USD, JPY, AUD, EUR flows: USD firm, AUD and JPY soft

USD firm after FOMC minutes. AUD suffering as China stocks ease. JPY pressures intervention levels

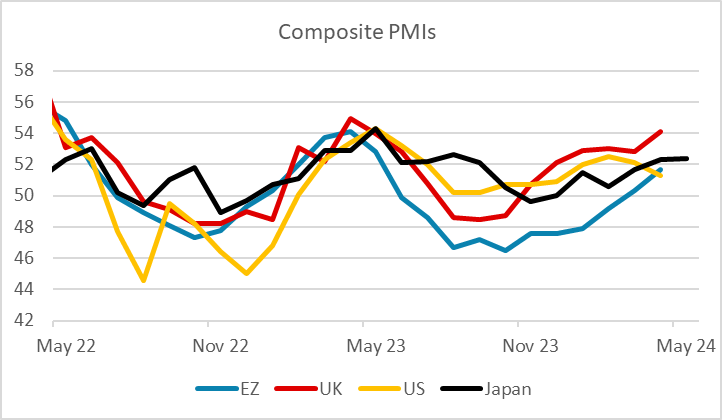

The USD has been firm overnight, making gains on the back of the FOMC minutes which indicated various participants were willing to tighten more if needed. However, gains have been modest, and the focus today will be on the May preliminary PMI data to see if the US underperformance in April is repeated. USD/JPY continues to push intervention levels, with the effective exchange rate already below the level seen when the BoJ intervened in Late April/early May, but USD/JPY not yet quite there. Japanese PMIs overnight were firm, with the composite and manufacturing indices rising in spite of a decline in services, but Japanese economic performance tends to have little impact on the JPY.

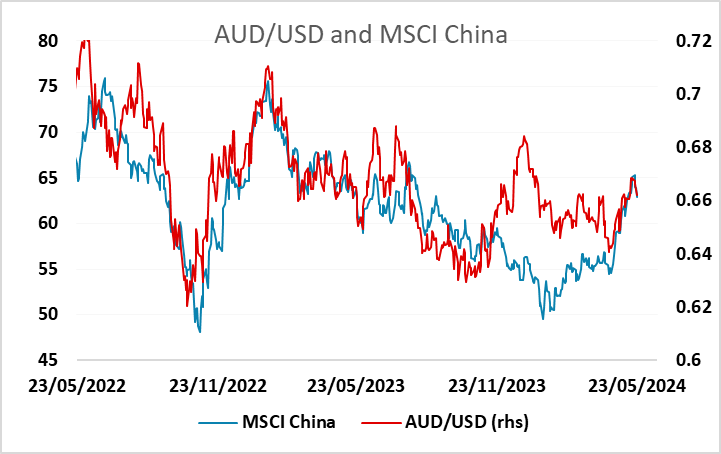

JGB yields continue to push the 1% level and yields spreads still suggest scope for significant JPY gains, but overnight strength in US equities helped by strong results from Nvidia argue for a risk positive tone. Even so, Chinese stocks were weaker, undermined by military drills around Taiwan, and this, combined with the mildly hawkish FOMC minutes, has helped push the AUD lower. The PMI data this morning is likely to be the main driver for EUR/USD, with the consensus anticipating another modest improvement.