FOMC Minutes from May 1 - Data expected to slow, but alert to risks

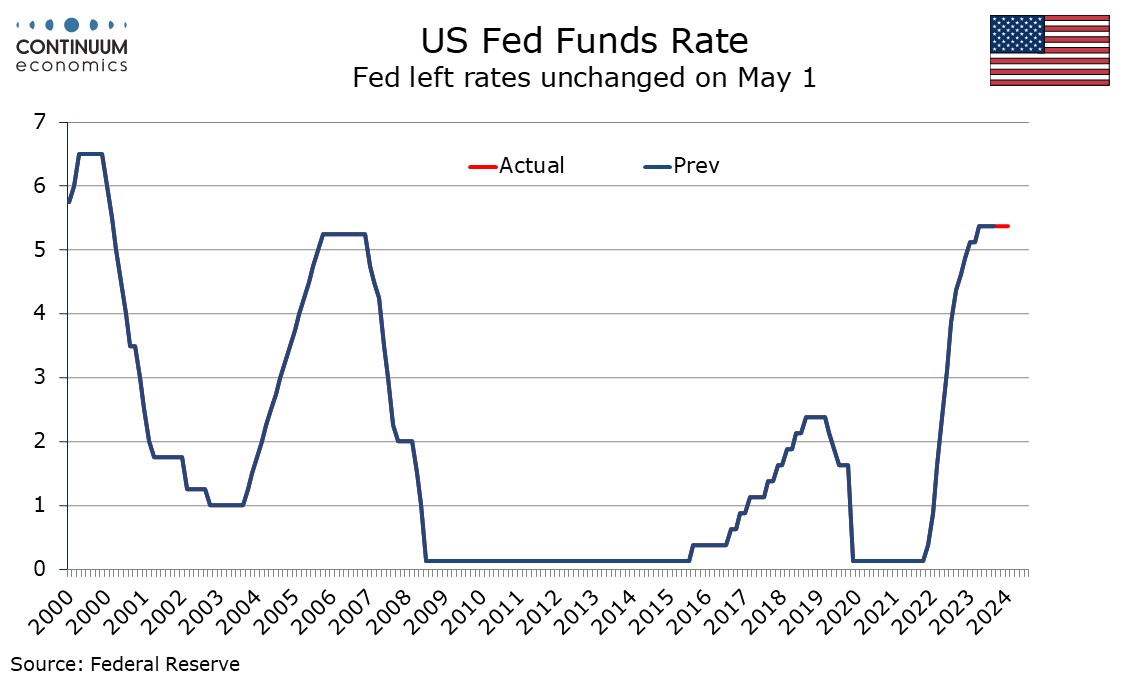

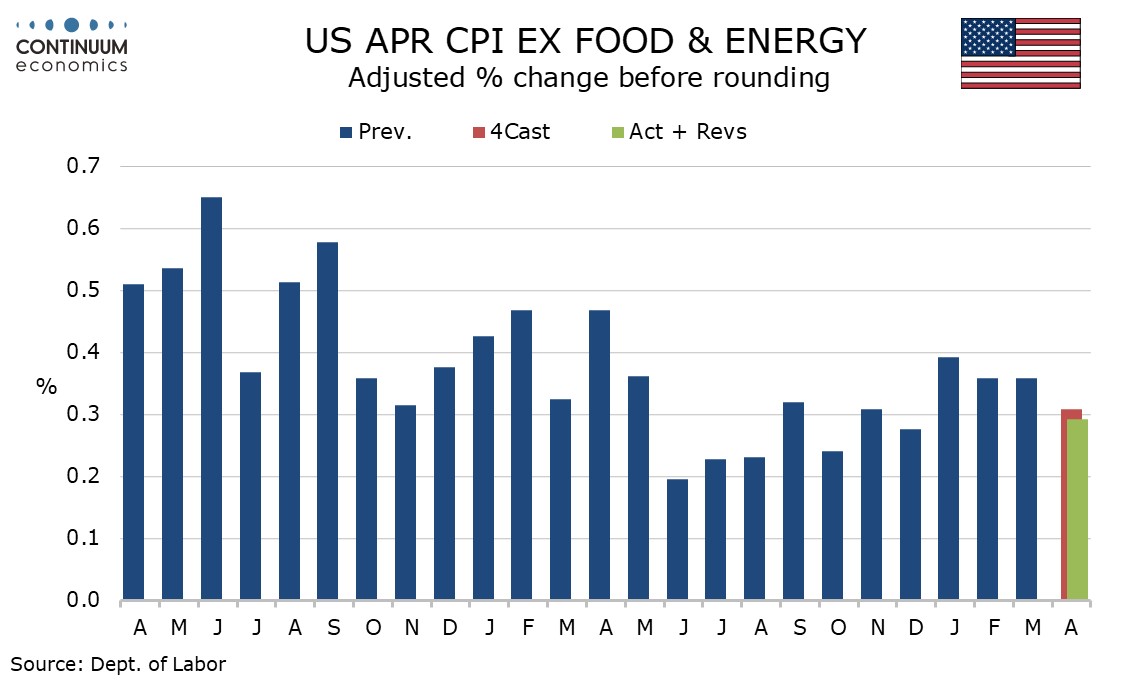

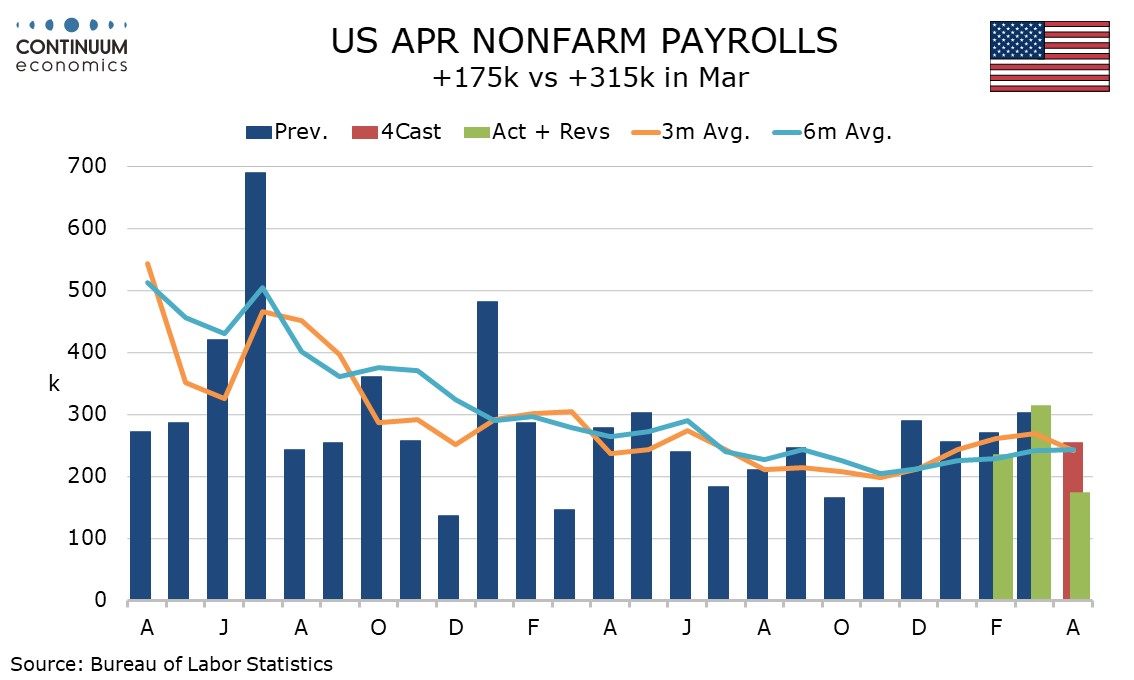

FOMC minutes from May 1 do not show a very hawkish view of the economy, with inflation and the economy still expected to slow, though with the former seen at a slower pace and with less confidence. Policy is seen as data-dependent, and the potential for a more hawkish turn if data disappoints can be seen. April data released since the meeting may have reduced the hawkish risks somewhat.

That various participants mentioned a willingness to tighten policy further suggests there may be a few more hawkish voices than the balance of recent speakers have implied. Many participants also commented on their uncertainty over the degree of restrictiveness of current policy. However the main considerations appear to be reflected in participants discussing maintaining the current stance for longer if inflation does not show signs of moving sustainably to 2% or reducing policy restraint in the event of an unexpected weakening of labor market conditions. It is clear that employment data as well as that for inflation will matter for policy.

Participants continue to expect inflation to fall to 2% over the medium term but recent data had not increased their confidence and suggested the disinflation process would take longer than previously thought. A few considered the possibility of seasonal issues in January’s inflation strength and several noted the role of volatile components in recent data, though some emphasized the broad based nature of recent inflationary disappointment.

Participants assessed that supply and demand in the labor market were continuing to come into better balance but at a slower rate. Slowing in Q1 GDP was downplayed given strength in private sector demand, but a slowing in GDP from 2023’s strong pace was still expected, consumer spending in particular. Many felt that the public had a good understanding of their data-dependent approach.

While all participants judged it was appropriate to keep monetary policy steady at the meeting, it was decided to taper the pace of Quantitative Tightening starting in June. Almost all agreed with the decision to reduce the monthly redemption cap of USTs to $25bn from $60bn though a few indicated they could have supported continuation of the existing cap or a slightly higher cap than was decided upon.