USD flows: USD rises on strong PMIs

Much stornger than expected US services PMI boost the USD across the board

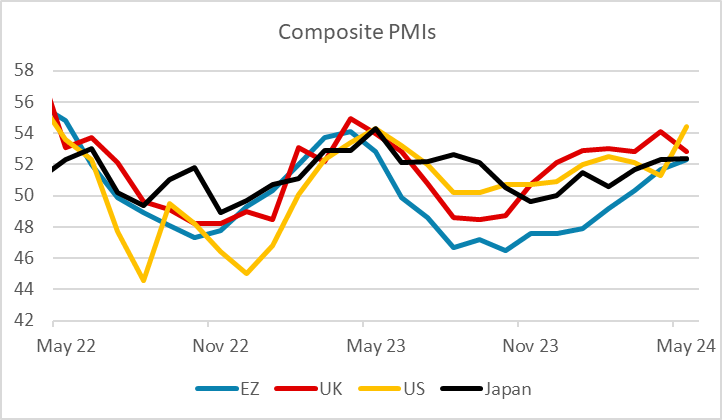

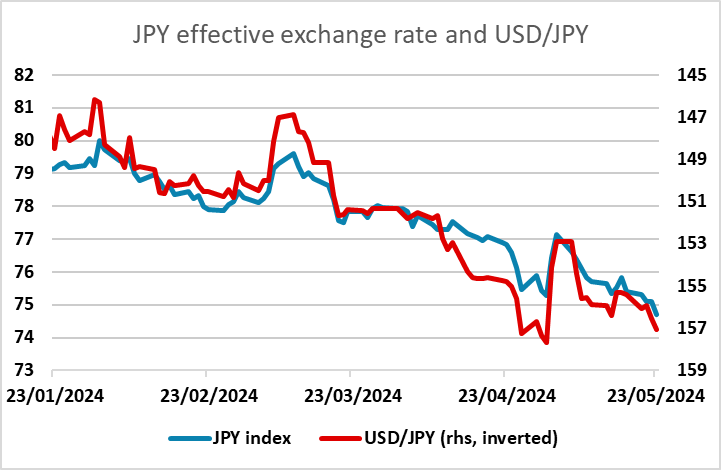

US May PMIs are much stronger than expected, services in particular which surged to their highest for a year, while manufacturing also edged higher. After the dip in April this restores the impression that the US is maintaining solid growth, and should support the USD. USD/JPY is trading above 157 for the first time since the BoJ intervention in NZ time on May 1, and EUR/USD has reversed the gains seen through the day after the better than expected Eurozone PMIs. US yields are higher along the curve, and the chances of a Fed rate cut by September have been reduced to a little less than 60%.

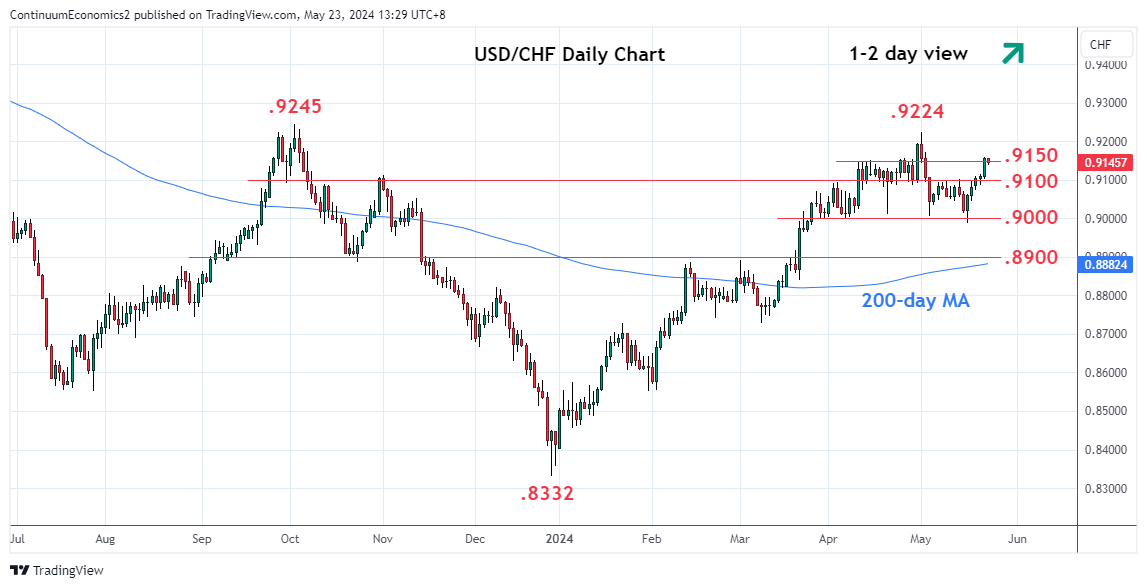

The broadly positive PMI data today suggests there is little urgency to cut rates in the US, but also elsewhere. However, central banks are driven more by inflation than growth expectations, so we would still expect significant rate cuts by year end. But higher yields will probably prevent much equity market strength resulting from better growth expectation. USD/JPY may see the most short term gains, but above 157 in USD/JPY and 170 in EUR/JPY the risk of BoJ intervention rises, so USD/CHF may be the better bet for USD bulls in a risk positive environment.