FX Daily Strategy: Asia, May 23rd

PMIs the focus for Thursday

More relative US weakness could undermine the USD

GBP well bid and could benefit from election talk

JPY weakness could trigger intervention very soon

PMIs the focus for Thursday

More relative US weakness could undermine the USD

GBP well bid and could benefit from election talk

JPY weakness could trigger intervention very soon

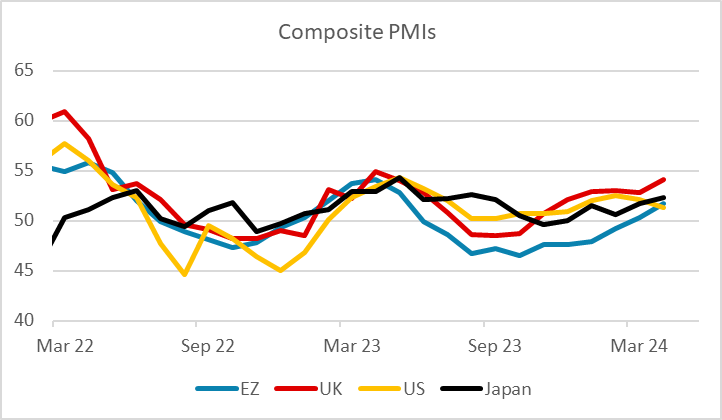

Provisional May PMI indices will be the main focus for Thursday. The April data was notable for the divergence between stronger European and Japanese services and composite numbers and weaker indices in the US. The US weakness was subsequently confirmed with an even weaker ISM services index. One month doesn’t make a trend but we have actually seen two consecutive months of declines in the US composite index while the Eurozone index has risen for the last three months. Another month of European gains and US declines might start to undermine the perception of US growth outperformance that has been one of the factors supporting the USD in the last few years.

The consensus looks for another modest rise in the Eurozone composite index while the US index is expected to stay steady. However, we look for further declines in both the US manufacturing and services indices, and by implication in the composite. The USD could consequently fall back across the board. The EUR would likely benefit most if the European indices are strong, but the JPY may get the most benefit if there is also weakness in Europe. The reaction will also depend on the US jobless claims data, which saw a sharp rise last week. The solidity of the US labour market has been a big factor underpinning the strength of the USD even when some of the growth numbers were less robust, and any further evidence of deterioration could be expected to undermine the USD.

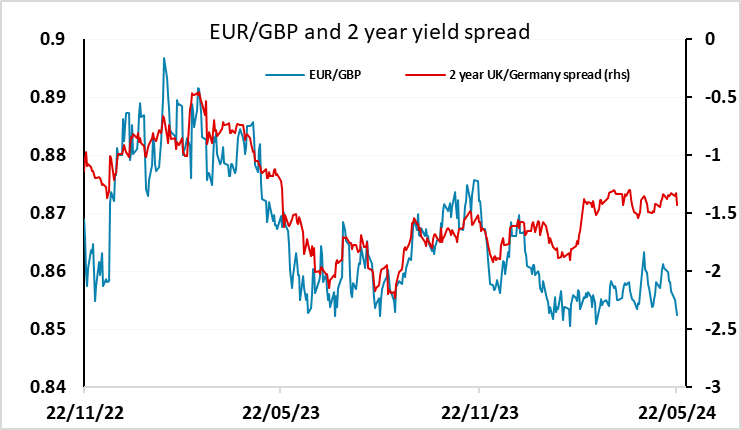

Wednesday was characterised by a stronger pound and more weakness for the JPY and CHF. GBP strength stopped short of the support area of 0.8492-0.8500 in EUR/GBP, even though the market has now all but priced out the chance of a BoE rate cut in June after the stronger than expected UK CPI numbers. BoE chief economist Pill is due to speak again on Thursday, and may clarify whether a June move is still possible, but the tone for GBP may depend more on how the UK PMIs perform relative to the Eurozone (even though this has not been a particularly good guide to the relative GDP performances). Another factor for GBP could be speculation about a general election. This was rife on Wednesday as an emergency UK cabinet meeting was called, with July 4 seen as a favourite date, although nothing had been announced at the time of writing. An early election might be seen as mildly GBP positive, as the current administration is not seen as likely to produce any policies with positive long term intentions.

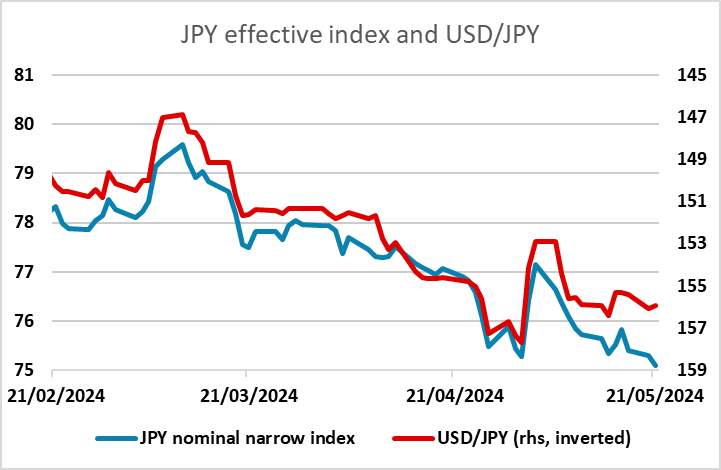

JPY and CHF weakness continues to relate partly to the low level of volatility and the attraction of the carry trade. But the JPY continues to hit new lows in effective terms even though USD/JPY hasn’t quite reached the highs seen in late April. The BOJ aren’t going to stand for this indefinitely. Unless we see an organic decline in USD/JPY by the end of the week, intervention to push it lower looks quite likely – very likely if we print above 157.