y/y from 2.6% y/y, but the drop was due to a change in the measurement of education pricing which most see as anomalous. The national number will most likely follow the Tokyo data lower, but few will see this as having much significance.

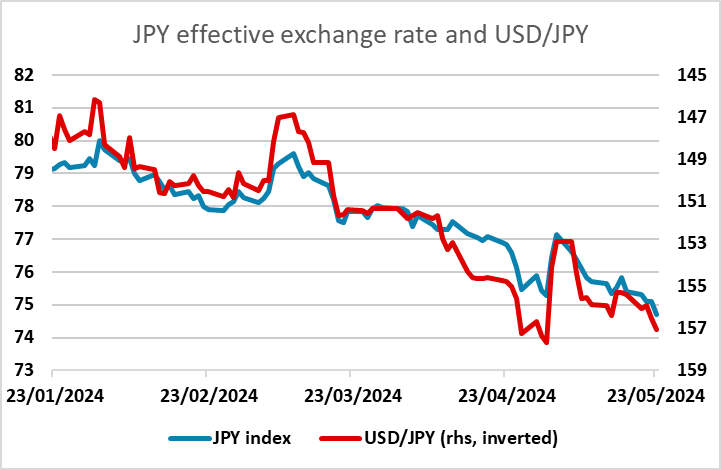

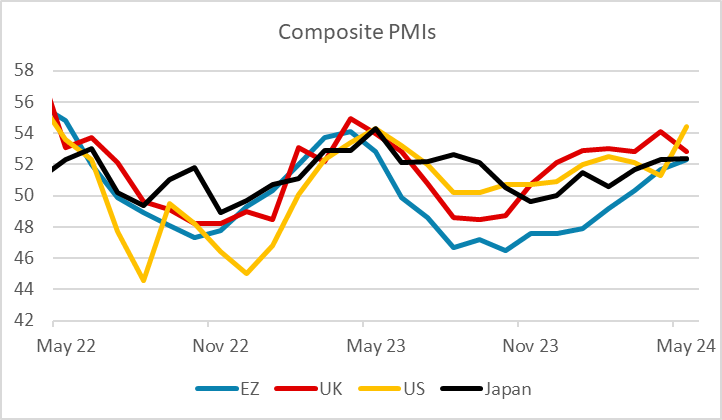

More important for the JPY was Thursday’s stronger than expected PMI data, notably in the US where the services index hit its highest for a year. This triggered a rise in US yields and pushed USD/JPY above 157. There was a sharp drop of 50 pips after the move above 157, but the drop doesn’t seem to have been large enough or sustained enough to be the result of intervention, even though we are at levels where intervention looks increasingly likely. The Asian session will be focused on whether the Japanese authorities decide to intervene at these levels, with the trade-weighted JPY already below the levels seen at the last intervention. Action looks inevitable sooner or later, but the BoJ may prefer to maintain an element of surprise rather than get tied down to defending a particular level. While US yields rose in response to the data, it is notable that yield spreads don’t provide a strong case for USD gains as Japanese yields have been rising in the last week.

GBP was one of the less strong performers on Thursday as UK PMIs were less impressive than the Eurozone and the US numbers. Retail sales data will be of interest but seems unlikely to impact the market much after the stronger CPI data and the election announcement, both of which argue against a June rate cut. The retail data has in any case been choppy so while the market is looking for a 0.5% decline in the April numbers, 1% either way from this will not be seen as too significant. The weaker PMIs limit the GBP upside, but with no June rate cut seen, the bias looks to be towards the GBP upside, although teh0.8500 area remains strong support for EUR/GBP.

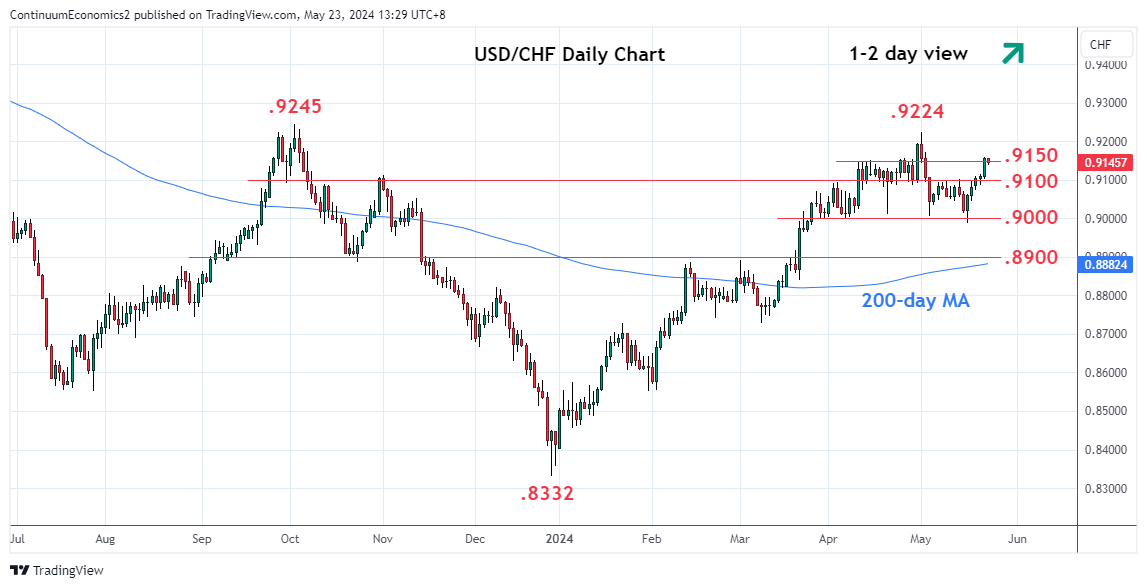

Neither US durable goods orders not Canadian retail sales numbers looks likely to have any significant market impact. For the USD, the risk of BoJ intervention may mean USD bulls look elsewhere. In a risk positive environment USD/CHF looks to be the obvious alternative given low Swiss rates, the SNB’s comfort with a weaker CHF and the strength of the CHF in recent years (particularly against the JPY). There may be scope to test the recent highs above 0.92 in USD/CHF.